-

The $4.24 billion-asset Banner said Tuesday it has agreed to buy Home Federal Bancorp (HOME) in Nampa, Idaho, for $197 million in cash and stock.

September 24 -

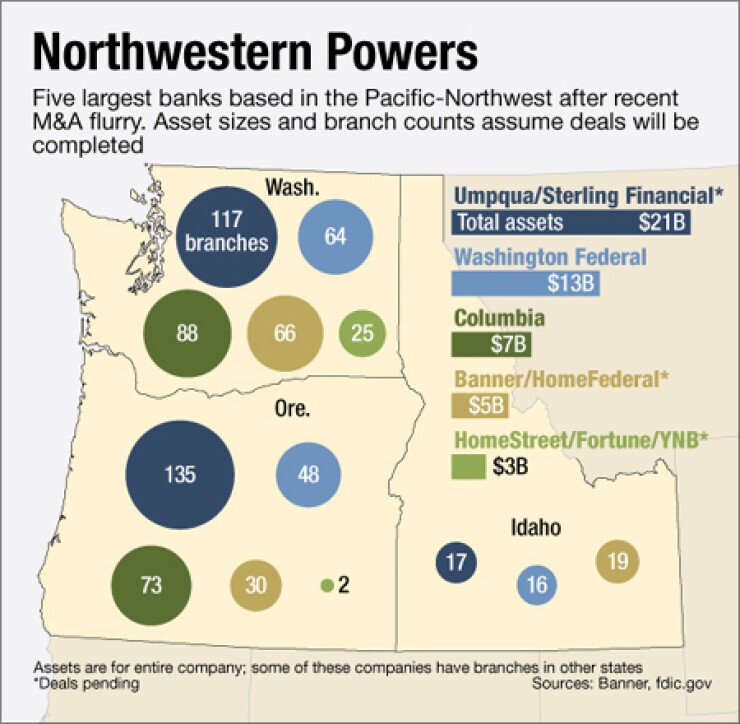

Umpqua Holdings' agreement to buy Sterling Financial is the latest in a series of deals this year to pair similarly sized banks, creating a new crop of midsize financial institutions.

September 12 -

Accounting-related gains are dwindling for many acquirers of failed or troubled banks. Their alternatives include cutting costs — or buying again.

January 9 -

Home Federal Bancorp (HOME) in Nampa, Idaho, said Friday that it is closing four branches in Oregon as part of its ongoing effort to reduce overhead and improve efficiency.

November 30 -

Industry observers have commended the Walla Walla, Wash., company for righting the ship after it was hammered by exposure to bad construction loans. But now investors are wondering how it will grow in a weak economy.

September 20

Sometimes the best buyers turn out to be sellers.

Take the slow and steady Home Federal Bancorp (HOME) in Nampa, Idaho, which agreed this week to

Home Federal weathered the downturn and acquired two failed banks in recent years, but its chief executive says that its inability to add higher-yielding loans organically or through acquisition motivated the company to sell.

"The issue is growing higher earning assets at a pace, and utilizing all of that excess capital at a pace, that can be beneficial to the shareholders," Len Williams, the CEO of Home Federal, said in a conference call Wednesday. "We have continued down the path of negotiating with potential acquisitions. We just couldn't get to a share-value accretion number quick enough with some of the potential deals that are out there."

The pressure Home Federal felt will intensify in the next couple of years for other buyers of failed banks, observers say. The whole industry is finding it hard to add loans, but failed-bank acquirers face a special challenge. The

For example, thanks to the accounting benefits of the covered loans known as the accretable yield Home's margin was 4.47% at June 30. On its non-covered assets, the margin was closer to 3.10%.

If the failed-bank buyers are unable to find high-yielding assets to offset the shift, either organically or through buying other banks, more could follow Home Federal's move to sell.

"The FDIC deal accounting does mask the lack of loan growth for several years, but as that goes away there is going to be an increased pressure to do more M&A or try to grow loans organically," says Robert Rogowski, director of investment banking for McAdams Wright Ragen in Seattle.

In order for Banner to take over Home Federal's loss-share agreement, the companies must get approval from the FDIC. The agency has received several similar requests, but said there is no clear trend indicating that the number is rising, an FDIC spokesman said.

Randy Dennis, president of DD&F Consulting, one of the most active advisors of failed-bank bidding in the last few years, says there will likely be an increase next year when the agreements hit their fifth year, the time when the buyers can no longer submit claims for commercial credit losses.

"We are about a year away from the final bell of the recovery," Dennis says. "You'll begin to see people look twice at what they want to do."

While the $1 billion-asset Home Federal was struggling to find earning assets, the $4.2 billion-asset Banner saw an opportunity to deepen its presence in Boise.

Banner has a stated goal of becoming a top-performing bank in the Pacific Northwest, but lacked a meaningful business in Idaho's capital city. Banner had five branches and a 1.3% market share. By adding Home Federal, it will have 15 branches and a 5.7% market share.

"We had a nice presence but needed scale," says Mark J. Grescovich, the president and CEO of Banner. "Home had the presence, but not the product offering we bring."

As Grescovich sees it, the goal is to become a "top-quartile performing" bank by measures like net interest margin and return on assets, not just to grow the bank for the sake of size.

"We are not out to build an empire," Grescovich says. "But scale, from a strategic standpoint, does allow for that top-quartile performance."

Followers of the company say the deal is a good one, because Banner could have otherwise faced some earnings pressure of its own.

"Banner had to do something. It needed to get bigger because the cost of operating a bank is getting more expensive," says Tim Coffey, an analyst at FIG Partners.

M&A in the Pacific Northwest has been hot recently, but Coffey says Banner still could eventually look to sell.

"It is making a relatively small acquisition to help it become more efficient, but I'm not sure if it is appropriate to view them as off the table," Coffey says. "In fact, it could possibly increase Banner's value."

Several observers also pointed out that the economy of Boise, although behind Portland and Seattle, is starting to improve. The up-and-coming nature of its economy is evident in the deal's pricing. At 116% of tangible book value, there is an indication that the market has a ways to go.

"Boise isn't limping along anymore, but it is still in second gear," Rogowski says. "It is a smart move to buy into a market that hasn't recovered fully. Just contrast that to the 170% of tangible book