-

Some speculate that the banks who do business with credit reporting agencies may be looking for alternatives after mounting concerns about their ability to keep information private. But breaking up is hard to do.

April 4 -

Some fear that the removal of such data from individual credit reports could lead lenders to believe a consumer is a better bet than they really are.

April 2 -

Legacy financial firms like the big credit bureau are seeking out financial technology to diversify themselves, bring new products to market faster and meet the needs of global customers.

March 15 -

Use of alternative data in traditional credit scoring would help consumers access the banking system and lower their cost of credit.

March 15LendUp -

Calls for less reliance on credit bureaus and Social Security numbers for verification are leading many to envision a future of identity on a distributed ledger.

October 30 -

Sen. Elizabeth Warren, D-Mass., called for bipartisan action against Equifax during a Senate floor speech on Tuesday, criticizing the credit bureau for waiting several weeks after a massive data breach to reveal it to the public.

September 19 -

The Equifax breach has millions of Americans now thinking about freezing their credit to guard against identity theft. But those who act could be cutting themselves off from the nation's vast credit economy.

September 19 -

Efforts to persuade regulators to allow Fannie Mae and Freddie Mac to use alternative credit scores would stifle competition between the credit bureaus and FICO and do little to expand access to credit, according to industry analyst Chris Whalen.

September 18 -

Rep. Carolyn Maloney, D-N.Y., sent a letter to the top executives at TransUnion and Experian on Wednesday asking them what steps they are taking to safeguard consumer data in light of the Equifax breach.

September 13 -

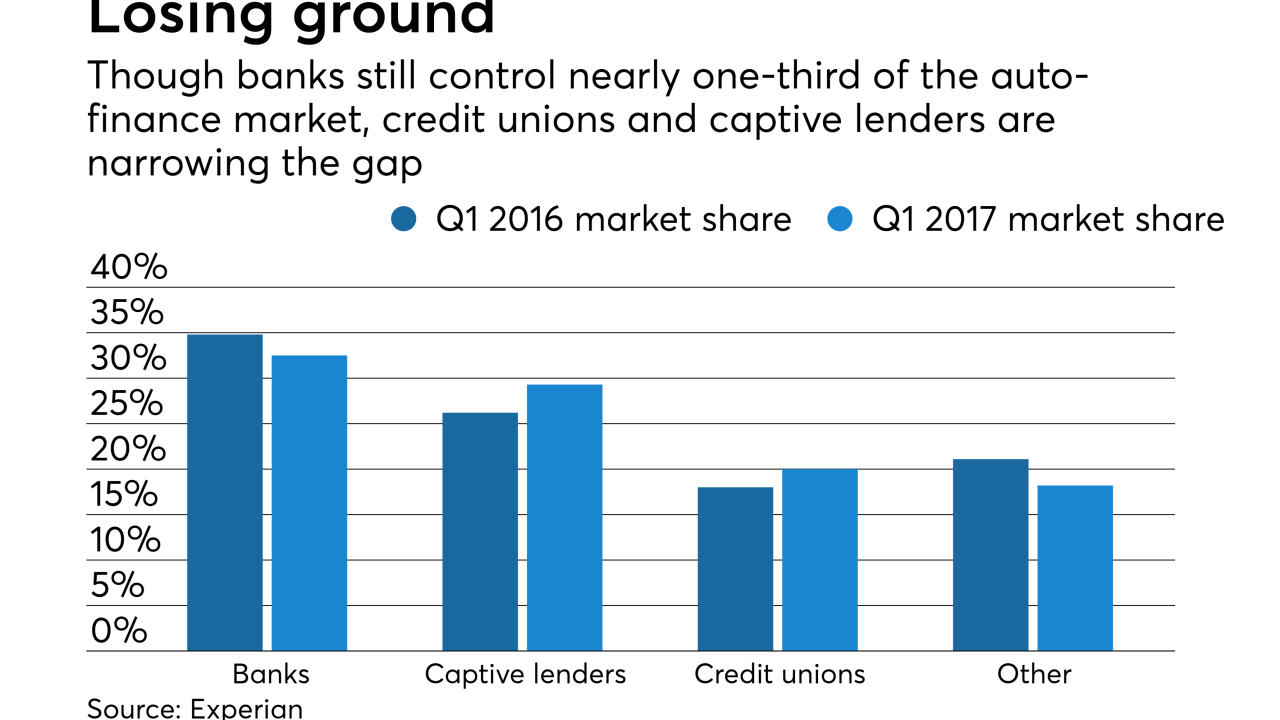

Large banks have scaled back lending as competition has intensified and credit unions and financing arms of car manufacturers are picking up the slack.

June 8 -

Large banks have scaled back lending as competition has intensified and credit unions and financing arms of car manufacturers are picking up the slack.

June 7 -

There is a growing opportunity for voice assistants such as Siri, Alexa/Echo and Google Home in banking and payments, according to new research carried out by Experian in conjunction with Creative Strategies.

May 12 -

To battle the rise of new-account fraud, Dublin-based Experian has adopted a new tool from BioCatch, which uses behavioral biometric technology to spot fraudulent applicants.

April 19 -

The credit bureaus will change the way they include information about tax liens and civil judgments in credit reports. This could spur lenders' use of alternative credit data.

March 30 -

The Consumer Financial Protection Bureau said Experian sold consumers an "educational" credit score and falsely claimed in advertisements that the score was used by lenders to make credit decisions.

March 23 -

Experian and Finicity have released a product that aims to speed up decisions on mortgage applications, using financial data aggregation technology.

March 20