-

Congress and financial regulators have implemented a number of measures to help the industry survive the financial impact of the pandemic, and a fourth phase of stimulus could be coming.

April 6 -

For the second time in a week, the National Credit Union Administration has delayed the deadline for public comment on a proposed regulation.

April 1 -

The regulator will provide $4 million in loans and $800,000 in grants so institutions can assist their communities during the pandemic.

March 31 -

The industry still grapples with stopping corrupt employees — the failure of CBS Employee FCU last year highlights that — and now that could become even harder with the pandemic.

March 31 -

The regulator formally announced the 60-day delay on Monday after tweeting about it over the weekend.

March 30 -

The credit union regulator will hold off in-person examinations until at least May and has already pushed back at least one comment deadline as the pandemic worsens.

March 30 -

The $2 trillion stimulus package, which the House passed earlier in the day, aims to expand Federal Reserve liquidity resources and provide financial institutions with some regulatory relief.

March 27 -

The joint statement said examiners will not impede banks and credit unions’ responsible efforts to offer open lines of credit, closed-installment loans or other products to borrowers dealing with fallout from the pandemic.

March 26 -

NAFCU and CUNA wrote to the regulator asking for a variety of measures to help credit unions weather the pandemic, including not implementing the CECL standard until at least 2024.

March 26 -

The joint statement said examiners will not impede banks’ responsible efforts to offer open lines of credit, closed-installment loans or other products to borrowers dealing with fallout from the pandemic.

March 26 -

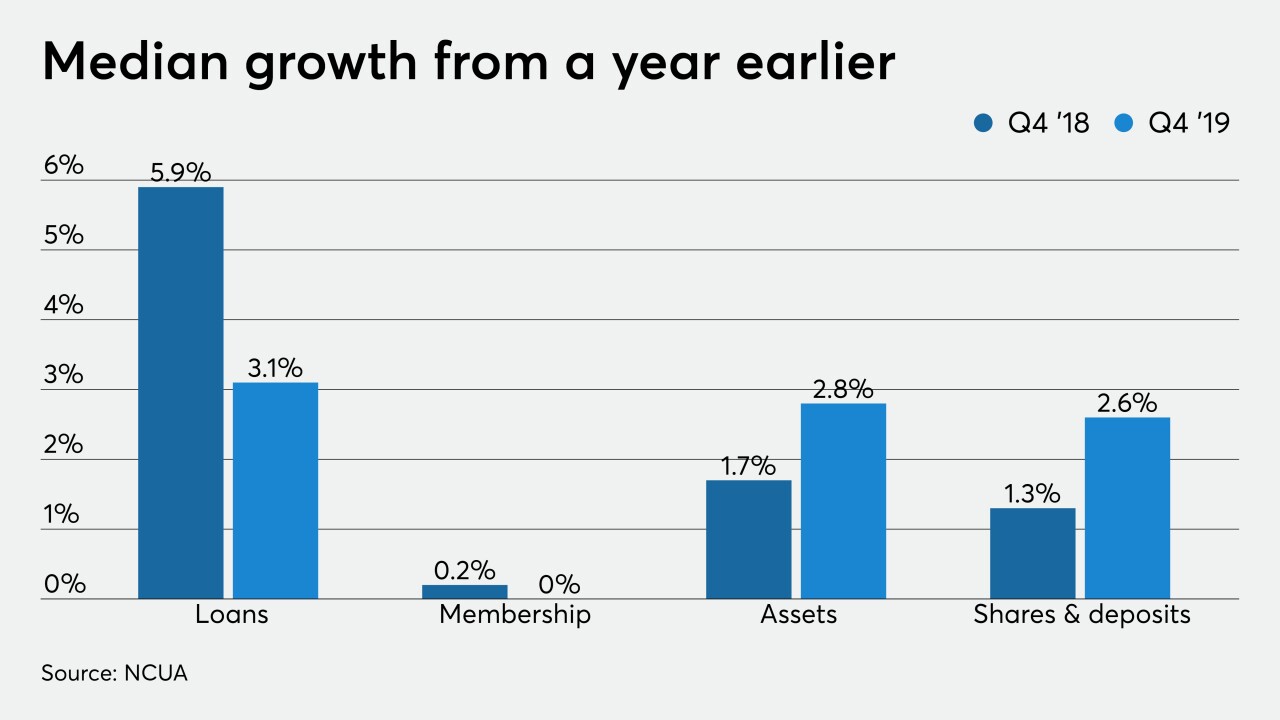

While loans continued to increase, growth was slower than one year previously and membership was flat.

March 25 -

The credit union regulator's Office of Credit Union Resources and Expansion is making grants of up to $7,500 available to low-income designated institutions.

March 23 -

Accommodations for borrowers affected by the coronavirus pandemic, such as payment delays and fee waivers, are "positive and proactive actions that can manage or mitigate adverse impacts," several banking agencies said.

March 23 -

Accommodations for borrowers affected by the coronavirus pandemic, such as payment delays and fee waivers, are "positive and proactive actions that can manage or mitigate adverse impacts," the regulators said.

March 22 -

The Ohio Democrat argued that the public wouldn't be able to meaningfully provide feedback on rules given the stressful circumstances related to the outbreak.

March 20 -

The National Credit Union Administration also ordered its own employees to work from home until at least the end of March.

March 16 -

As the health crisis upends the United States, credit union trade groups have called for lawmakers and regulators to provide relief for institutions dealing with the pandemic's impact.

March 16 -

The banking lobby asserts that the NCUA's field-of-membership rule goes beyond the agency's legal mandate.

March 11 -

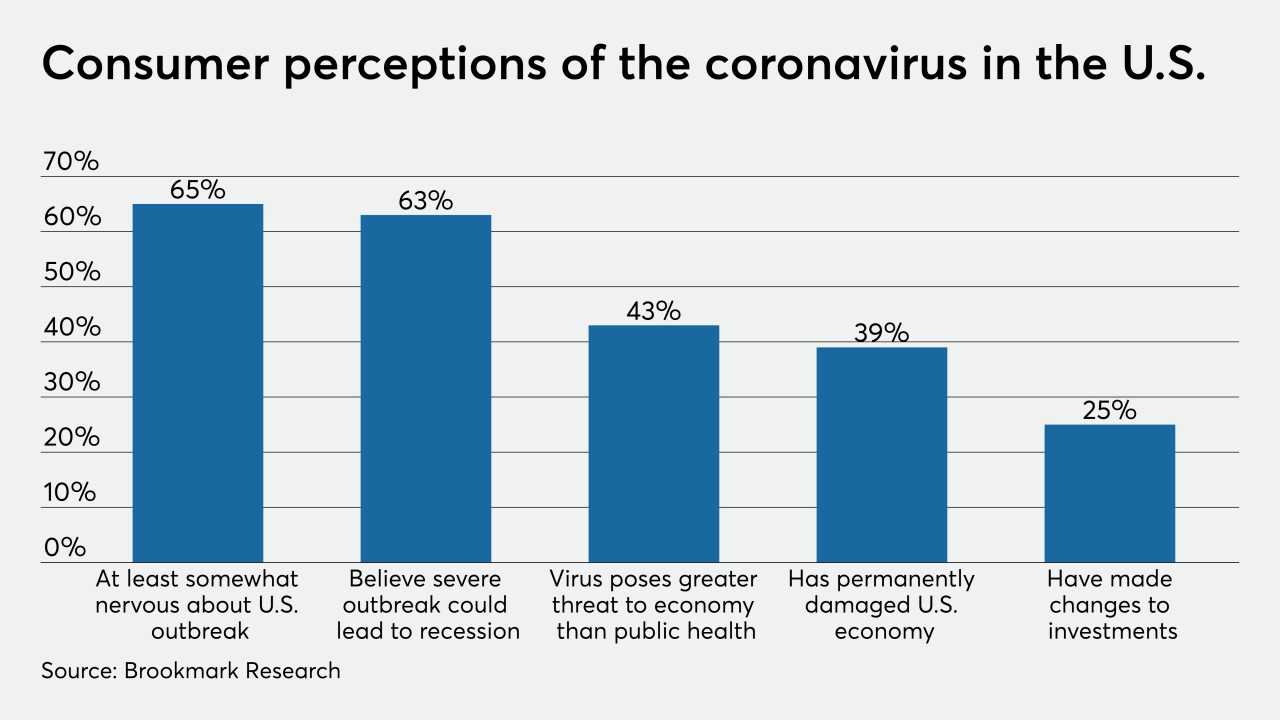

There may only be so much institutions can do if the outbreak affects borrowers' ability to repay credit.

March 10 -

State and federal officials committed to providing “appropriate regulatory assistance” to banks whose customers may be hurt by the coronavirus outbreak and said prudent measures would not be subject to criticism by examiners.

March 9