-

Stadiums, arenas and theaters are natural fits for innovations such as social P2P, mobile commerce and transferrable authentication. This, in turn, makes such venues a magnet for the payments industry’s most recognizable brands.

January 29 -

Marketing and venture capital veteran Allison Johnson will become PayPal's executive vice president and chief marketing officer — a new role at the payments company as it tries to monetize its Venmo app.

January 14 -

Business pay has always lagged consumer innovation because of complexity. But new advancements in underlying business technology should change that, according to Rob Eberle, CEO of Bottomline Technologies.

December 28 Bottomline Technologies

Bottomline Technologies -

PayPal is using Venmo's fast growth to power several initiatives, but the app suffered a damaging fraud surge early this year, showing it's not immune from enrollment fraud that challenges the entire P2P sector.

November 26 -

Shopify is no stranger to social media — it’s had a partnership with Facebook for three years — and it sees Venmo users' social sharing habits as the perfect means to expand its mobile commerce platform.

October 26 -

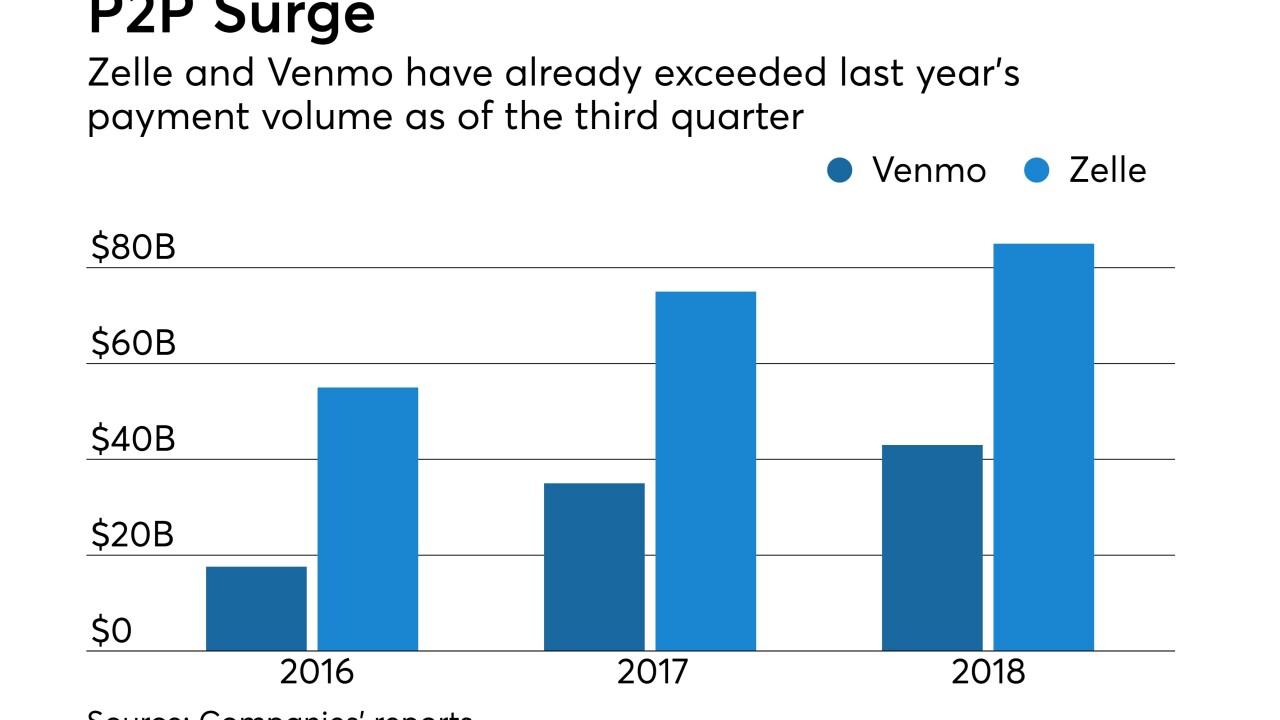

Zelle processed 116 million transactions during the third quarter as its payment volume jumped to $32 billion, while Venmo's volume increased 78% to nearly $17 billion.

October 23 -

Zelle processed 116 million transactions during the third quarter as its payment volume jumped to $32 billion, while Venmo's volume increased 78% to nearly $17 billion.

October 23 -

The Zelle network processed 116 million transactions during the July-September 2018 timeframe with a total value of $32 billion in payments.

October 23 -

PayPal reports it’s adding users to Venmo’s new initiatives quickly, pushing the company’s wish to monetize Venmo to what its CEO calls a “tipping point."

October 18 -

As Venmo does battle with Zelle and Square for consumers' P2P payments, one thing is clear: Innovation is not cheap.

October 15 -

It all comes down to convenience. New payment apps, like Venmo, and widely adopted mobile wallets, such as Apple Pay and Alipay, have made the consumer payment experience incredibly convenient, writes Ralph Dangelmaier, CEO of BlueSnap.

September 13 BlueSnap

BlueSnap -

Deutsche's investment in Modo Payments is a bet that banks need to spend money on technology that connects to popular non-bank payment apps.

September 4 -

The real-time ticker of strangers’ spending habits could soon go away.

August 23 -

Zelle is working on ways to ensure that customers can safely pay small businesses as well.

August 16 -

Shoppers using the retailer’s namesake and Hollister apps will be able to select the popular payment platform as an option when checking out

August 7 -

On the surface, the Uber-Venmo partnership sounds like a coup for Venmo, getting its brand into the app that defined the ride-sharing category. But the partnership is a much bigger deal for Uber.

July 16 -

The ride-hailing giant is the largest retailer to accept Venmo payments to date, and the move is an indication of how the platform plans to make money.

July 12 -

In the era of digital and mobile payments, many banks and tech companies have strived to completely do away with cash, checks and cards. But quite a few have had to concede that the market isn't quite ready to give up the physical trappings of payments.

June 29 -

PayPal has many brands with which it wants to permeate online commerce, but it doesn't need a separate button for each one.

June 28 -

Despite a reputation for being the go-to P2P app of digital natives, Venmo is once again pushing its market in the opposite direction with the debut of a plastic card.

June 25