Comerica Bank

Comerica Bank

Comerica Inc is a financial services company headquartered in Dallas. It is primarily focused on relationship-based commercial banking.

-

-

-

-

West Plains Bank and Trust in Missouri, No. 11 on this year's Best Banks to Work For ranking, wins high marks for constructive training, employee development, team culture — as well as excellent benefits.

November 19 -

Bankers should stop thinking of small companies as difficult to serve, Comerica's Brian Haney says; "How does succeeding in small business make the retail bank stronger?"

November 14 -

"We'll be taking steps to offset expense pressures," CEO Curtis Farmer told analysts after the company reported an 11% year-over-year jump in costs and falling profits.

October 20 -

Comerica CEO Curt Farmer and CFO James Herzog as well as the company itself face a purported class action by shareholders for allegedly making false and misleading statements about the Dallas company's oversight of the Treasury Department's Direct Express program.

August 25 -

The rapid pace of innovation, reliance on a web of vendors and regulatory scrutiny means fourth-party risk is a more pressing consideration than in the past.

August 4 -

The Dallas-based company, which saw $3.7 billion of deposits withdrawn after Silicon Valley Bank failed, now predicts average deposits will fall 14% to 15% compared with last year. However, the pace of outflow is slowing, say the bank's executives.

July 21 -

Curt Farmer, CEO of the Dallas company, defends its management of a Treasury Department program that provides federal benefits on prepaid cards. He says a recent American Banker investigative article "ignores the fact that Comerica took steps to protect Direct Express users when it became aware that a third-party vendor had not followed program protocols for reviewing customer inquiries."

June 1 -

Comerica's shoddy handling of its Treasury contract to manage Social Security and veterans benefits — including outsourcing fraud claims to a vendor in Pakistan — is emblematic of how the banking industry treats the poor.

May 30 -

A Comerica Bank executive admitted to major failures in its handling of the Treasury Department's Direct Express program, including data and resolved fraud disputes sent to a vendor's office in Lahore, Pakistan, a "serious" contract violation.

May 29 -

The Dallas-based bank, whose deposit base is more commercial-focused, has seen significant outflows in deposits over the past year. But last quarter's declines were "better than we expected," and there are other signs that the environment may moderate this year, its CFO said.

January 19 -

The Dallas-based company is expanding in the Southeast and the Mountain West, and overhauling its digital systems, as part of a plan that executives say will pay off over a two- to five-year period.

December 7 -

The industry must adapt quickly to the changing preferences of entrepreneurs and the innovation of nonbanks such as PayPal and Square, according to speakers at American Banker's Small Biz Banking Conference. Traditional players such as U.S. Bancorp and Comerica say they're making the necessary investments.

October 5 -

-

The largest bank based in oil-rich Texas is building a framework for gauging the threat that climate change poses to its business and plans to disclose more information on the subject this summer. Meanwhile, its energy loan portfolio shrank 24% year over year.

January 19 -

The Dallas bank appointed Sonya Trac to lead business development in communities that have been hit hard by both the pandemic-induced recession and a recent wave of discrimination. It is also depositing $2.5 million at a Los Angeles bank that serves Asian Americans.

May 12 -

Gage is essentially charged with implementing executives’ vision into practical changes at the Dallas-based company.

May 5 -

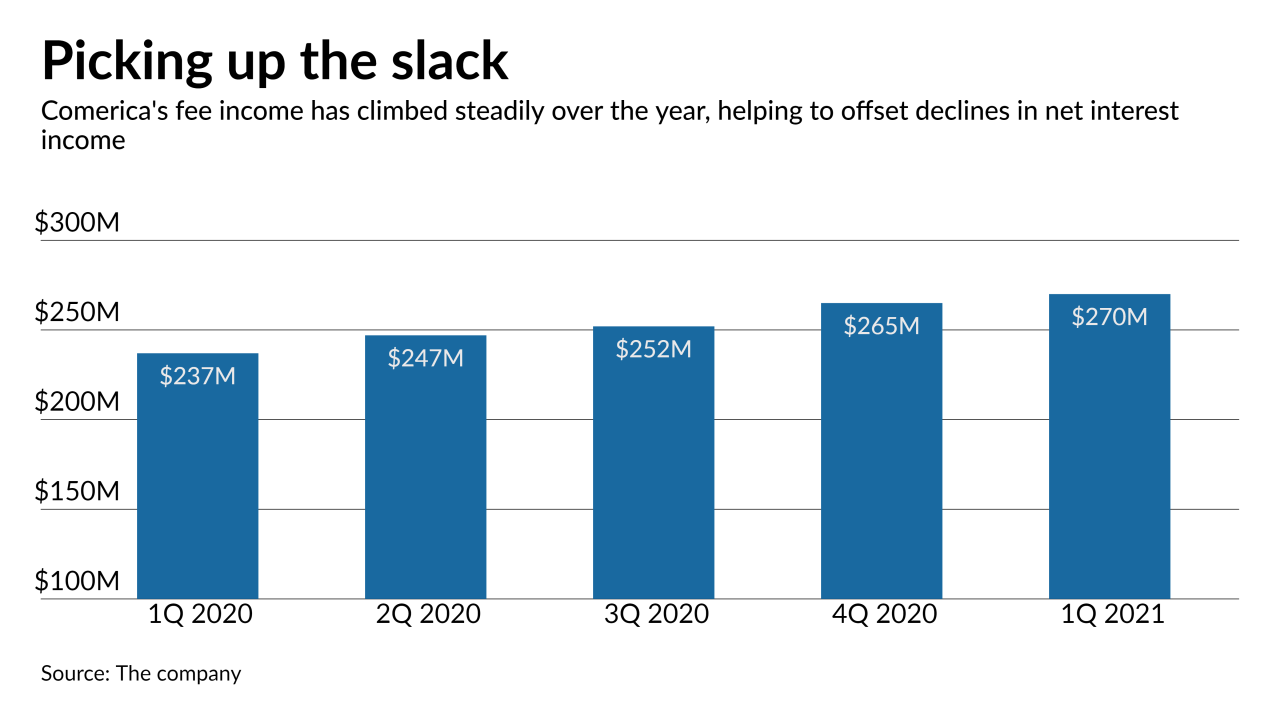

At Comerica and Synovus, higher fees from cards, mortgage banking and other sources helped to offset declines in net interest income.

April 20