-

How most banks obtain deposits has changed radically over the past 30 years, thanks in part to innovation. It is time for regulators to rethink their notion of what constitutes a quality deposit portfolio.

September 27 MainStreet Bank

MainStreet Bank -

Acting Comptroller of the Currency Keith Noreika on Monday gave a ringing endorsement to online lenders seeking to expand into banking, suggesting they should consider taking deposits and seek out national bank charters as they mature.

September 25 -

Readers chime in on debates about ILCs, the CFPB’s arbitration rule, the financial services ambitions of tech firms and more.

September 22 -

The Trump administration is prepping recommendations to address shortcomings in the capital markets in a report to be released next month, a top Treasury Department official said Monday.

September 18 -

David Dotherow, CEO of the newly formed Winter Park National Bank, stresses the need for strong management and a straightforward business plan when applying for a charter.

September 15 -

Few lawmakers have stated positions on fintech applications for industrial loan company charters. It may not stay that way.

September 13 -

Square became the third fintech firm in recent months to seek out a bank charter. Others are likely to follow.

September 11 -

The nominations of Randal Quarles as Federal Reserve Board vice chairman and Joseph Otting as comptroller of the currency will now head to the full Senate.

September 7 -

The debate over the separation of banking and commerce has come roaring back, but instead of Walmart in a spotlight role, many banks have centered on a player they see as the new villain: fintech.

September 5 -

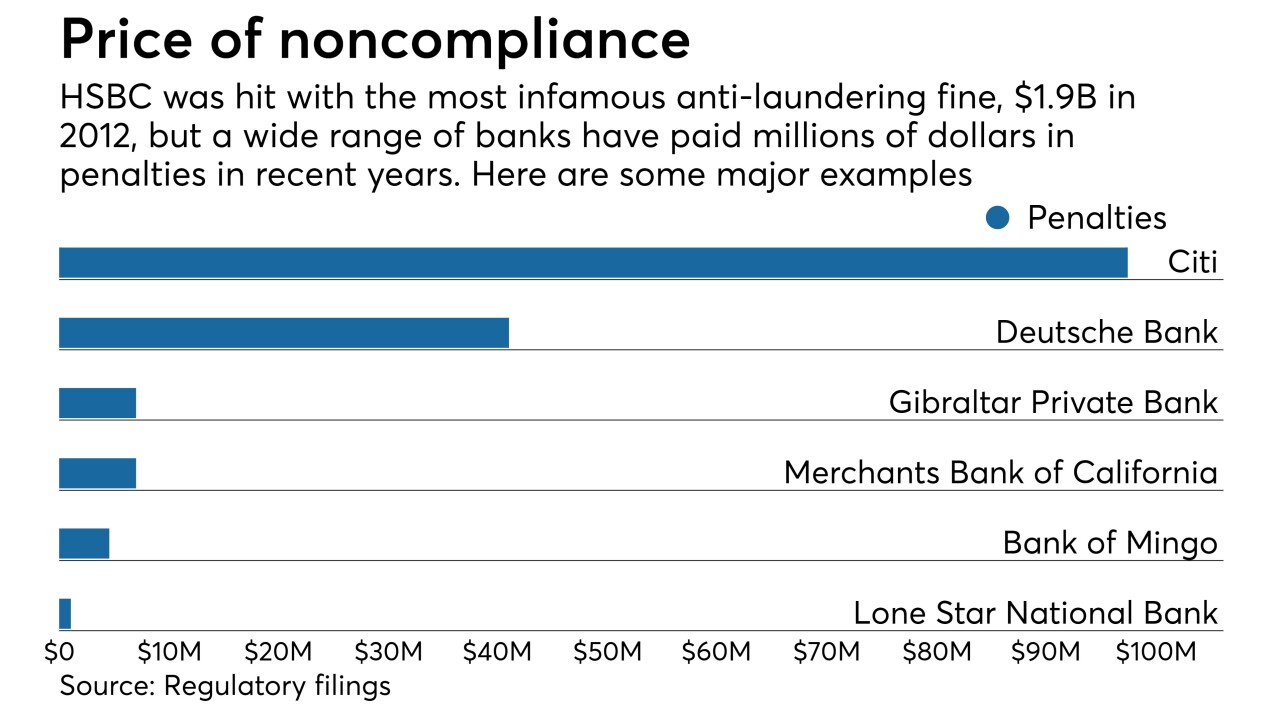

Nothing like revelations of a client’s Ponzi scheme that lead to your bank paying $4 million in anti-money-laundering fines. That’s what happened at Gibraltar Private Bank & Trust, but its CEO argues its compliance overhaul has given the bank a competitive advantage in cosmopolitan New York and South Florida.

September 5