Synovus Financial

Synovus Financial

Synovus Financial operates dozens of community banks throughout Georgia, Alabama, Florida, Tennessee, and South Carolina. Concentrating on commercial loans and commercial real estate, the bank uses its small-town image to establish strong relationships with its small-business customers.

-

The Georgia bank warns that the one-two punch of rising inflation and supply-chain issues on its smaller commercial customers makes that asset class “something we would watch” for potential losses.

April 21 -

Costs climbed 11% in the fourth quarter, but the Georgia company says it remains on track to generate $175 million by the end of this year through a combination of expense cuts and revenue enhancements.

January 20 -

The bank is planning to make product changes and roll out new digital tools that will allow customers to avoid the charges, according to CEO Kevin Blair.

July 20 -

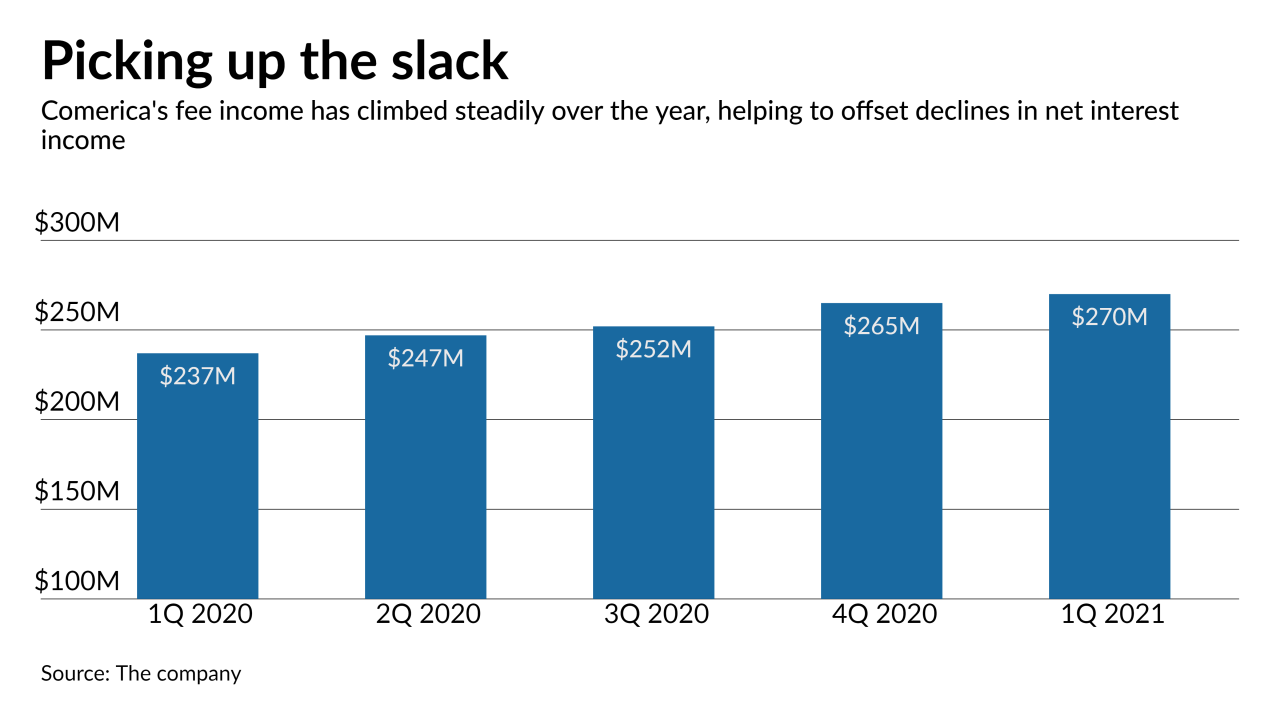

At Comerica and Synovus, higher fees from cards, mortgage banking and other sources helped to offset declines in net interest income.

April 20 -

President and Chief Operating Officer Kevin Blair will take the helm in April at the company’s annual meeting while Kessel Stelling will transition to a new role as executive chairman.

December 17 -

The Georgia lender has hired bankers away from Wells Fargo to build a new ag lending team that will look to capitalize on soaring lumber demand in its home state.

December 2 -

Many eateries that relied on outdoor dining to survive the pandemic could see revenues plummet as the weather turns cold.

October 30 -

Banks have managed to steer around trouble spots in energy, hotel and mall-related credits. But fears of further deterioration, an eviction wave or more job losses are keeping lenders circumspect.

October 21 -

A federal judge in Florida ruled that lenders are not required to make payments to borrowers' attorneys and accountants unless they struck upfront agreements to do so. The decision has implications for a slew of related lawsuits.

August 20 -

The Georgia company warned that outstanding loans could fall and deferrals will likely rise as its home state and Florida grapple with the pandemic.

July 21 -

Accountants, as well as lawyers and consultants, who helped small businesses apply for emergency relief funds through the Paycheck Protection Program want to be compensated. Are they entitled to be?

June 10 -

Often overlooked in narratives about essential workers, branch and call-center employees are responding to challenges posed by the COVID-19 crisis. They’ve processed emergency-relief loans late into the night, coached customers unfamiliar with mobile banking and made house calls to elderly account holders.

May 13 -

The Georgia bank could rely more on drive-through-only branches, trim office space and reassess staffing levels after the coronavirus crisis, according to Kessel Stelling.

April 24 -

The Fed’s decision to cut its benchmark interest rate amid growing coronavirus concerns is bound to have an impact on banks, but just how broad and how deep remains to be seen.

March 3 -

As the COVID-19 virus spreads globally, many U.S. financial institutions are said to be taking steps to protect employees and minimize disruption. But only a handful are sharing specifics, to avoid contributing to any public panic.

February 26 -

The additions come as the Georgia regional looks to maintain momentum in commercial lending.

February 10 -

In addition to overseeing the bank’s lines of business, technology and operations, Kevin Blair will now be responsible for human resources, credit administration and all customer-facing support functions.

December 13 -

The Columbus, Ga., company had been counting on increased volume to offset a squeeze in net interest margins.

October 22 - Edit License

Wolverton has been accumulating responsibility and influence at Synovus in recent years and is the highest ranking woman at the company.

September 22 -

"Truist" was roundly mocked when it was unveiled as the name of the merging BB&T and SunTrust, but it’s hardly the first bank moniker to elicit a "huh?" from critics.

June 16