-

The big payment processor/bank technology mergers that were announced early this year are officially closing, setting the stage for complicated conversions and a fierce battle for customer share.

September 18 -

The large payment processor mergers were meant to give bigger companies a better way to compete against the nimble startups that were luring their customers away for digital services such as mobile point of sale. And post-merger, Fiserv and First Data have fired their first salvo.

September 9 -

JPMorgan Chase ends business loan partnership with OnDeck; Truist out to prove it can best the megabanks in tech; Capital One's data breach was bad, but it could've been worse; and more from this week's most-read stories.

August 2 -

Two of the three multibillion-dollar payment mergers announced in 2019 closed this week, and these global giants must now fend off the invigorated fintechs eager to nab unhappy merchant and bank clients.

July 31 -

If Bank of America had decided a few years ago to end its joint venture with First Data, it would have been looked upon as just another instance in which a bank was either planning to handle its own payments in-house, or turning those tasks over to a processor.

July 31 -

Fiserv expects its $22 billion purchase of First Data Corp. to close on Monday after clearing regulatory requirements.

July 26 -

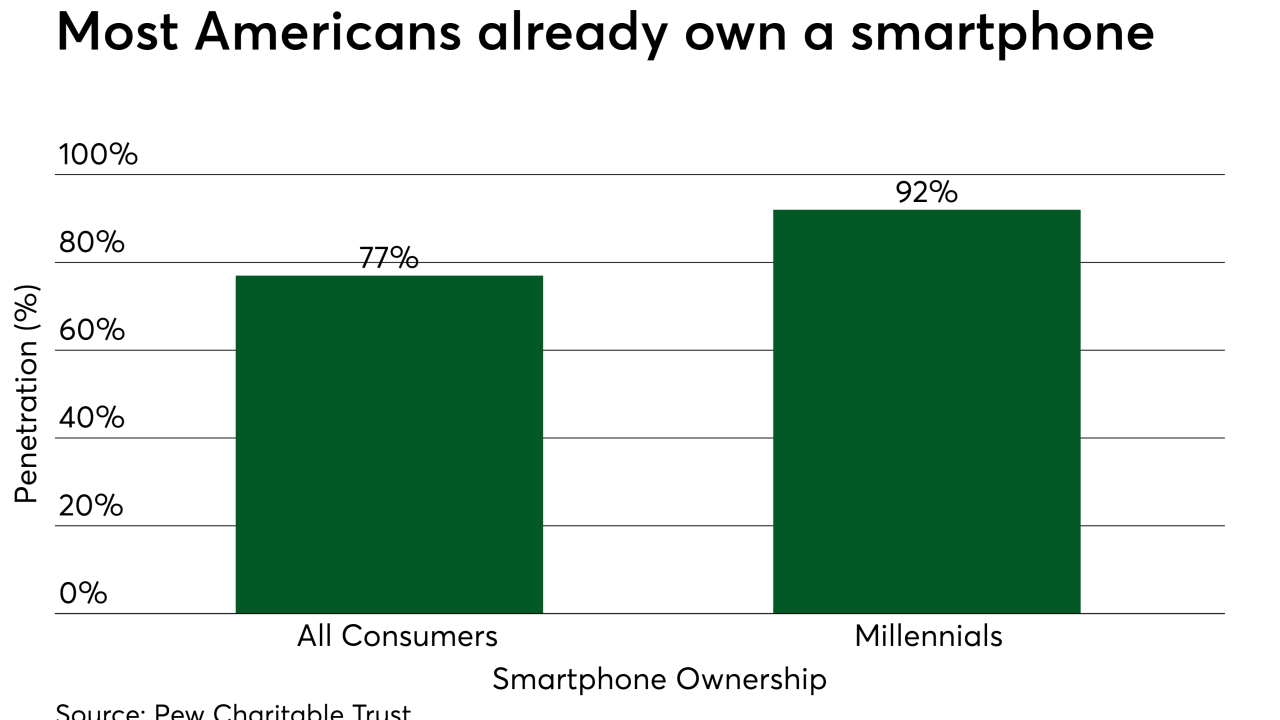

Fiserv is supporting mobile bill presentment in to meet a growing demand for receiving and paying bills through smartphones, which are now nearly ubiquitous in the U.S.

July 1 -

An acquisition as large as Fiserv's deal to buy First Data has lots of moving parts, but one big piece may be a new First Data product that's designed to improve the vexing problem of payment approvals.

June 20 -

Banks and merchants absorb billions of dollars in payment card fraud annually, but it's not for a lack of tools designed to stifle that fraud. It's becoming increasingly apparent that those tools simply aren't being used to their fullest capabilities.

June 12 -

A trio of big deals in the payments and financial tech area and continued bank and venture capital interest in fintech investments are creating expectations for a banner year.

June 10 -

Fiserv Inc. is kicking off a cross-Atlantic bond sale that could raise about $12 billion to help finance its acquisition of First Data Corp.

June 10 -

The stocks of a wide swath of publicly traded payments companies are rising faster than the overall S&P 500 index, potentially fueled by several mega mergers in the first half of 2019.

May 31 -

The London firm lags the three largest U.S. vendors but bets its new open banking platform can win it more business.

May 30 -

Following the FIS-Worldpay and Fiserv-First Data deals, the payments and bank technology industries are in the midst of major consolidation, and TSYS is looking for a merger partner to stay competitive.

May 24 -

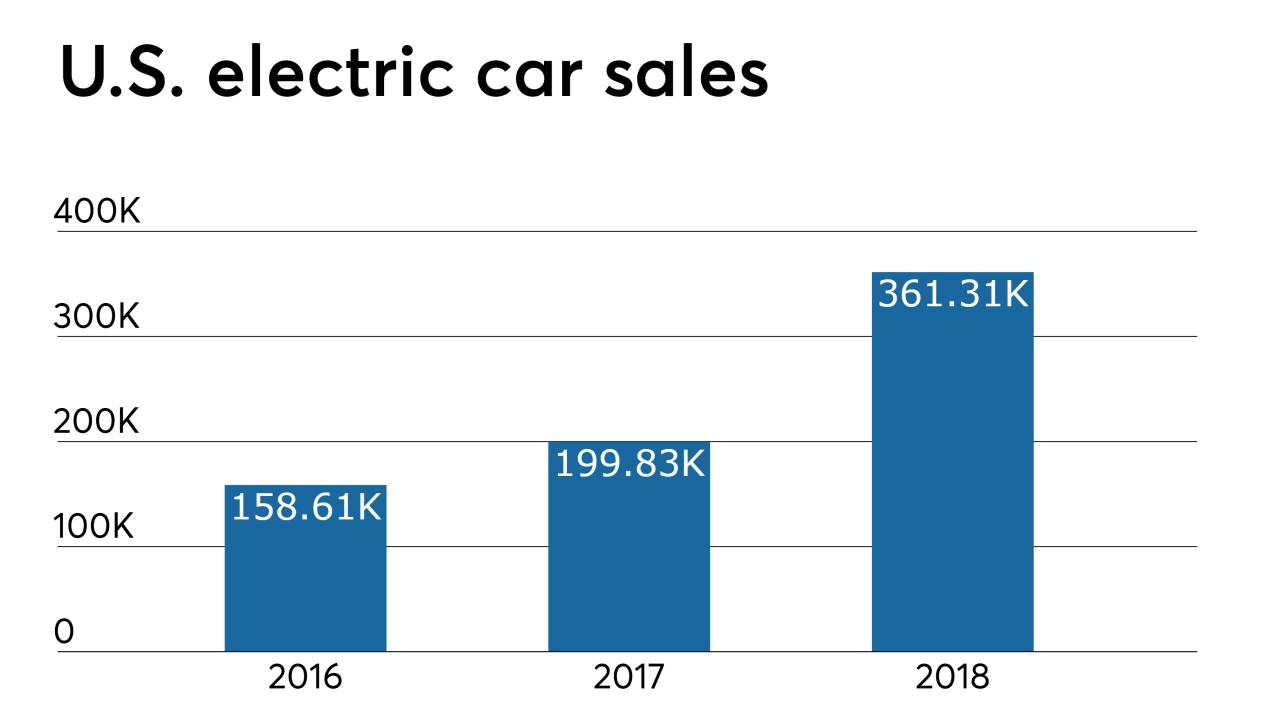

All-electric, zero-emission vehicles make up less than 2% of the market, but a handful of credit unions see an opportunity despite some unusual variables.

May 22 -

The tech company denied allegations from Bessemer System Federal Credit Union regarding security issues and other problems with Fiserv's services.

May 2 -

Much like Visa's CEO, Mastercard's top executive is viewing the recent mergers in the payments industry as a chance to build partnerships rather than a competitive threat.

April 30 -

As major payments M&A deals mount, some free agents are awaiting deals of their own — and one area where that’s most apparent is in debit and ATM networks.

April 15 -

FIS’s $43 billion agreement to acquire Worldpay and Fiserv’s $22 billion deal to buy First Data are largely closing the gaps between financial technology and merchant acquiring. But these mergers are only the first of many steps.

April 3 -

Bank technology giants FIS and Fiserv are spending nearly $66 billion between them in just the past few weeks to add a broad swath of payments technology — including a few key nuggets that will help them go toe to toe with fintechs.

March 18