For years, financial services firms have said they want their apps to be as intuitive as Uber's ride-hailing app.

But Stephanie Cohen, global co-head of consumer and wealth management at Goldman Sachs, says this was not on her mind when she hired Peeyush Nahar, vice president of technology at Uber, to become partner and global head of Goldman’s consumer business, which includes Marcus, on Monday. He starts on June 1.

“We chose Peeyush for Peeyush,” she said Monday evening. “What we think he brings is deep engineering and technical expertise. He's run businesses at scale and he's taken businesses from nothing to grow them. He's also done this inside of large companies."

Nahar spent 14 years at Amazon, where he led technology teams working on its business-to-business marketplace, Amazon Lending and the machine learning platform for Alexa. Before that he had operations roles at Delphi, a technology startup that spun off from General Motors.

He joins Marcus at a time of high turnover for the unit, which at the end of March had about $8 billion of loan balances and about $100 billion of deposits. Observers say the mix of startup and big tech company experience he brings to the group is just what this digital-bank-within-a-bank needs to reach Goldman executives' goal of increasing deposits to $125 billlion and more doubling the loan portfolio by 2024.

“His appointment won't necessarily make up immediately for the high turnover, but he is a solid, proven hand to build a next generation of products and culture at Goldman at a time when they seem open to redefining parts of their culture,” said Robert Voth, managing director at Russell Reynolds Associates, an executive search and advisory firm in New York.

Nahar’s hire is also part of an ongoing trend of financial services firms hiring tech company executives to lead digital initiatives, said Daniel Latimore, chief research officer at Celent.

“They bring a different perspective, one that’s often very customer focused,” he said.

Square, for instance, has recently hired leaders from Apple and Microsoft, Voth pointed out.

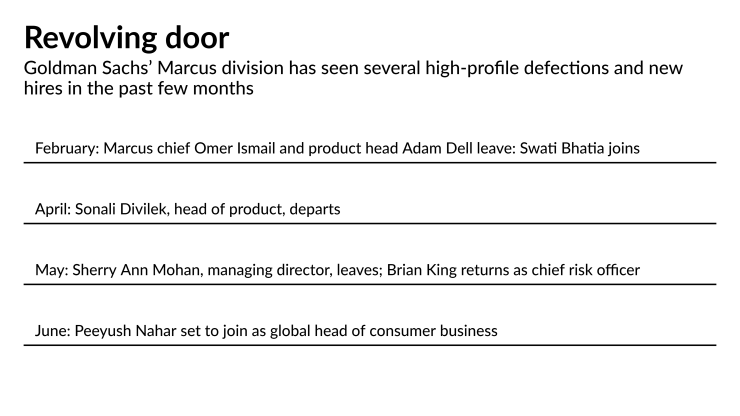

The upheaval at Marcus begain in February when Omer Ismail, who officially became Marcus’s leader the month before, left to join the fintech Walmart is setting up. Goldman partner David Stark went with him. Adam Dell, who was partner and head of product at Marcus since his startup, Clarity Money, was bought by Goldman in 2018, also left the bank in February. Sonali Divilek, a managing director at Goldman, who was promoted to Dell’s former position in February, said in April she was leaving for JPMorgan Chase. On Friday, Sherry Ann Mohan, Marcus's chief financial officer, said she was also leaving for JPMorgan Chase.

Goldman has also made a few key hires to the Marcus group. Brian King, a former Goldman executive who left for a brief stint at Wells Fargo, returned in May and is now Marcus's chief risk officer. Swati Bhatia joined from payment technology company Stripe in February as head of proprietary business. Robert Cochran was hired from Facebook last year as digital product lead at Marcus.

Harit Talwar, who launched Marcus five years ago, remains chairman of the consumer business.

In explaining the recent turnover, Cohen pointed out that at Goldman, some people stay for a few years, some stay for a decade and some stay for their entire career.

“That's normal and natural,” she said. “One of the things about us growing the consumer business is we've gotten to a place where people have looked and said, you guys have amazing talent. And so the fact that some of our people leave to do fantastic things, we think is a normal evolution. That’s what happens when you recruit and you train and you develop the world's best people, some of them stay, and some of them leave. And we think that that creates a really fantastic ecosystem.”

Business Insider has reported that

“We have achieved a tremendous amount in a short period of time,” Cohen said. “We're listening to the organization and what people need in order to work, and we’re super proud of what we've been able to do for customers. The other thing is that I think the pandemic across all businesses has made it hard to separate work from home. It's on all of us to help our people with that. So we're learning from this and we've spent a lot of time listening to our people.”

In the bigger picture, it’s not surprising that a smaller, semi-independent digital bank within a large institution would face challenges. JPMorgan Chase shut down its Finn unit a year after launching it. Wells Fargo closed its Greenhouse digital bank to new customers three years after its debut.

“It is immensely difficult to incubate a long-term, successful startup inside a large-scale, venerable, conservative institution,” Voth said. “It's just hard. At some point, there will be areas where the path forks and the institution says, we appreciate what you've done, but this is us. And the startup will say, we appreciate the support you've given us, but this is who we're becoming.”

It's also not surprising that Ismail would have left for what some consider to be a career-defining challenge: creating Walmart's as-yet-unnamed fintech startup.

“I would imagine that is an exciting prospect for anyone at a big bank that wants to make their mark,” said Brad Leimer, co-founder of Unconventional Ventures. “While Marcus has lofty goals, it will impact fewer people, and certainly impact less people that are lower to mid income.”

Voth said Marcus is still evolving and that its growing pains are similar to those of a teenager.

“From a parenting standpoint, it's growing, it's finding success and it's finding its way,” he said. “And while everyone still does love each other, you will have instances where people just don't agree. And that's where they are now.”