Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

How do you restore profits after a banking scandal that victimized both customers and employees — without inflicting more pain on either side?

August 18 -

The bank agrees to pay $6 million to a California couple a judge said was illegally foreclosed on; do rewards programs help or hurt card issuers?

August 18 -

Sanger is out at Wells Fargo and so it is a crisis that gives us our first female board chair at a major U.S. bank. Women lead two major tech initiatives at JPMorgan Chase, which is also adding a fourth woman to its executive committee.

August 17 -

Credit card issuers have been trying to outdo each other to offer the best rewards program. And it shows, as customer satisfaction rates with many (but not all) of their banks have never been higher in a yearly J.D. Power study. But they may not last forever.

August 17 -

There are outstanding questions about whether Elizabeth Duke, who has been on Wells Fargo's board since January 2015, is the right person to lead a culture change at a large bank mired in scandals and investigations.

August 16 -

As expected, the bank elevates its vice chairman, former Federal Reserve Governor Elizabeth Duke, to the top spot; credit card delinquency rates rise along with balances.

August 16 -

Duke, currently vice chairman, was rumored to be a likely contender for the chairman spot last week.

August 15 -

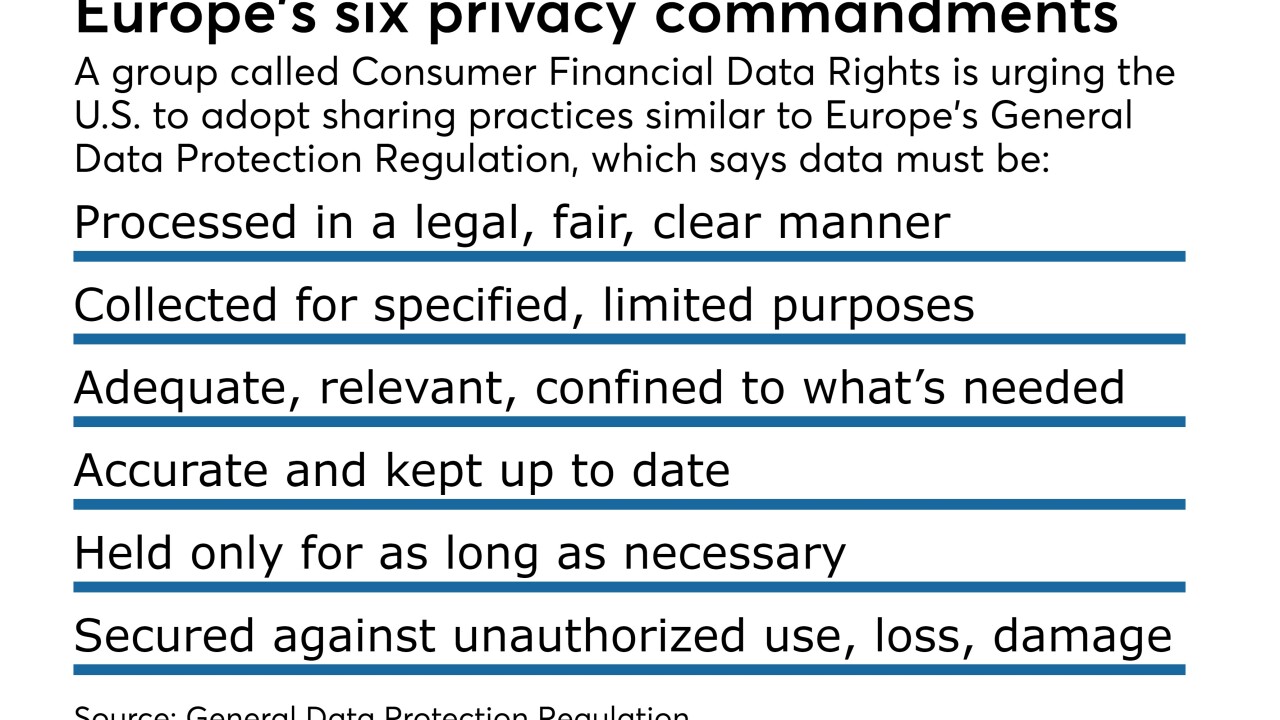

The Consumer Financial Data Rights group, representing aggregators and fintechs, says banks still aren’t forking over enough customer data. The group is meeting with bank regulators and trying to get consumers to petition regulators on its behalf.

August 15 -

Warren Buffett’s firm buys big stake in retail credit card issuer while dumping shares in its former parent, GE; long-awaited update speeds transactions in the digital currency network.

August 15 -

The mishandling of the two former employees’ complaints, detailed in documents and by former OSHA officials, raises questions about the government’s treatment of whistleblowers throughout the financial services industry.

August 14