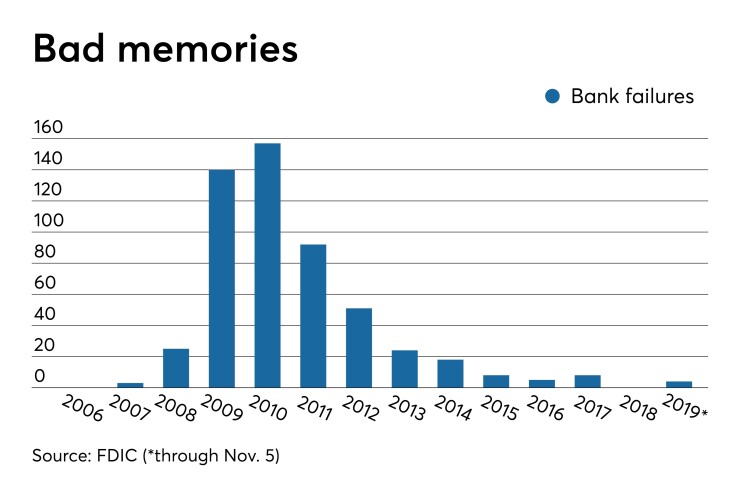

The closing of three banks in the span of a week should be viewed as a reason to exercise caution — though it is too early to expect a run of failures.

Regulators shuttered

Only two banks were closed between December 2017 and last May, with both involving cases of alleged fraud.

Bankers should pay attention because the recent closings could portend a stiffer regulatory stance on capital adequacy and risk, industry experts said. Regulators could be looking to address instances of poor management and inadequate capital before the next economic downturn.

"With the economic cycle slowing, I'm afraid we haven’t seen the end of bank failures," said Michael Jamesson, a principal at Jamesson Associates, a consulting firm in Scottsville, N.Y. He noted that income pressures, including a flat yield curve and slowing loan demand, are challenging growth-minded banks.

Recent closings could have been "house cleaning," said Bert Ely at the consulting firm Ely & Co. in Alexandria, Va. "It was time to kind of put those banks out of their misery."

"I’m not so sure banks are realistically calculating their risks appropriately," said Danny Payne, a bank consultant and former commissioner of the Texas Department of Savings and Mortgage Lending, noting that several small banks have been slow to reduce certain loan concentrations.

While

A spokesman for the Office of the Comptroller of the Currency, which shuttered Resolute and City National, declined to comment. While an FDIC spokesman cautioned against reading too much into the recent failures, he noted that an extended period of zero interest rates helped keep credit issues at bay for many banks.

Ely found it interesting that no premiums were paid for the failed banks, which he said indicates a lack of buyer interest.

Kentucky Farmers Bank in Catlessburg bought most of the assets, and all of the deposits, of the $29.7 million-asset Louisa Community in Kentucky when it was closed on Oct. 25. An hour later, Buckeye State Bank in Powell, Ohio, acquired most of the assets, and all of the deposits, of the $27.1 million-asset Resolute Bank in Maumee, Ohio.

The $120.6 million-asset City National Bank of New Jersey, a minority depository institution in Newark, was closed on Nov. 1. Its deposits, and most of its assets, were sold to Industrial Bank in Washington, D.C., another minority depository institution.

To be sure, small banks are in better overall shape than they were a few years ago.

About 5% of banks with less than $500 million in assets were unprofitable in the first half of 2019, an improvement from 8% in mid-2014 and 27% a decade earlier, according to FDIC data. The average Tier 1 risk-based capital ratio for smaller banks rose to 17.09% on June 30 from 16.54% in mid-2014. (The average Tier 1 ratio was 14.11% in mid-2009.)

In comparison, Resolute had a 4.77% Tier 1 capital ratio on June 30, while Louisa Community's ratio was 2.57%. City National's ratio at midyear was 5.61%.

Still, banks that struggle with capital or liquidity should be concerned, industry experts said. Ailing banks are often given deadlines that coincide with the end of the fiscal year, so more failures could take place this quarter.

The OCC, in particular, tends to favor closure over lengthy workouts, Payne said.

"Having patience and monitoring workouts are staff-intensive and risky by nature as opposed to the hammer," Payne said.