-

As VR and AR mature, new possibilities open up for customer interaction in a virtual space.

October 19 -

Crowdsourced cybersecurity is making inroads into the world of big banks, even though there is a risk bad actors will exploit the opportunity.

October 18 -

Mastercard is making the first move among the card networks, again, on moving away from the signature requirement — completely removing the space for a signature from its cards.

October 18 -

The U.K. market has reached a tipping point where consumers are conducting more in-store transactions using a contactless form of payment (card or phone) instead of a process that requires the card to be inserted into a POS terminal.

October 17 -

Called Bill Pay Exchange, it will power instant bill pay for consumers from their bank or credit union accounts in a matter of seconds versus days when using the traditional bank bill pay ACH network.

October 10 -

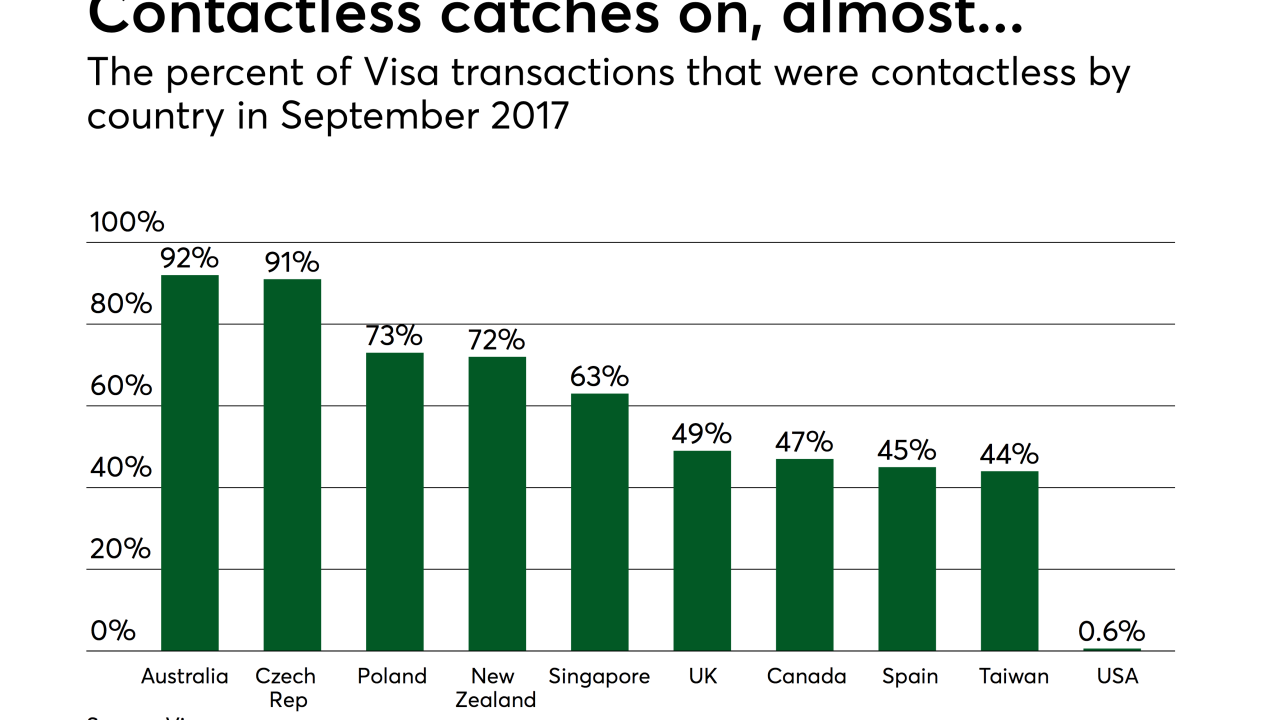

Contactless payments are a big success story in most countries around the world—including developing markets—but not in the U.S.

September 27 -

Visa Inc. and Mastercard Inc. agreed to pay as much as $6.2 billion to end a long-running price-fixing case brought by merchants over card fees, the largest-ever class action settlement of an antitrust case.

September 18 -

Each major disaster is a real-world testing ground for payments technology, but it can also be a stark reminder of the limits of these advancements.

September 14 -

The payments company released a platform made up of nine B2B networks and powered by Microsoft’s Azure.

September 13 -

Technology developers have little choice but to see big data deals like Mastercard’s reported collaboration with Google as an opportunity for deep, actionable analysis, setting aside the chilling effect of privacy concerns and a consumer buy in.

September 6 -

While the card networks have greatly benefited by the global boom in e-commerce, they are confronted with the corresponding growth in digital advertising. This will increasingly lead them to seek out data-sharing deals like Mastercard's reported arrangement with Google, which could prove vital to the networks' future survival.

September 5 -

The deal lets Google learn more about what people buy based on online ads, but raises privacy concerns; checkbooks favor Congressman Sean Maloney.

September 4 -

As the pressure to monetize data in an omnichannel environment increases, so does the fear of misuse.

August 31 -

For the past year, select Google advertisers have had access to a potent new tool to track whether the ads they ran online led to a sale at a physical store in the U.S. That insight came thanks in part to a stockpile of Mastercard transactions that Google paid for.

August 30 -

KeyBank will deploy Mastercard's advanced transaction decisioning technology, boosting the card network's push into artificial intelligence-powered authorization.

August 24 -

Debit push payments proved an essential component of the ride-sharing boom, with many drivers opting to pay a fee for immediate funds throughout the day to cover fuel and other expenses. And the technology is finding fans in other niches as well.

August 23 -

After 20 years of working with a clunky, time-consuming 3-D Secure authorization method for online purchases, the wheels are finally in motion to get the upgraded 2.0 version in place for merchants and banks, granting access to more data for spotting fraud.

August 20 -

The U.S. companies agreed to reduce the average annual interchange rate in Canada by 10 basis points to 1.4 percent on cardThe new rate takes effect in 2020 and runs for five years. The government estimated that small and medium-sized businesses could save C$25,000 over the period.

August 10 -

Mastercard's strong performance is dampened by threats from trade disputes and Brexit, both of which could cause the company pain in the future.

July 26 -

Maybe it's coincidence, or maybe it's progress — in recent weeks, a number of large payment networks have suffered brief but widespread outages, particularly in Europe.

July 23