In January 2022, two men in a van trekked from Atlanta to central Oklahoma on a mission to buy a bank that wasn't for sale. They had one meeting scheduled, a few contacts in the state and the belief that the will of God was on their side.

They didn't know how the deal would get done, but "failure was not an option," said Mike Ring, who took the journey with Eric Ohlhausen to create a financial institution in the name of American patriotism.

In true biblical fashion, by the seventh day, they had met with the management at First State Bank. The pair would ultimately acquire and reincarnate First State as Old Glory Bank, a digital-first institution that launched this month.

The idea of creating a financial institution aimed at reaching a certain population or dedicated to a particular cause isn't new. But Old Glory's management has picked a market — those who are "pro-America" and anti-cancel culture — that perhaps doesn't have unique banking needs that aren't being met elsewhere. Because of that, convincing consumers to leave their current financial institution and join them could be a tough sell, experts said.

However, Ohlhausen is convinced there's a need for a bank like Old Glory.

"There's probably half the country that is pro-America, a patriotic crowd that doesn't have a financial services firm out there that really resonates with them," Ohlhausen, who serves as chief operating officer, said. "First responders, military, hard-working farmers…the people who really get things done in this country. We feel that this is a bank that they can be proud of doing business with, a bank they feel respects them for what they are and what they do."

Old Glory Bank's genesis

Old Glory was conceived when Ohlhausen called Ring in November 2020 with an idea. After 15 years of working in the payments and card programs industry, Ohlhausen was seeing fintechs begin to "decommoditize" the industry. Many financial technology companies have leaned into offering services based on identities or interests, such as Kinly for Black Americans, Daylight for LGBTQ+ families, Panacea Financial for physicians and Aspiration for environmentalists. There is also Amalgamated Bank in New York, a traditional bank owned by a labor union that embraces liberal causes.

But there have been fewer financial institutions dedicated to more conservative or right-leaning principles. Moreover, conservatives have long complained that corporate America has become too woke and too quick to appease liberals. The banking industry has not been immune to this criticism.

A number of major financial institutions have pumped the brakes on doing business with companies in the firearm and coal industries — sectors that are decidedly not in the good graces of liberal politicians. In response, Republicans are proposing and passing laws in an attempt to stymie these moves. In 2021, Texas Gov. Greg Abbott signed legislation, for instance, that requires banks looking for government contracts to certify they do not have policies that limit their dealings with gun or ammunition companies.

Given all of this, Ohlhausen's proposal was pretty straightforward: Why not create a bank that is openly, ardently "pro-America" and that would not restrict its business based on political or popular pressure?

Ring, a 30-year corporate and securities lawyer and a U.S. Air Force veteran, loved the idea. They gathered a group of co-founders that included some of the biggest names in conservative politics, such as former Secretary of Housing and Urban Development Ben Carson, radio and television host Larry Elder and country music artist John Rich.

Once Old Glory had its team, it just needed a bank. Ring, now CEO of the bank, said they wanted to acquire a family-owned, single-branch, state-chartered bank in the Southeast or West with less than $50 million in assets. After getting outbid to buy a bank that was for sale in Alabama, Old Glory's team decided it needed to search in a less densely populated state, like Oklahoma, Wyoming or one of the Dakotas.

First State Bank was founded in 1903 in Elmore City Oklahoma, the town that inspired "Footloose." Notably, the bank wasn't for sale when Ohlhausen and Ring showed up last year. They told then-owner and CEO Clay Christiansen, who's now on the board of Old Glory Bank, that they wanted to take the small-town family-owned culture from First State and expand it nationally.

The two companies entered an acquisition agreement by mid-March. In November, the deal got regulatory approval from the Federal Reserve, which will be the bank's regulator, along with the Federal Deposit Insurance Corp. and the Oklahoma Banking Commission.

"Old Glory Bank will serve lower- and middle-income Americans and those Americans that other banks have marginalized and ignored—hard-working patriots who keep this country running every day," Carson said in a statement when the company announced it had acquired First State Bank.

To be sure, no U.S. banks have publicly stated a refusal to accept first responders, military members and farmers as customers.

Along the way, the team picked up a number of veteran bank executives: Chief Credit Officer Bennett Brown, Ohlhausen's cousin-in-law and a five-decade banking veteran; Chief Compliance and Risk Officer Maureen Carollo, who has 25 years of bank compliance experience; and Chief Financial Officer Robert Halford, who has been in banking for 30 years.

All staff members have equity in the company, and all the employees from First State Bank came aboard to Old Glory's team.

The promise of unfettered financial freedom

The bank started offering savings and checking accounts, along with an internal peer-to-peer payment system dubbed Old Glory Pay, this month. On March 15, the bank began inviting folks off a waiting list, which Ring said is currently "many tens of thousands of people."

The bank plans to roll out business banking by July 4. Despite the conservative heavyweights involved with the bank's purchase, Ring said the institution is catering to the needs of "Middle America." To Ring, Middle America is a state of mind, not a geography, focused on "community, country, family and faith." Personal views will not color the bank's business decisions. Ring noted that if Planned Parenthood wanted to bank with Old Glory, the company would oblige.

The bank's website is full of classic Americana imagery, such as a man holding a baseball and glove and the U.S. flag proudly waving in a breeze. It promotes the bank as "for people who believe in love of country, respect for the flag, and appreciate the military, law enforcement and first responders."

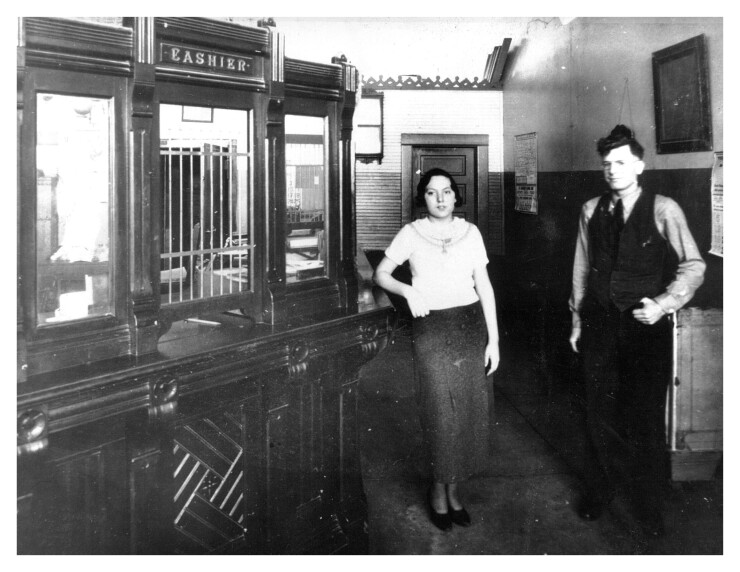

The website has the words "the real bank for real Americans" imposed over an old black-and-white photograph of the bank followed by a brief history of the institution and a promise of offering the latest technology.

Management does not align the bank with Republican or conservative dogma. Instead, Ring said that the bank has employees with beliefs from across the political spectrum, including Democrats and Independents.

A key tenet to Old Glory Bank is that it won't deny service or shut down accounts of users or organizations due to their beliefs, something the founders say happens at other banks. This commitment to not "canceling" customers is what Old Glory's executive team thinks makes the bank's pitch unique. It is also why Old Glory was adamant about developing its own peer-to-peer payments system. Since it is internal, it will be "cancel-proof."

Old Glory Bank's Executive Chairman Bill Shine, a former White House deputy chief of staff in the Trump administration and former co-president of Fox News, said consumers have gradually been losing freedom with their money due financial institutions' political stances.

"Mike and his team are putting together a banking concept for a broad array of people who love their country and think that with their hard earned money, financial institutions shouldn't be dictating a number of issues here, whether it be political issues, environmental issues, gun issues," Shine said. "They just want freedom with their money."

In the United States, there haven't been proven occurrences of FDIC-insured banks canceling or freezing consumer accounts due to political beliefs. A number of high profile conservatives, such as Dinesh D'Souza and MyPillow Founder Michael Lindell, have claimed that banks have penalized them by closing their accounts due to their political beliefs. But there has been little public evidence proving this.

After the Jan. 6, 2021, attack on the Capitol, several payments companies, including Venmo and PayPal, stopped processing payments for groups and users that helped organize and fund travel and expenses for rioters.

Stripe also halted its payments processing service for President Donald Trump's campaign website at the time. Last year, the Canadian government froze the bank accounts of hundreds of truckers who had blockaded city streets and bridges in Ottawa for weeks protesting COVID-19 vaccine mandates. Prime Minister Justin Trudeau, for the first time, invoked the country's Emergencies Act, which allowed officials to lock up finances to pressure protesters to remove their trucks, and lifted the freezes the following week.

Old Glory Bank's policy is that it won't "cancel" law-abiding customers, but will take action if a customer violates its rules and policies, such as defaulting on loans, or commits a financial crime, such as fraud.

"If a government official requests that we punish or cancel you for lawfully attending a protest, we will not comply," Old Glory's website says in a frequently asked questions section. "If there is a request to punish or cancel you for conducting lawful business, that request will be unlawful, and we will not comply. If other banks (and tech companies) want to stand with their elite friends in government and media to punish and cancel Americans for fossil fuels, the meat industry, firearms, or speaking truth to power, that's on them."

Shine, who doesn't have banking experience, said the team wouldn't have created Old Glory if canceling wasn't a real problem in banking.

Ron Shevlin, chief research officer at consulting firm Cornerstone Advisors, said banks don't freeze accounts because of the customer's political beliefs. He added that a bank would face legal action if there were credible instances of this. Some fintechs, like Chime, have faced scrutiny for erroneously closing consumer accounts. In Chime's case, the account closures were over suspected fraud and not tied to politics.

Todd Baker, a senior fellow at the Richman Center for Business, Law & Public Policy at Columbia University and the managing principal of Broadmoor Consulting, said he thinks Old Glory's use of language like "cancel-proof" is more about marketing than banking. Baker added that a niche marketing strategy can help banks differentiate themselves in a competitive field.

Shevlin said banks can successfully target niche markets when they offer products specific to the needs of those markets, which he doesn't see at Old Glory Bank.

"The concerning focus is: Do consumers who care about patriotism and freedom have unique banking needs?" Shevlin said. "Not to say that there aren't, but I really struggle to understand the unique banking needs of people who care about patriotism and freedom…I see the value of a niche strategy, but this niche I don't get at all."

Old Glory's executives admit that the company isn't doing anything new from a business perspective. Fintechs and credit unions have long targeted niche markets, and it will comply with know-your-customer requirements and the Bank Secrecy Act, like any other institution.

COO Ohlhausen said it's the confluence of factors that sets Old Glory apart: catering to what he calls the "pro-America" market as an FDIC-insured bank.

"We think it's novel. We think that the business opportunity was identifying a market that's actually quite broad, but that was not being addressed," Ohlhausen said. "And doing it as a bank. So in that regard, call it the first or one of the first to do that, but it's not like doing something untested."

Management is hoping that customers will have an emotional connection to the brand.

"We believe that if we offer the greater, or at least equal to, products, but we have a brand that people can identify with, it will work," Ring said. "So that really is our value proposition. Come for our brand, stay for our technology."

But will that be enough?

Old Glory isn't the first financial company with the idea of tapping into the "pro-America" niche market. GloriFi, a nonbank fintech unaffiliated with Old Glory, launched last year touting similar values, like patriotism, respect for veterans and financial freedom.

The neobank, which had previously raised $50 million from major investors and conservative figures, shut down in November, two months after it started offering checking and savings accounts. GloriFi folded when funding that management thought it had secured fell through, the Wall Street Journal reported. Importantly, as an FDIC-insured bank, Old Glory will have easier access to capital than GloriFi.

Shevlin, of Cornerstone Advisors, said that this will be an advantage for Old Glory, but it isn't a selling point to most average consumers. He added that he doesn't think consumers will care enough about the bank's message to switch bank accounts if their current accounts work. Banking is a famously sticky industry with consumers reluctant to switch financial institutions. Because of that, it could be difficult for Old Glory to convince consumers to unwind their relationships with another institution to support a principle without receiving vastly different products in return.

"This will work to some degree, because there are always people who are sufficiently committed to a cause," Baker, of Columbia, said. "The question is whether these people will get the full banking relationship. What will be the size of the deposit base? How much will people use the debit card that the bank will issue for their daily spending?"

Initially, Old Glory will lean on non-interest income from interchange fees more than other community banks, expecting that roughly 80% of its revenue will come from non-interest income and 20% from interest income. Old Glory Bank's debit card program with Mastercard will generate its interchange fees, which Ring said will be sustainable because, as a bank, Old Glory won't have to split that income with a sponsor bank, like many fintechs.

Chief Financial Officer Robert Halford said the bank will also utilize net interest income and other service charges, but Old Glory's nationwide product expands its ability to lean on interchange fees.

"It's still banking 101," Halford said. "We are relying a little bit more on interchange fees. Any community bank is going to have income from that segment, but ours is going to be more because we can have the volume of accounts, where a normal community bank cannot. That's where the national branding comes in."

Shevlin and Baker said relying on interchange fees is difficult unless a bank captures a consumer's full wallet, but Baker added that the strategy can sometimes facilitate faster growth.

"Bank regulators do not like fast-growing banks," Baker said. "They believe that high growth is inevitably correlated with high credit risk when the growth is coming from the asset side, or loans, so they don't like high loan growth. One advantage that a bank like Old Glory, that's going to be deposit and interchange focused, has is that they can grow a lot faster because they're not adding credit risk."

Ring said that as Old Glory grows, the bank's interest income could make up about 50% of its business by year five. In the first year, Old Glory plans to onboard tens of thousands of customers, and by 2024, projects that 10% of its business will come from business banking. Ring estimates that half of the country believes in Old Glory's message, but the bank expects its general demographic to have household income of $25,000 to $64,000, and skew older in age.

It's long been understood that there's a digital divide between Black banks and credit unions and other depositories. A new Urban Institute analysis looks at the prevalence of online banking services and mobile apps — and finds a chasm between the haves and have-nots.

America first and digital first

Old Glory will operate almost entirely digitally, and Ring thinks the pandemic has shown that consumers across all ages will bank online. But some experts believe this could be a risky strategy. Charles Wendel, president of Financial Institutions Consulting, said that the bank's lack of branches could eliminate potential customers, especially older folks, who may prefer to have an in-person relationship with their bank.

According to research from Arizent, American Banker's parent company, one-third of banks and credit unions plan to reduce their branch network in 2023, while 39% expect to keep branch networks the same and 28% plan to increase their branch count. Global and national banks are more likely to reduce branch counts than community banks and credit unions.

Ring said that he could potentially see Old Glory eventually opening another branch in The Villages in Central Florida, about 60 miles northwest of Orlando, since that area is densely populated with those Ring deems as Middle Americans.

Generally, though, he said the bank will maintain its digital-first strategy. To create "the bank in your pocket," as Ring says, Old Glory started from scratch on its technology stack, bringing on ClearTouch by Fiserv for its back-end and Q2 for its front-end development. Currently, the digital bank and the Elmore City location are organized as two branches, with separate routing numbers and systems, but the legacy bank is slated to integrate the modern technology in May.

The Q2 platform offers a customizable dashboard, with features like goal setting and transaction categorization. The app also powers consumer banking functions like bill pay, biometric login, direct deposit up to two days early, and a feature called Clickswitch, which facilitates the transition of direct deposits and automated payments into new accounts.

Shevlin said he thinks Q2 has a great platform, but strong technology doesn't drive customer acquisition. However, Ring doesn't think customer acquisition will be an issue. Right now, Old Glory isn't planning on buying any other banks and wouldn't consider selling either.

Becoming part of another institution would dampen the bank's mission.

"It would be unlikely that we ever allow ourselves to be acquired," Ring said. "I don't believe that, when we get to the proper size, anyone who could afford to buy us would continue to respect our mission of serving Middle America. The last thing we want to do is be bought by a company that makes us woke. That would be a turnback of many years of hard work and passion, and following God's calling."

Woke, to Ring, means putting politics ahead of practicality and infringing on legal rights around issues like gun ownership. Instead, the CEO said he thinks Old Glory Bank will eventually go public, specifically via a direct listing to "bypass big banks."

"I believe Middle America will want to buy and own our stock and literally have a piece of their own financial freedom… And that will ensure that we continue to have the capital to grow and service every person in this country that we can, and also will reward our investors who took the risk to put us here and reward our employees."