It may be known as the most wonderful time of the year, but for many Americans year-end is disastrous for their budget.

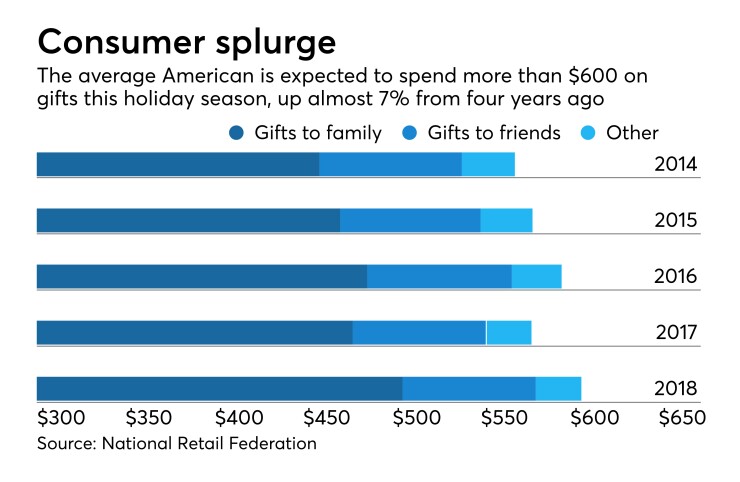

The average American consumer will spend $1,007 this holiday season, 4.1% more than last year, according to a recent survey conducted by the National Retail Federation. They will spend in three main categories: gifts ($638 on average); food, decorations, flowers and greeting cards ($215); and other purchases to take advantage of deals and promotions ($155). There is also travel, which the NRF does not track.

Meanwhile,

Several fintechs say they are trying to help consumers bring order to this holiday madness.

“The holidays for lots of Americans are very stressful, not just because you’re around your family, but because of the financial implications,” said Ethan Bloch, CEO of Digit, an app that offers automated savings and tools for paying down credit card debt more quickly. “We need to think about gifts, we need to think about travel, we need to think about decorations.”

About a third of Americans will either go into debt, or go deeper into debt, to cover holiday expenses. Those who were already in the red will increase their debt load by an average of $1,000, Bloch said. About 75% of Digit customers already have credit card debt.

“When you tie that back to what we know about financial health and financial well-being, how do people get to a place where they can participate in this holiday in a way that doesn’t break them financially?” Bloch said. “I think that’s a real challenge.”

App-based 'Christmas clubs'

A friend of mine has one son and eleven nieces and nephews to shop for every December. Each month throughout the year, she puts a small chunk of money in a drawer to save for this.

Banks used to offer something like this called “Christmas clubs.” These were temporary savings accounts in which customers would deposit money periodically to be withdrawn at the end of the year. Some small banks and credit unions still have them.

“There are a few relationship banks that have it, but it’s gone at the big banks — they’re these faceless machines that are out of touch," Bloch said. "It’s a gap now.”

Digit users fill this gap for themselves within the app, Bloch said.

“’Gifts’ is the fifth most common goal people create in Digit,” he said. “We see people go through this spending cycle, and then in January, February and March, as they are reflecting on some pain, they’ll plan for next year and they’ll create their own holiday fund, digitally.”

Digit’s software also does some of this for the user. It assesses each customer’s financial situation every day and periodically puts aside amounts that it thinks are safe.

“It’s adjusting for that on the fly, so it’s really tailored to your circumstance, and it’s automated,” Bloch said.

Chime, the challenger bank with 2 million users, also helps people save throughout the year for their holiday spending. Every time members spend money on anything, their purchase is rounded to the nearest dollar, and the difference is moved to a savings account. Each time they get paid, 10% of the paycheck is transferred into savings.

“That’s helped our members save about $400 million this year alone,” said Zachary Smith, vice president of product at Chime. “We know because we’ve seen the data that that money is coming in handy this time of year.”

Chime plans to offer goal-based savings where people can save automatically for things like holiday gifts.

Pluto, a money management app for college students, helps its users set savings goals but also challenges them to spend less on things like fast food.

“Users can do spend-less challenges for a variety of categories and merchants,” said Tim Yu, co-founder and CEO. “For the holidays, they can do them for gifts, shopping, and numerous merchants like Amazon. Everything is automatically tracked, we provide smart notifications that nudge you to spend smarter, and you can see how your savings from the challenges help you towards your saving goals.”

If someone is doing a “spend less on restaurants” challenge, for instance, they might get a notification like, "You can save up to $30 this week! 🙌 Spend no more than 2x (~$10 each) the rest of this week to stay green." In other words, eat out no more than twice and spend less than $10 each time.

“Unlike other apps, we make things as actionable and positive as possible, focusing on your saving and telling you how many more times you can safely spend in the challenge,” Yu said.

A downside to automated savings?

Some users of automated savings apps have complained that because automated savings apps push money into another account, it is not available for emergencies, especially when it is in the process of being transferred from one account to another.

“Anecdotally, that definitely happens,” Bloch said. “I don’t think it’s an issue of automated savings — I think that will just happen” in traditional bank accounts and fintech accounts.

Digit’s money transfers usually take place within a business day, Bloch said.

“For most people in most circumstances that’s OK,” he said. “We’re doing a lot of work to get that faster.”

Digit also has a feature called low-balance protection, where it will monitor the account and if it drops below a level the user has set, it will automatically move money back to checking.

At Chime, money moves instantly between Chime checking and savings accounts, Smith said. Both types of accounts are held at The Bancorp Bank.

“If our members need to access money from their savings account they can have that in their checking account and ready to spend on a debit card in literally seconds through our app, which is one of the things people love about it,” Smith said.

Interestingly, though, Chime users tend to ask for more hoops to jump through to access savings, not fewer.

“They want us to hide their savings account, make them enter a password to access it, so they’re not tempted to draw from that when they don’t actually need it,” Smith said. “So it’s a funny balance. But in general, we believe the movement of money should be instant and free, and that’s a big part of what we do.”

Editor at Large Penny Crosman welcomes feedback at