Synovus Financial

Synovus Financial

Synovus Financial operates dozens of community banks throughout Georgia, Alabama, Florida, Tennessee, and South Carolina. Concentrating on commercial loans and commercial real estate, the bank uses its small-town image to establish strong relationships with its small-business customers.

-

The Columbus, Georgia-based bank is working with a financial adviser and has recently held merger talks with at least one rival, people familiar with the matter said.

July 22 -

Wolverton is in her third year leading consumer banking and brand experience at the Columbus, Georgia, bank. The $60 billion-asset Synovus is Georgia's largest bank.

September 26 -

The Georgia-based bank recorded a $257 million hit after unloading a bundle of securities that it expects to redeploy into higher-yielding assets. It also forecast a resumption of loan growth in the second half of the year.

July 18 -

Katherine Weislogel's career began by being in the right place at the right time.

May 7 -

Charge-offs and nonperforming loans rose at the Georgia bank in the first quarter. But it blamed the problem on one large client and said the matter has been resolved.

April 18 -

-

-

-

The Georgia-based bank says it's expanding its relationship with GreenSky, a home improvement lender that Goldman Sachs bought in 2022 but put up for sale a year later. The deal will bring a one-time revenue boost and a recurring fee income stream.

December 7 -

The Columbus, Georgia, bank is selling a $1.3 billion portfolio as part of a plan to pay off higher-cost funding. Though there are rising concerns about the office sector, Synovus said the loans it's offloading have pristine credit quality.

July 20 -

Aileen Thomas oversees the six-member consumer bank product management team, which includes consumer and business banking: deposits, home equity and personal lending, debit and credit cards.

July 19 -

Lenders are bracing for more companies to fall behind on their loan payments. That could create more opportunities for banks to dispose of these nonperforming credits through an Article 9 sale.

April 7 -

After filling various roles at the Columbus, Georgia-based bank for almost 20 years, Liz Wolverton was tapped to lead the consumer bank in December 2021.

October 5 -

The Georgia bank warns that the one-two punch of rising inflation and supply-chain issues on its smaller commercial customers makes that asset class “something we would watch” for potential losses.

April 21 -

Costs climbed 11% in the fourth quarter, but the Georgia company says it remains on track to generate $175 million by the end of this year through a combination of expense cuts and revenue enhancements.

January 20 -

The bank is planning to make product changes and roll out new digital tools that will allow customers to avoid the charges, according to CEO Kevin Blair.

July 20 -

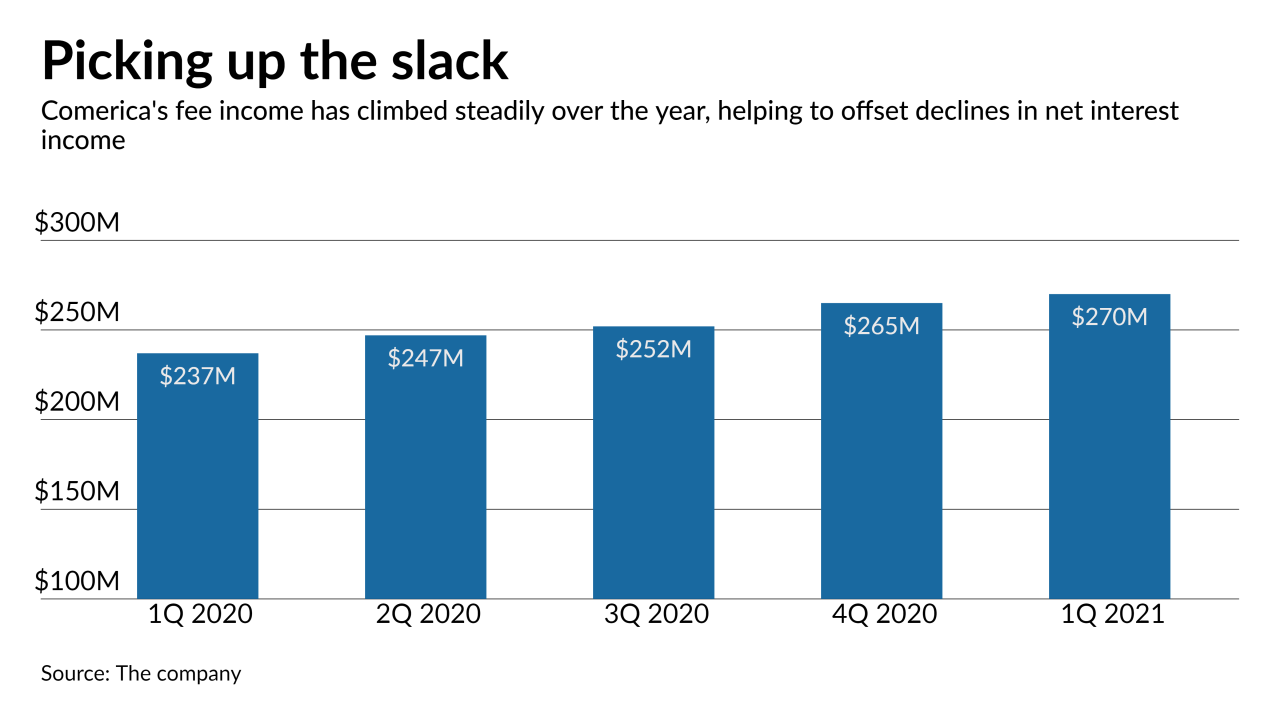

At Comerica and Synovus, higher fees from cards, mortgage banking and other sources helped to offset declines in net interest income.

April 20 -

President and Chief Operating Officer Kevin Blair will take the helm in April at the company’s annual meeting while Kessel Stelling will transition to a new role as executive chairman.

December 17 -

The Georgia lender has hired bankers away from Wells Fargo to build a new ag lending team that will look to capitalize on soaring lumber demand in its home state.

December 2 -

Many eateries that relied on outdoor dining to survive the pandemic could see revenues plummet as the weather turns cold.

October 30