Home equity lines of credit would normally thrive in a market with

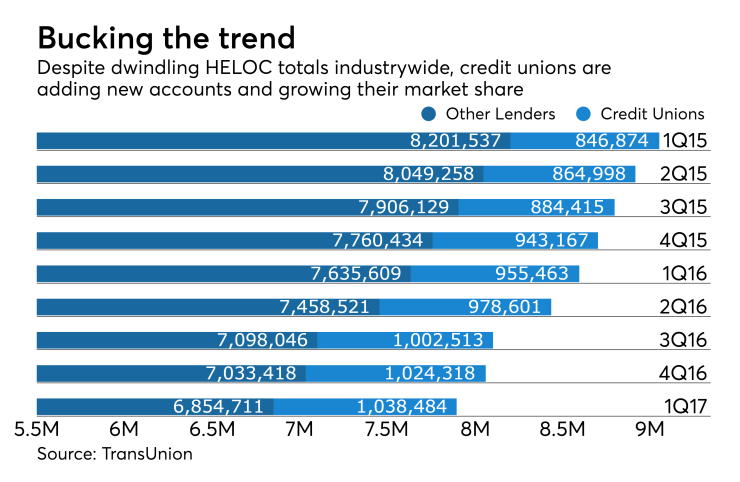

There were nearly 7.9 million open HELOC accounts in the first quarter of 2017, down 12.77% from the first quarter of 2015, when there were about 9 million open accounts, according to TransUnion.

The number of open HELOC accounts is down in part because new account openings aren't outpacing closed accounts. Through April, the number of new HELOC accounts increased 1.5% from the prior year, and "that's really not an exciting number," said Equifax Chief Economist Amy Crews Cutts.

But when it comes to credit unions, "HELOCs are a different story," said Ginny Gomez, senior vice president of product management at TransUnion. Credit unions had about 1 million open HELOC accounts in the first quarter of 2017, up nearly 23% from two years ago. Credit unions now hold 13.16% of the HELOC market, up from 9.36% in 2015.

Put another way, the growth of credit union HELOC lending, combined with the industrywide decline in open accounts, has sent credit unions' market share soaring 40% over the past two years.

The advantages that credit unions have in underwriting and pricing loans may be among the reasons behind the trend, and with short-term rates climbing, those pricing advantages could intensify.

"We're primarily a portfolio lender … and home equity is a great portfolio product," said Jerrold Anderson, vice president of residential lending at Chicago-based Alliant Credit Union, which offers HELOCs in about 30 states. "It really fits well, the yield is good on it and with an increase in interest rate, obviously based on prime, you're going to see an increased yield which is attractive."

Credit unions are member-owned and have more incentive to offer their customers attractive pricing, noted Jorge Ponce, director of business development at FirstClose, a vendor that develops technology for refinance and home equity lenders.

"Credit unions, the way that they're set up, they don't have investors, per se," Ponce said. "They don't have shares. Every member owns a part of the credit union, so everything is done to serve those members. They don't have to pay out stakeholders. That's what allows credit unions to be more competitive than banks."

While credit unions, like others, got burned by underperforming mortgages during the crisis, they still generally remained more comfortable with slightly looser underwriting than lenders like banks because they know and answer to their members.

"Lenders have been very conservative in mortgage underwriting, and credit unions do a good job of working with member loyalty," so they may be willing to make a loan another institution may not, said Ezra Becker, senior vice president and head of research for TransUnion's financial services business unit.

That conservative attitude toward HELOC underwriting helped Alliant and other credit unions avoid taking larger losses during Great Recession. Now, "we don't have a bad taste in our mouths," Anderson said.

"We know people are upside down and we did take losses, but as we underwrote the member, I think that was a very strong point for us," he said. "It might be a pain when we're originating, because you're doing a full documentation review. But at the end of the day, it's really worked in the portfolio and delinquencies and charge-offs were relatively low."

Banks also have regulatory considerations on their HELOC activity that don't apply to credit unions. For example, there was recent speculation whether Basel III capital rules would introduce additional risk weighting complications when it came to HELOCs, Crews Cutts at Equifax said.

"The issue became that Basel wanted to impose a capital set-aside against the entire credit line, whether used or not used," she said. "In the United States, we never required that of our banks. So where Basel came down was to say because it's not callable, they would only have to have a set-aside based on the balance that's drawn on the loan. But it took a long time to get there. Once it was resolved, [bank] lenders started to go after HELOCs." But the historical issue has reduced banks' outstanding HELOC volumes.

Now, banks are working to compete with credit unions for HELOCs. TD Bank, for example, offers discounts on its HELOCs to borrowers who also have checking accounts with the bank — a move designed to deepen customer ties. But there are other hurdles, as TD Bank found in a recent survey, where 29% of its customers said they don't fully understand the HELOC product.

And credit unions aren't resting on their laurels. Alliant, which has $9.5 billion in assets and a nationwide membership, is refreshing its HELOC product set to offer new loan features. It's also investing in new technology to streamline the HELOC origination process and take advantage of new tools, like income verification services.

"As equity continues to increase in our members' and in borrowers' homes, the opportunity is just going to keep increasing," Anderson said.