-

Like many financial companies, the brokerage wants to go where customers are. Since that means communicating with them via a third-party platform, it is working through privacy and security issues.

August 22 -

Despite rising home prices and a market where many older homeowners are loath to sell, home equity line of credit lending remains muted in all but one corner of the industry: credit unions.

August 14 -

Luring developers from Silicon Valley and cloud computing are among the bank’s strategies for staying competitive in a changing tech environment.

July 27 -

When the U.S. withdrew from the Paris Agreement, business leaders across the country called on the private sector to step up their own efforts to reduce greenhouse gas emissions and ultimately limit global warming to 2 degrees Celsius. From new corporate governance practices to energy efficient upgrades, here’s a look at some of the ways the banking sector is combating climate change.

July 11 -

The following are some of the noteworthy things we heard at American Banker’s Digital Banking 2017 conference held earlier this month in Austin, Texas.

June 26 -

Digital banking services should solve consumers' problems and offer them advice, and they must rely on artificial intelligence and other cutting-edge technology, bankers from TD, RBC and Bank of the West said.

June 13 -

Canada's big banks are pursuing wholesale banking, capital markets and select M&A opportunities across the border to hedge against a slowing mortgage market and other economic concerns on the home front.

May 26 -

The good news: SBA lending is going gangbusters and business owners are optimistic about growth prospects and their ability to access credit. The not-so-good news: Many firms are still not particularly interested in borrowing and startups are not the engines of job creation they once were.

May 11 -

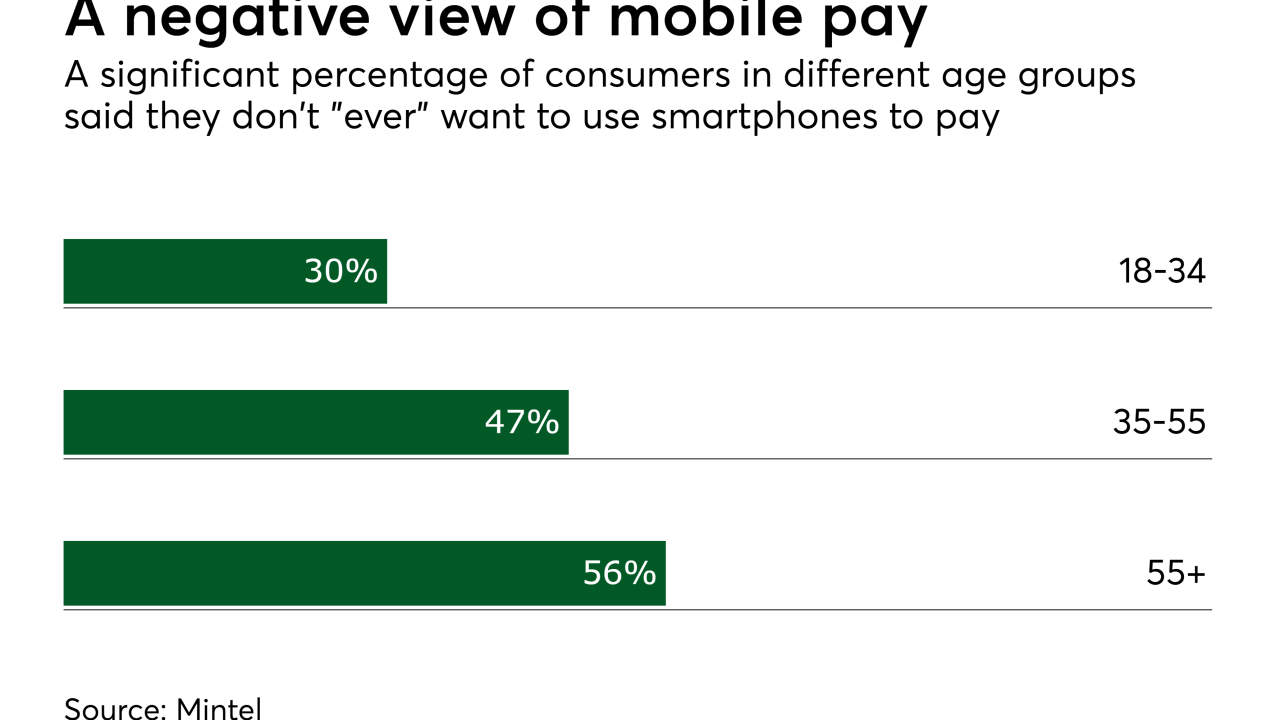

Payments stayed the same for years, then started evolving rapidly. That has issuers considering different ways to help consumers manage the change.

May 11 -

Millennial homeowners are more likely to be current and future users of home equity lines of credit than either Gen-Xers or baby boomers.

April 5