-

The advancement of mobile wallets has never quite aligned with U.S. dining habits, where patrons are accustomed to handing off their credit cards to wait staff — something they are less likely to do with their phones.

February 12 -

Newcomers Nymbus, Neocova, Finxact and Technisys and older competitors like Temenos, Infosys and Oracle are winning over community and regional banks by offering what some bankers describe as more flexible technology at fairer prices.

February 3

-

Amazon is starting the new year with a major payment technology deployment at more than 11,500 gas stations, providing the e-commerce giant with an added leg to its rapidly expanding payments network ranging from checkout-free stores to Whole Foods to its own planned grocery chain.

January 6 -

2019 kicked off with a series of large, multibillion-dollar acquisitions that promised to forever change the landscape of the payments industry. And while those big deals were clustered at the start of the year, many other pivotal deals took place over the course of the year.

December 30 -

Fiserv has sold a lockbox processing unit to Deluxe, the second such acquisition for Deluxe in as many months.

December 20 -

The success of Fiserv’s acquisition of First Data, FIS’ purchase of WorldPay, or Global Payments merger with TSYS rides on the companies’ ability to address merchants that are under extreme pressure.

December 20 -

The mobile point of sale platform Clover was a star in First Data’s attempts to diversify beyond payment processing. First Data's new owner, Fiserv, sees a similar role for Clover — with sports becoming a prime venue.

November 26 -

Over the past several years, well-established companies in the space like Klarna and FIS have become big enough to buy competitors, fueling the majority of the M&A we’ve seen of late, says AvidXchange's Michael Praeger.

November 13 Michael Preager is CEO and Co-founder of AvidXchange

Michael Preager is CEO and Co-founder of AvidXchange -

Leveraging new technology and APIs, Fiserv has rolled out CheckFree Next, a major update of the core CheckFree bill payment technology Fiserv acquired in 2007.

October 24 -

Now that the big, multi-billion dollar payment deals of the past year have closed, the companies must figure out how their new scale can address tasks such as software migrations or data sharing compliance in specific markets.

September 30 -

The big payment processor/bank technology mergers that were announced early this year are officially closing, setting the stage for complicated conversions and a fierce battle for customer share.

September 18 -

The large payment processor mergers were meant to give bigger companies a better way to compete against the nimble startups that were luring their customers away for digital services such as mobile point of sale. And post-merger, Fiserv and First Data have fired their first salvo.

September 9 -

JPMorgan Chase ends business loan partnership with OnDeck; Truist out to prove it can best the megabanks in tech; Capital One's data breach was bad, but it could've been worse; and more from this week's most-read stories.

August 2 -

Two of the three multibillion-dollar payment mergers announced in 2019 closed this week, and these global giants must now fend off the invigorated fintechs eager to nab unhappy merchant and bank clients.

July 31 -

If Bank of America had decided a few years ago to end its joint venture with First Data, it would have been looked upon as just another instance in which a bank was either planning to handle its own payments in-house, or turning those tasks over to a processor.

July 31 -

Fiserv expects its $22 billion purchase of First Data Corp. to close on Monday after clearing regulatory requirements.

July 26 -

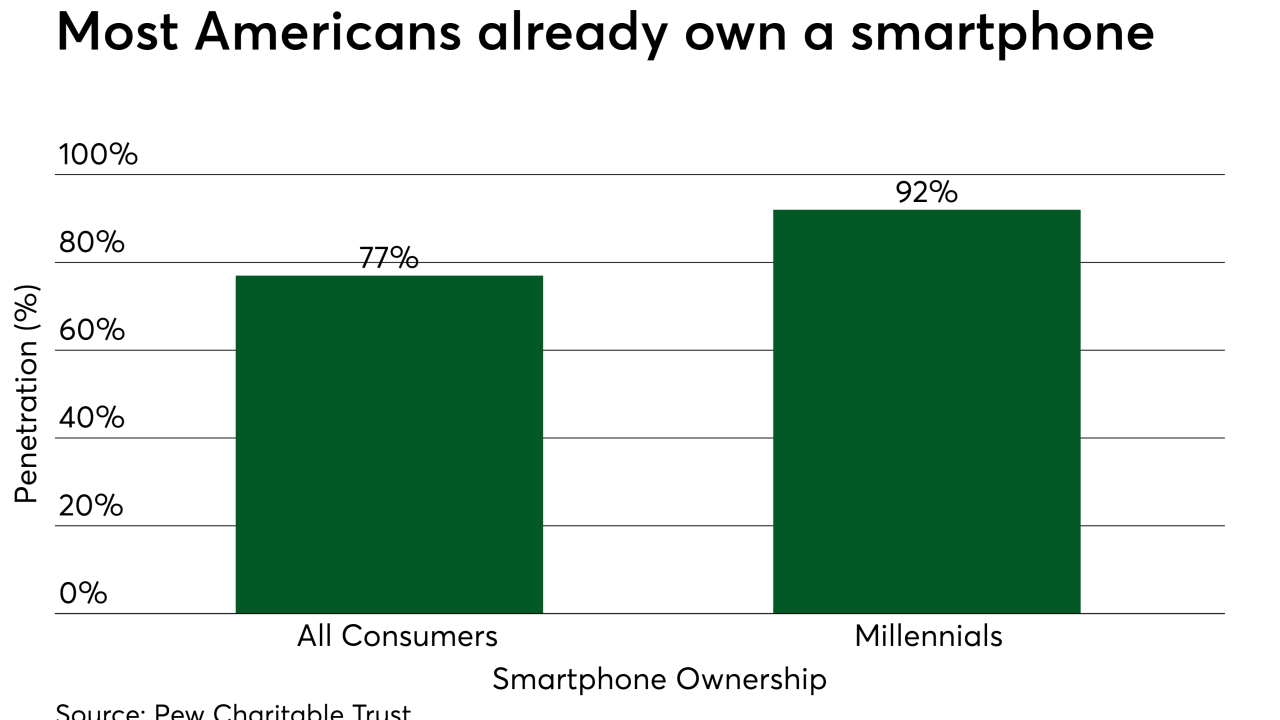

Fiserv is supporting mobile bill presentment in to meet a growing demand for receiving and paying bills through smartphones, which are now nearly ubiquitous in the U.S.

July 1 -

An acquisition as large as Fiserv's deal to buy First Data has lots of moving parts, but one big piece may be a new First Data product that's designed to improve the vexing problem of payment approvals.

June 20 -

Banks and merchants absorb billions of dollars in payment card fraud annually, but it's not for a lack of tools designed to stifle that fraud. It's becoming increasingly apparent that those tools simply aren't being used to their fullest capabilities.

June 12 -

A trio of big deals in the payments and financial tech area and continued bank and venture capital interest in fintech investments are creating expectations for a banner year.

June 10