-

The National Credit Union Administration board signed off on a controversial budget, and it delayed its risk-based capital rule to buy itself time amid complaints by bankers.

December 12 -

The National Credit Union Administration is widely expected to approve another budget increase during its December board meeting, but that doesn’t mean the industry is happy about it.

December 12 -

More than 50 banks and banking groups responded to the National Credit Union Administration's call for public comment as it attempts to explain why a new field of membership provision won't permit redlining.

December 10 -

With 2019 winding to a close, regulators and members of Congress are working to wrap up key items for credit unions before the end of the year.

December 9 -

The National Credit Union Administration recently made it easier to hire job applicants with small criminal offenses in their past, but some in the industry still have concerns.

December 6 -

Thursday's hearing brought Brown and NCUA Chairman Rodney Hood face to face for the first time since an October letter in which the senator slammed some of Hood's political activities.

December 5 -

The industry's dominant growth strategy of 2019 was a hot topic during a House Financial Services Committee hearing.

December 4 -

The National Credit Union Administration barred a half-dozen people from participating in the affairs of any federally insured financial institution following charges of theft, fraud and other offenses.

December 3 -

The chairman of the National Credit Union Administration will have to answer lawmakers' questions about his political activities, while comments on various agency proposals are also due this week.

December 3 -

The housing market has changed dramatically since 2002 but the current appraisal limit has not. It's time for NCUA to catch up.

November 25

-

A new National Credit Union Administration proposal would raise the threshold for residential mortgages that require appraisals. However, the final rule is by no means a done deal.

November 21 -

The National Credit Union Administration board pushed back against criticisms about its rising budget by noting its oversight is still cheaper than that provided by other financial agencies.

November 20 -

An Indiana bank is looking to complete the first outright purchase of a credit union since the financial crisis. Though hurdles exist, some industry observers say more such deals are doable.

November 19 -

The National Credit Union Administration is funded by the institutions it oversees and insures. Some of them are pushing back against spending trends at the agency.

November 19 -

The National Credit Union Administration's public budget briefings are a step in the right direction, but the institutions it regulates still have too little say over how those monies are spent.

November 19

-

The financial policy views of progressive candidates atop the presidential field are sure to worry many in the financial services industry, but it would be difficult for any new president to implement sweeping regulatory changes.

November 19 -

The National Credit Union Administration will meet this week to discuss its proposed budget while the Senate and House work to avoid a government shutdown.

November 18 -

A prominent credit union blogger is calling for the National Credit Union Administration to follow the Federal Reserve and FDIC's lead on possibly revamping the risk-rating system.

November 18 -

The junior member of the National Credit Union Administration board has proposed additional oversight for larger credit unions, citing a “guiding principle” of “uniformity between the regulators.” That could pit him against much of the rest of the industry.

November 15 -

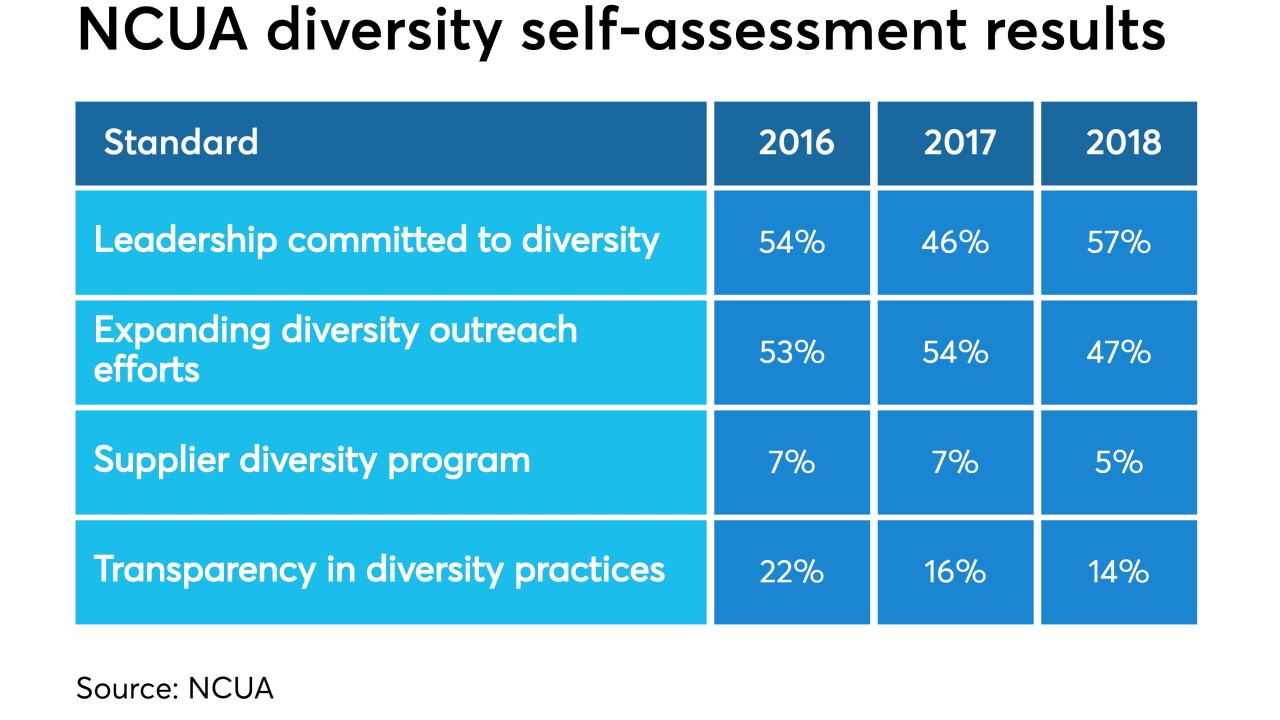

The regulator’s inaugural event on equity and inclusion highlighted the personal and professional but also veered into addressing hurdles credit unions face regarding this issue.

November 7