-

Hauptman said dealing with the economic fallout from the coronavirus was a top priority for the agency, along with aligning incentives and expanding the use of technology in the industry.

December 14 -

Lawmakers and the credit union regulator have packed schedules this week as both groups attempt to wrap up their 2020 business before the holidays.

December 14 -

The credit union regulator's monthly meeting will cover the agency's budget proposal and subordinated debt, among other items, along with taking another shot at an overdraft proposal that was rejected earlier this year.

December 11 -

Credit quality has remained strong at credit unions, but there are hints that some of them — especially the smallest ones — could report lackluster earnings well into next year, according to the National Credit Union Administration's latest intel on industrywide finances.

December 8 -

Elizabeth Fischmann will take on the role later this month and will oversee the regulator's compliance with federal ethics laws, among other responsibilities.

December 7 -

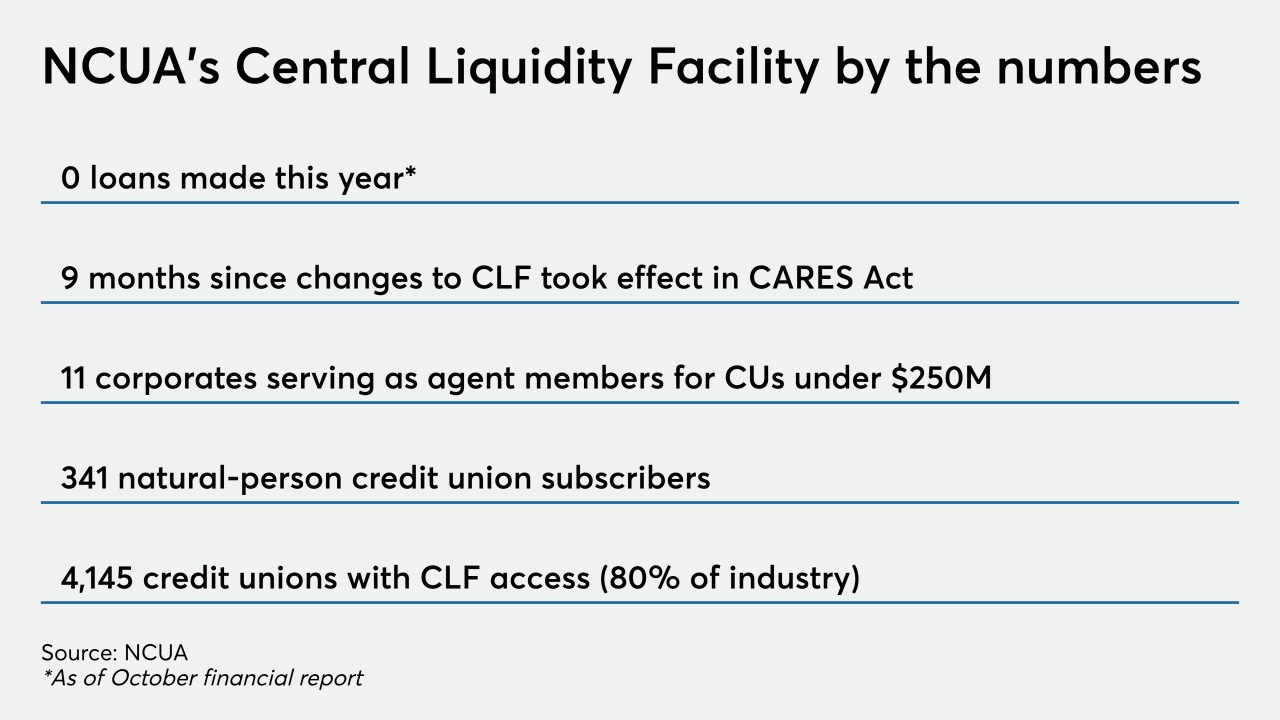

Thousands of institutions could lose a safety net on New Year's Day if Congress fails to act before leaving for the holidays.

December 7 -

A number of reasonable changes to the National Credit Union Share Insurance Fund could help NCUA avoid charging premiums.

December 3

-

Board member Todd Harper was concerned that the credit union regulator was not adequately preparing for the impact of prolonged economic turmoil and could be caught "flat-footed" as it was heading into the last crisis.

December 2 -

The confirmation ensures Republicans will hold the majority vote at the credit union regulator until at least 2023.

December 2 -

Controversies over trainings that address white male privilege detract from the important role DEI initiatives play in helping the country move forward.

December 1 National Credit Union Administration

National Credit Union Administration -

The regulator issued prohibitions for former credit union employees in Virginia and Connecticut.

November 30 -

The credit union regulator's budget briefing could produce fireworks, but possible Senate action could make the result of an eventual budget vote a foregone conclusion.

November 30 -

The biggest questions following the former chairman's resignation aren't about regulation but whether the agency can recapture a spirit of bipartisanship and collaboration.

November 24 -

It remains unclear how Mark McWatters's departure will impact the credit union regulator, and there is growing evidence that the country could face a "double-dip recession."

November 23 -

The annual survey from the National Credit Union Administration shows credit unions making gains in some of their inclusion efforts, but the industry still has much it can do to improve.

November 23 -

The former chairman recently butted heads with colleagues over the agency’s budget plans, and the Senate is expected to vote to confirm a successor early next month.

November 20 -

The credit union regulator's November board meeting covered a variety of issues, including the voluntary self-assessment, disagreements on the budget proposal and the possibility of new insurance premiums in 2021.

November 19 -

Markland, the former CEO of Affinity Plus FCU in Minnesota, takes the helm 17 months after the New York-based institution entered conservatorship.

November 16 -

The Iowa Republican followed one term in the Senate with six years as chairman of the credit union regulator.

November 16 -

Credit unions will have their first opportunity to hear from the federal regulator about its recently released budget proposal and also get an update on the agency's diversity self-assessment.

November 16