Citizens Financial Group on Wednesday sized up the cost of its new overdraft policies: around $40 million in lost fee income each year.

But the Providence, Rhode Island, company expects to more than make up for that shortfall with cost savings and growth in other types of fee income, executives said on a conference call to discuss quarterly earnings.

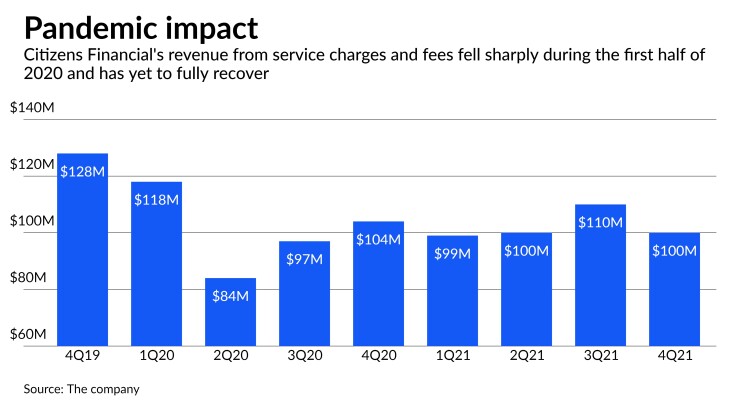

Service charges and fees, which include overdraft fees, fell to $100 million during the fourth quarter — a 4% decline from the same period in 2020 — largely because of a new policy that gives customers 24 hours to reverse overdraft charges.

Still, the $188 billion-asset Citizens said that it anticipates 2022 fee income growth of between 4% and 7% from the previous year, driven primarily by capital markets and wealth management. During the fourth quarter, capital markets fees more than doubled to $184 million, a function of nonbank acquisitions made over the years and strength in mergers-and-acquisitions advisory and loan syndication fees.

“What we’re seeing is just the culmination of a significant buildout effort of our coverage teams and product capabilities over a number of years,” Chairman and CEO Bruce Van Saun said in an interview. “We’ve entered an active market period, and sponsors in particular were very active in putting money to work and getting deals done.”

Citizens

Citizens expects to reap some cost savings from its new overdraft policy, executives said during a call with analysts. For example, calls and complaints to the bank’s customer service center have fallen 40% since the policy was implemented, they said.

During the fourth quarter, the company’s net income rose by 16% to $530 million, due partly to higher capital markets income and a negative loan loss provision of $25 million. Earnings per share totaled $1.17, but would have been nine cents higher if not for some one-time items related to an efficiency initiative and integration expenses from several ongoing and

Total noninterest income rose 3% to $594 million. Mortgage banking fee income declined 61% from the same period a year earlier to $76 million, mainly because of lower gain-on-sale margins and production volumes. Trust and investment services fees increased 15% to $60 million.

Citizens still has room to grow in the wealth management business and hopes to make one or two acquisitions in that industry this year, Van Saun said in the interview. Until now, valuations have been the main factor holding Citizens back from buying another wealth management business. The company has preferred to look for wealth management firms that want to continue to add customers, rather than those strictly looking to sell for the highest price.

“We’re competitive in what we pay, but I think we bring other aspects to this in terms of a strong customer culture and a very big customer base that is underpenetrated and can result in meaningful growth opportunities for the firm over time,” Van Saun told American Banker.

Citizens is on track to close two bank deals in the months ahead. It should finish its acquisition of HSBC’s East Coast retail operations in February, and it expects to close on its purchase of Investors Bancorp in Short Hills, New Jersey, in early April, according to executives. Those

“I think we have enough scale that we can compete against all comers,” Van Saun said in response to an analyst’s question Wednesday. “Doing this New York metro play and picking up another $30 billion of assets, I think, is a positive. But we don't feel compelled to have to run out and do more deals to stay competitive.”