-

Acting Comptroller of the Currency Brian Brooks’ focus on allowing fintech firms into the federal banking sphere appears to have a more ambitious and risky goal: redefining the agency’s regulatory focus.

September 14

-

Acting Comptroller of the Currency Brian Brooks and Department of Financial Services Superintendent Linda Lacewell stuck to opposing scripts on whether federal or state regulators are best equipped to protect consumers and supervise new entrants into the banking system.

September 9 -

In a sharp escalation of the battle over the future of the dual banking system, the acting chief of the Office of the Comptroller of the Currency suggested that states should defer to federal authority in supervising global money transmitters.

September 8 -

The regulatory road ahead is as uncertain and risky to banks as the pandemic.

-

The OCC’s efforts to bring the technology into the financial mainstream could help people in underserved communities execute payments more securely.

September 2 FinClusive

FinClusive -

Backers of lawsuits challenging federal charter and interest rate policies for nonbanks say states are sticking up for consumer protection. Others say the legal quagmire could slow efforts to improve the regulatory framework.

September 1 -

The division asked for public feedback as it weighs changes "to reflect emerging trends in the banking and financial services sector."

September 1 -

The Justice Department alleges that the bankers worked with “higher-ranking bank officials” at Washington Federal Bank for Savings in Chicago to falsify records and hide funds before the bank's December 2017 collapse.

August 29 -

Even as the bank’s sales practices faced intense government scrutiny following the Wells Fargo scandal, senior leaders in Oregon were fostering a culture that valued credit-card sales above all else, according to several former employees.

August 27 -

Even as the bank’s sales practices faced intense government scrutiny following the Wells Fargo scandal, senior leaders in Oregon were fostering a culture that valued credit-card sales above all else, according to several former employees.

August 27 -

The agencies completed steps to ease a community bank capital measure temporarily and to delay a new credit-loss accounting standard.

August 26 -

The OCC’s efforts to bring the technology into the financial mainstream could help people in underserved communities execute payments more securely.

August 26 FinClusive

FinClusive -

Citigroup’s $900 million payment blunder in a normally low-profile part of the financial market dominated by a handful of banks has experts wondering if regulators will uncover a deeper problem.

August 25 -

A borrower advocacy group is asking federal banking regulators to investigate PayPal and Synchrony Financial, which partner on a product that is used to offer high-cost education financing.

August 24 -

The agency said national banks could close offices “at their discretion” as a safety precaution if they are affected by fires in California and Colorado.

August 24 -

A group of eight Attorneys General filed suit against an FDIC final rule related to ‘rent-a-bank’ partnerships, mirroring a similar suit filed against the Office of the Comptroller of the Currency last month.

August 20 -

The Office of the Comptroller of the Currency is overstepping its authority in granting charters to fintechs and other companies that don’t take deposits.

August 19 Conference of State Bank Supervisors

Conference of State Bank Supervisors -

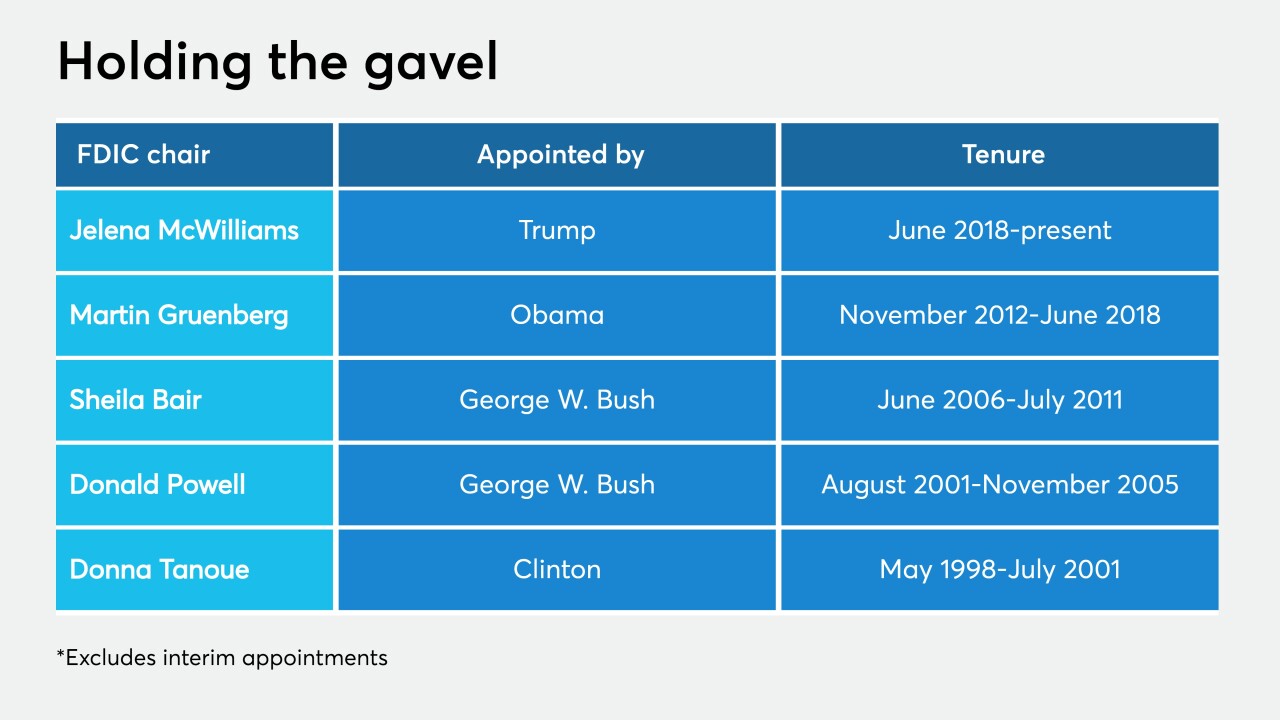

Jelena McWilliams's term as FDIC chair expires in 2023, and she cannot be removed by an incoming president. But if Joe Biden prevails, he may ask her to stay — and if she does, governing a Democratic-majority board would be a very different proposition.

August 18 -

Mary Mack is expected to say that other employees were scared of Carrie Tolstedt, according to the bank’s regulators. Tolstedt, one of five former Wells executives facing civil charges in connection with the bank’s phony-accounts scandal, could be fined as much as $25 million.

August 17 -

The bank has begun briefing regulators about how it mistakenly sent payments to creditors of Revlon, the financially strapped cosmetics company. Citi has also filed a lawsuit against Brigade Capital Management seeking to recoup $175 million it sent to Brigade on Revlon's behalf.

August 17

![“The parochial interests of individual states … [prevent] people from accessing credit,” said acting Comptroller of the Currency Brian Brooks. New York State Department of Financial Services Superintendent Linda Lacewell argued “there is no federal authority for any kind of chartering for fintech companies … that are not depositories.”](https://arizent.brightspotcdn.com/dims4/default/c4fde46/2147483647/strip/true/crop/1600x900+0+0/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2F7b%2Fc0%2F2fa8f8d1414882919a458e895b10%2Fbrooks-lacewell.png)