Members of the Financial Accounting Standards Board could be in for an earful Monday.

The FASB will hold a highly anticipated roundtable at its Norwalk, Conn., headquarters to discuss the Current Expected Credit Loss accounting standard.

The session was scheduled to discuss

But it is the agenda item allowing for a more general discussion that could make things interesting. It is that The potential for fireworks has some industry observers urging for calm discourse.

“I hope the meeting Monday lets investors be heard without bias,” said Joseph Stieven, CEO of Stieven Capital Advisors in St. Louis and an opponent of the new standard.

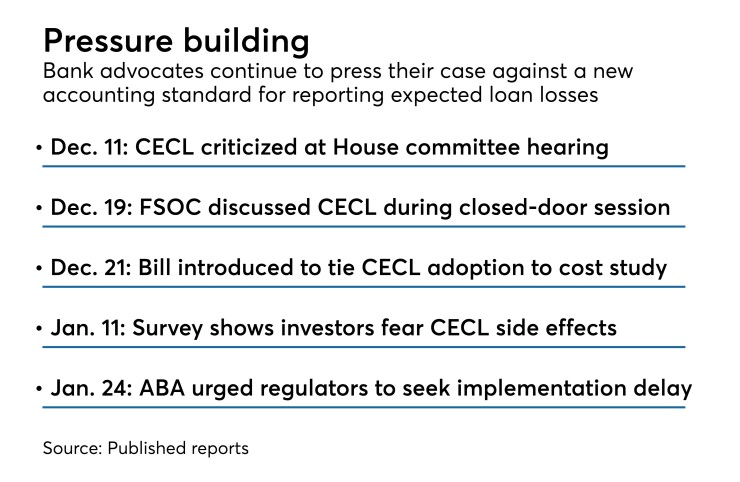

Criticism of CECL, which would require institutions to record projected credit losses when a loan is originated, reached a fever pitch in December when

A day after the FSOC meeting, nine Republican members of the House Financial Services Committee sent a letter to FASB Chairman Russell Golden, as well as Jay Clayton, chairman of the Securities and Exchange Commission, suggesting that surveys and educational work that FASB pursued prior to approving the standard in June 2016 were flawed.

“FASB standard-setting should be enhanced through formal review and approval processes and ensuring new rules will not create unnecessary or market instability,” the lawmakers wrote.

The same day, Rep. Blaine Luetkemeyer, R-Mo., one of the letter’s signatories, introduced a bill to make CECL implementation contingent on the completion of a qualitative impact study. His bill echoes an earlier call by the American Bankers Association for a similar study.

The uproar has continued into 2019.

Earlier this month, a survey of more than 50 investors conducted by FIG Partners found that a four out of five participants believed no change was needed from current accounting rules, while 83% expressed a belief that the new standard would prove procyclical and magnify fluctuations in credit performance.

The ABA on Thursday called on industry regulators to seek a delay in CECL implementation, claiming that "the lack of quality guidance has prevented many smaller banks from making significant progress in their implementation efforts.”

While there is some uncertainty over the meeting's direction, the FASB is set to discuss the regional banks' proposal, which is designed to blunt CECL’s potential negative impact on bank earnings and capital ratios by allowing financial institutions to record losses beyond 12 months as part of accumulated other comprehensive income. More immediate losses would be kept on the balance sheet.

At least one of the regional banks will be represented at the meeting.

BB&T in Winston-Salem, N.C., plans to have someone attend, spokesman Brian Davis said in a Friday statement to American Banker.

While CECL "is a well-intended effort to provide investors with better information, we’re deeply concerned it could produce negative economic effects by hindering the flow of credit to consumers and businesses,” Davis said.

“We’re committed to work alongside the FASB and other stakeholders to fully examine the possible real-world consequences of CECL in its current form and identify changes that will ultimately benefit all stakeholders,” Davis added.

FASB adopted CECL in June 2016 after more than five years of consideration and debate. Publicly traded banks are scheduled to convert to the new standard beginning Jan. 1, 2020, followed by privately held institutions and ultimately credit unions, which have until Jan. 1, 2022.