-

The availability of some loans used to build homes dried up due to the coronavirus. Opening up the economy may help if it doesn't lead to a spike in infections, and if consumer demand persists.

June 16 -

As lawmakers tackle Fannie Mae and Freddie Mac, any revamp must lessen risk to the mortgage system and U.S. taxpayers.

October 21 Treliant Risk Advisors

Treliant Risk Advisors -

As the demand for home rentals continues to rise, regulatory burdens could decrease the multifamily housing supply and drive up costs, witnesses said at a congressional hearing.

September 5 -

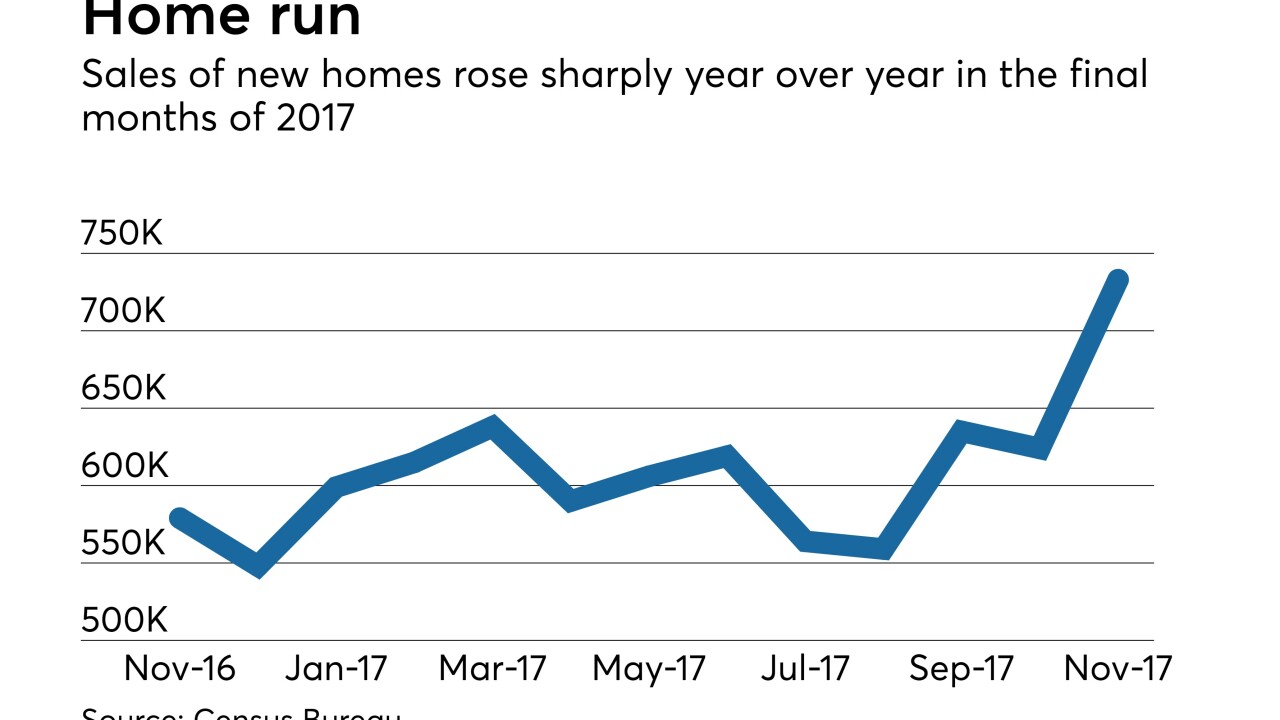

The recently enacted tax reform bill is likely to encourage more consumers to rent instead of buy and tamp down the rapid rise in home prices.

January 4 -

Hopes that tax reform might soften a weakening of the mortgage interest deduction were quickly dashed as the GOP plan landed a double punch on the incentive cherished by the mortgage and housing industries.

November 2 -

Some housing groups are warming to an idea that they say could help more Americans benefit from housing-related subsidies than the mortgage interest deduction.

October 20 -

While the House disaster relief bill would provide $16 billion in debt relief for the National Flood Insurance Program, it does not include a Trump administration proposal to ban new construction in flood-prone areas.

October 12 -

The National Association of Home Builders is backing off long-held support for the mortgage interest deduction in hopes that the Trump administration can deliver on its promise of lower taxes.

October 3 -

House Financial Services Committee leaders and two top real estate trade groups have cut a deal on a bill to reform the National Flood Insurance Program.

July 21 -

The National Association of Home Builders is objecting to a measure that would impose a surcharge on National Flood Insurance Program policies for newly constructed homes.

June 23 -

The House Financial Services Committee is slated to vote on several bills Wednesday that are designed to make private flood insurance a viable alternative to the National Flood Insurance Program.

June 13 -

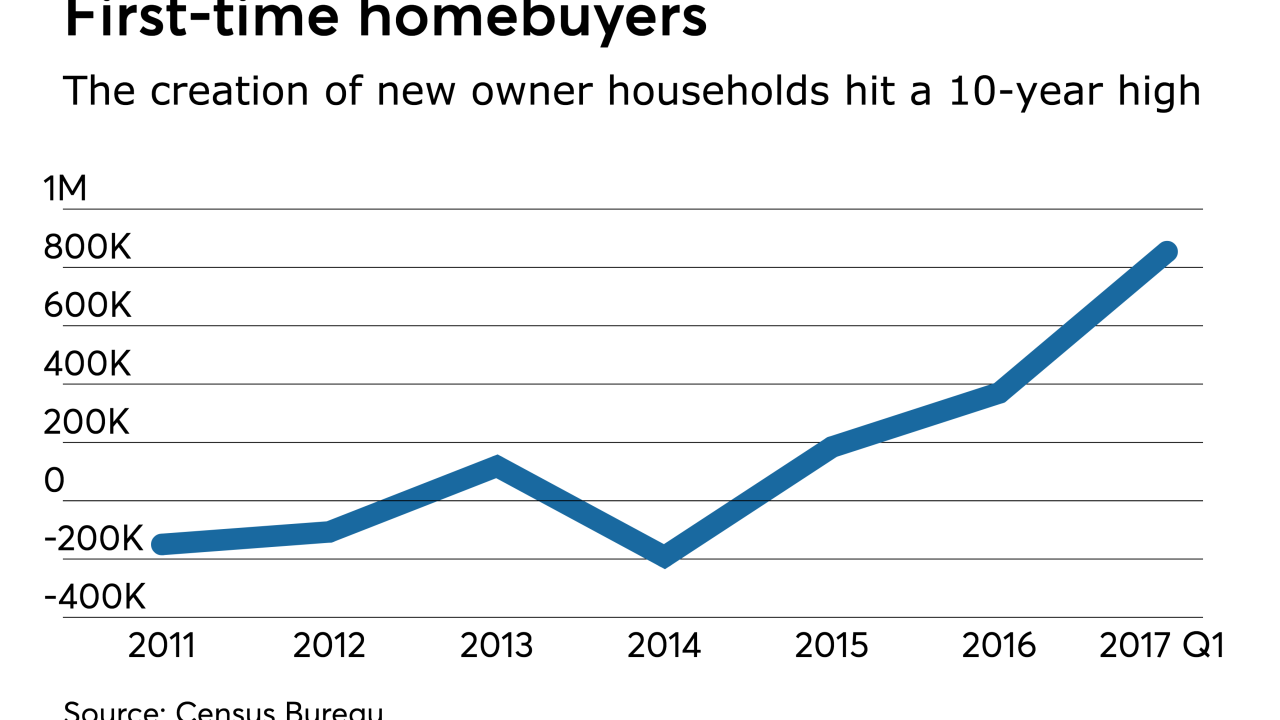

For the first time in a decade, new-owner households created in the first quarter were higher than the creation of renter households.

June 2 -

A new tariff on Canadian lumber threatens to further disrupt homebuilding at a time when lenders are increasingly concerned about a purchase mortgage resurgence that has failed to materialize.

June 1 -

Homebuilders looking for single-family construction loans may have better luck with small and midsize banks than larger ones, according to a report by the National Association of Home Builders.

April 18