An aggressive ad campaign by Peapack-Gladstone Bank has revived a debate on how community banks should react when a large bank goes astray.

It started with a treatise where Doug Kennedy, the Bedminster, N.J., company's president and CEO, outlined his views on the banking industry. He criticized industry “abuses,” railed against emphasizing sales over service and urged customers to find local banks, such as his, that would put their best interest above the bottom line.

Though he didn't name Wells Fargo, Kennedy referenced a "nationally known bank" that had been fined $1 billion for problems in its home and auto loan businesses.

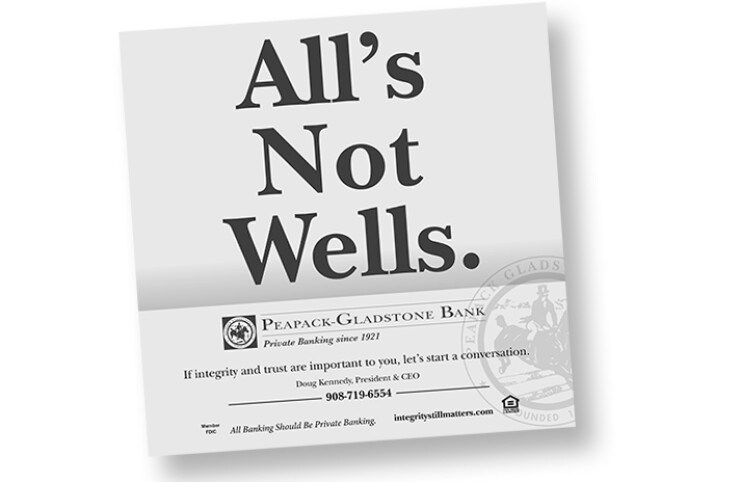

Then came the digital billboard at the entrance of the Lincoln Tunnel stating, "All's Not Wells."

The advertising campaign directs readers to visit www.integritystillmatters.com, a domain bought by Peapack that leads to a special page that again highlights the heavy fine without mentioning Wells directly. The campaign will run over the next several months and includes print, radio, internet and mobile spots.

Intentionally provocative, Kennedy expressed hope that other community banks will publicly distance themselves from the nation’s biggest institutions. Peapack, for its part, voiced similar concerns in a smaller 2016 ad campaign.

“As a community bank, I’m surprised our industry hasn’t been much more assertive in trying to use this as an opportunity to help differentiate what a community bank is and does,” Kennedy told American Banker.

Should other community banks follow the $4.3 billion-asset Peapack’s lead and publicly lash out against bigger institutions? If so, they may want to be prepared for the risks involved.

As news of Wells Fargo’s fake-accounts scandal erupted in 2016,

Small banks' efforts to peel away customers often take place behinds the scenes, however, limited mostly to private discussions with potential clients. It is rare for a bank to launch a public campaign that targets another institution's struggles.

There are good reasons for that.

For one, some banks fear that publicly slamming another institution may be setting up their own bank for an eventual fall. Bank CEOs often complain that they are the subject of arbitrary scrutiny by regulators.

Dan Rollins, BancorpSouth's chairman and CEO, has described his bank's regulatory snags as not knowing “what we did wrong to get drawn as the candidate of the week.” The Mississippi bank spent more than three years addressing compliance issues tied to the Bank Secrecy Act and the Community Reinvestment Act.

So reveling in another bank’s misfortune may be seen as an invitation for karma, especially if enforcement can strike any bank at any time as Rollins implies.

Kennedy, who has worked at larger institutions, said his focus with the Peapack campaign was less on the regulatory actions taken against Wells and more on a culture that emphasizes making sales over providing useful products. He was confident, at least in that regard, that the bank is clean.

“The point isn’t the regulatory action,” Kennedy said. “It is the behavior that is inherent. … The $1 billion fine is the consequence of a certain culture and behavior, and we don’t have that.”

A Wells spokesman declined to discuss Peapack’s ad campaign, though he said the company has taken steps to address its improper sales practices and was working to rebuild trust with customers and employees.

Another risk is that Peapack’s ads are openly highlighting a negative banking story at a time when the industry is rebuilding a reputation shredded during the financial crisis. If community banks shine a spotlight on negative press about one institution, are they perpetuating public mistrust in everyone?

Kennedy disagreed. He notes that customers are already aware of the negative headlines surrounding Wells, so his advertising push is simply demonstrating that there are good actors ready and willing to appropriately serve their communities.

“There isn’t a banker that doesn’t wince when news of a $1 billion fine hits,” Kennedy said. “I’m not stoking the fires. I’m starting the conversation.”

Kennedy understands that his move is controversial. But he's choosing this to supplement his traditional ads, which typically feature more sedate scenes, such as a young woman walking a horse in a stable (the logo of the bank is a horse jumping a fence).

"This is provocative," he said. "If I had just put horse ad on that, you wouldn’t be calling me right now.”

To be sure, community banks must be prepared to go beyond telling their customers what they are not. Reassuring clients that you won’t open fake accounts under their names isn’t exactly an inspiring message.

Still, defining what a bank stands for is trickier than one might expect. Often when CEOs are asked what differentiates their bank from the thousands of others out there, they answer their “culture.” When pressed to describe that culture, a CEO might point to a vague notion of “better customer service.”

While these banks might have a well-defined identity, plain vanilla answers highlight a communications challenge that must be improved.

Peapack’s outreach could work since it goes beyond veiled taunts about Wells and highlights the core values of integrity and trust that are prized by the wealthy clientele it targets. Kennedy stands behind the ad by including his phone number so customers could contact him.

“Why are we different? It can’t just be that we're local,” Kennedy said. “The next generation won’t care about that. The next generation of consumers will be less brand-oriented. They'll be looking at what you stand for and who you are.”

Bankshot is American Banker’s column for real-time analysis of today's news.