When the coronavirus pandemic struck in March 2020, the marketing team at Citizens Financial Group sprang into action.

In its marketing materials, it ditched a lot of imagery that featured people gathered together around dinner tables — behavior that was suddenly discouraged by public health authorities. It also moved much of its creative work in-house, experimenting with new illustrator-style ads the bank ran on streaming services like Hulu, instead of producing spots that required actors.

Not only was this easier to do while maintaining physical distancing, but it also lent the ads a homegrown touch that felt more relevant for the moment, said Lori Dillon, head of enterprise marketing at the $183 billion-asset Citizens.

The Providence, R.I., company also turned off direct mail marketing for every product except for its education refinance loan.

“We literally had to ask ourselves, were people even opening mail? People were scared,” Dillon said.

Many banks made these kinds of marketing choices early in the pandemic. They had to quickly figure out what tone ads should take while reevaluating how to best get those messages out. That sometimes meant pulling more traditional ads and producing more new spots for social media and streaming services, or learning to navigate virtual networking events and social media to nurture business prospects. As marketers do, they looked at widespread behavioral changes — like people turning to online gaming instead of going out, or saving more money because they weren’t traveling — and adjusted marketing messages accordingly.

Now, a year later, the country and the industry are in a very different place. Tens of millions of Americans have been vaccinated against COVID-19 and every shot in an arm brings us closer to the life we knew before the pandemic.

Marketing executives told American Banker they’re looking forward to bringing back sports sponsorships, commuter-rail ads and community events, like first-time-homebuyer seminars.

But they also said the experiences of the past year forced them to get more creative in reaching customers who were suddenly spending the bulk of their time in front of screens.

Avidia Bank in Hudson, Mass., canceled a number of events and sponsorships early in the pandemic and also pulled advertising at commuter rails because people just weren’t commuting as much, said Kate Cwieka, its communications manager.

“We’ll bring that back as commuting returns, but right now there’s nobody on the platforms seeing our ads, so it’s not worth the money,” she said.

In the meantime, the $2 billion-asset Avidia ramped up its use of a social selling program for its business bankers — that is, the practice of cultivating sales prospects via social media sites like LinkedIn. Avidia provides those bankers with a special app and preapproved content they can post for social selling.

It also participated in more virtual events, including a virtual conference that allowed the bank to set up a “booth” complete with a raffle and Q&A. In both of those cases, Cwieka said, it’s even easier for bankers to track and follow up with prospective sales leads than it can be after an in-person event.

Even digital banks, which were gaining ground on their brick-and-mortar counterparts before 2020, had to adapt their marketing strategies to these new and different circumstances.

Ally Financial in Detroit, for instance, usually runs some type of live “disruptor” event in major cities to call attention to its brand. One year, it scattered special “lucky pennies” across 10 U.S. cities, and another year, it created a Monopoly-style scavenger hunt across six cities using augmented reality. So when the $182 billion-asset Ally had to scrap several in-person promotions planned for 2020, it turned to online gaming to reach potential new customers, said Andrea Brimmer, the chief marketing and public relations officer.

Ally sponsored iRacing (instead of NASCAR) and Twitch streamers (video gamers who livestream their gameplay on the platform Twitch). It also built an island on Animal Crossing, a social simulation video game that enjoyed a surge in popularity early in the pandemic.

“We went to where people were,” Brimmer said. “It was a pretty simple strategy.”

Shifting budgets, shifting priorities

Banks didn’t tighten their marketing budgets in 2020 so much as shift dollars around.

According to a recent survey of 300 marketing decision makers in financial services, a little over half of banking respondents reported that C-level support for marketing actually increased last year. The survey, conducted by American Banker’s parent company Arizent, found that more resources were devoted to virtual events, email and social media marketing, and digital advertising in the coming year.

The survey also found that 55% of all financial firms plan to boost their marketing budgets this year and 72% of banking industry respondents said increased marketing through digital channels would be a top priority.

Digital marketing can often be cheaper to produce and faster to test than more traditional channels. But a more fragmented media landscape also means that marketers often need to be more precise in how they target those digital ads.

Juliet D’Ambrosio, head of strategy at the branding agency Adrenaline, described one client, Town & Country Federal Credit Union in Maine, that had identified foodies and pet lovers as two of its most likely audiences for a new personal loan offering. The $469 million-asset credit union bought banner ads on sites those audiences were likely to frequent, like culinary websites or the pet supplies site Chewy.com.

With people stuck at home and driving less frequently, Citizens pulled much of its radio advertising during the pandemic and shifted its spending to increasingly popular streaming services like Hulu, said Dillon. She added that the Illustrator-style ads were not only cheaper and faster to produce, but also tested better with consumers.

Still, bankers say they’re looking forward to bringing back some physical marketing — in branches, on billboards or via sponsorships — when the pandemic is over.

Cullen/Frost Bankers in San Antonio, for example, continued a branch expansion plan in the Houston area that it announced well before the pandemic and plans to add still more branches, said spokesman Bill Day. And while it paused much of its marketing for in-person events and sports in particular (the company is a sponsor of the NBA’s San Antonio Spurs), Day said that spending “will probably come back as things get back to normal.”

Cwieka said she expects Avidia to continue to pursue a predominantly digital strategy for the near term, but plans to reassess that strategy as the pace of vaccinations and reopenings picks up.

“Maybe in May or June we’ll reevaluate if we want to bring something back like those train station ads or start doing some events again,” she said. “We’re prepared either way.”

Messaging still matters

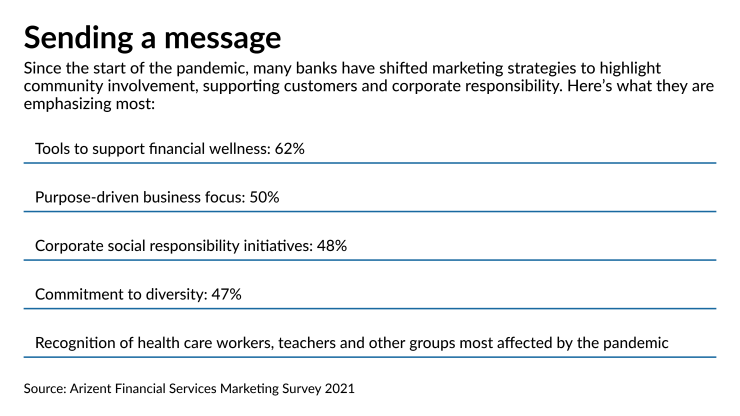

Marketing executives said the events of 2020 underscored the importance of reading the room and striking the right tone and message in outreach efforts. According to the Arizent Financial Services Marketing Survey 2021, banks were much more likely than others in the financial services industry to emphasize corporate social responsibility and recognition of consumer groups hit hard by the pandemic in their messaging. It also found that financial wellness was the top value the industry promoted in its messaging last year.

Huntington Bancshares in Columbus, Ohio, decided to turn the camera on some of its small-business clients. The $123 billion-asset Huntington sent its in-house ad agency, Greenhouse, on the road to interview small-business owners about how they were coping with COVID-19. Those road trips resulted in a series of spots encouraging viewers to shop local. In one, the co-owners of a barbecue joint in Pittsburgh talk about providing takeout bags and picnic tables outside to stay in business safely during the pandemic.

The bank’s name and logo feature only briefly during the ads, which don’t mention any kind of banking product or service. But the ads are not intended to promote any particular offering so much as to marry Huntington’s brand to messages of resiliency and optimism, said Julie Tutkovics, chief marketing and communications officer.

“We felt good because we were a part of that. We helped them financially make it through,” Tutkovics said.

Huntington also saw an opportunity to accelerate the launch of a new savings tool it had in development before the pandemic, she said. That tool, Money Scout, uses artificial intelligence to analyze saving and spending patterns and suggests nominal amounts for a customer to set aside.

The company had originally planned to release Money Scout late in 2020 or early 2021, but moved that launch up to September. Tutkovics said the company took its cues from search trends throughout the pandemic, finding that even consumers who hadn’t necessarily lost a job were still seriously reassessing their spending and saving habits.

“I think we all took 2020 as a moment to inventory what was important,” she said. “Whether you lost your job or not, or whether you face tremendous financial hardship, which so many did, we wanted to be there.”