Social Finance’s quest to add a banking subsidiary has hit a wall of opposition from progressive groups and community banks.

In June, SoFi

To move ahead with its banking plans, the San Francisco company

The reasons for the negative responses varied. But taken together, the comments show that SoFi faces a substantial challenge as it seeks to become the first U.S. online lender to enter the mainstream banking system.

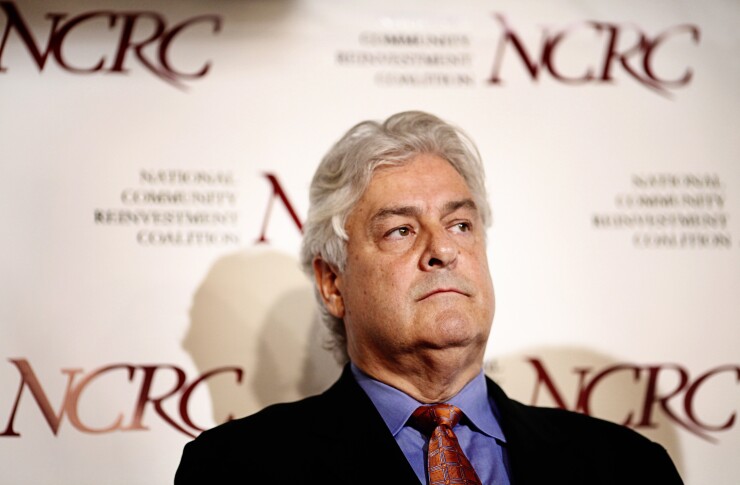

The National Community Reinvestment Coalition argued in its letter that SoFi’s plans to comply with the Community Reinvestment Act are inadequate. The group also questioned whether the algorithms SoFi uses to make lending decisions are resulting in a largely white, wealthy customer base.

“SoFi is in the business of cherry-picking the best, brightest and the richest,” John Taylor, NCRC's president and CEO, wrote in a letter that was joined by dozens of other organizations. “It is as if the products are designed to repel, not attract, modest-income people.”

In its application for a banking charter, SoFi announced plans to start offering a secured credit card aimed at low-income and moderate-income borrowers. But the company’s declaration that it will charge those customers interest rates in excess of 20% drew derision from the California Reinvestment Coalition.

“This is quite a statement for a CRA plan, and does suggest that perhaps this was a typo or mistake on the part of SoFi,” the group wrote in its letter to the FDIC.

The Independent Community Bankers of America, a Washington-based trade group for small banks,

The Dodd-Frank Act of 2010 imposed a three-year moratorium on the formation of new industrial banks, and in the years since, SoFi is the first company to file such an application.

The ICBA led the charge against Walmart’s effort to obtain a bank charter a decade ago, and it wants a firm wall between banking and other commercial activity.

Unlike Bentonville, Ark.-based Walmart, SoFi is primarily a financial services firm, which currently offers student loans, residential mortgages, personal loans and investment products. But the ICBA argued that if SoFi chose to expand into e-commerce, banking regulators would be powerless to stop the company.

“SoFi might even become ambitious enough to set up an online retail company that would compete with Amazon,” Christopher Cole, the trade group’s executive vice president wrote.

Meanwhile, Americans for Financial Reform, a progressive group that frequently defends Dodd-Frank from criticism, laid out another argument against SoFi’s application.

The group noted that firms with industrial banking charters are exempt from certain aspects of regulatory oversight to which most banks are subject, and argued that industrial banks threaten the integrity of the federal safety net for banks.

“This is likely to be particularly true in the case of SoFi, which is an aggressive, sophisticated, fast-growing financial institution at the cutting edge of online lending markets,” Americans for Financial Reform argued.

A SoFi spokeswoman did not respond to requests for comment Wednesday.

The negative feedback on SoFi’s application stood in contrast with comments that Acting Comptroller Keith Noreika made Wednesday at the Exchequer Club in Washington.

In response to an audience member’s question, Noreika expressed openness to the hypothetical idea that a tech giant like Google or PayPal could obtain a bank charter.

“They have to come in, they have to talk to us, they have to tell us what their business plan is, and we have to see whether it makes sense in the context of their operations,” Noreika said.

He added: “If you look at it across the international sphere, ours is the only country that has this strict separation of banking and commerce. And it’s historic, I understand it. But also having gone to business school and concentrating in finance, I know it’s not the best thing to put all your eggs in one basket.”

Noreika’s comments followed a speech in which he expressed support for the idea, championed by former Comptroller Thomas Curry, of establishing a new banking charter for fintech companies. The Office of the Comptroller of the Currency will not have a say on SoFi’s application.

Lalita Clozel contributed to this story.