Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

Mortgage fees at the nation’s biggest home lender declined by a third in the three months ended June 30 to the lowest in more than five years.

July 13 -

The change in store card branding would be a big blow to Synchrony; “equivalence” with EU rules “falls far short” of U.S. banks’ hopes.

July 13 -

Flagstar Bank, which is in the process of buying more than 50 branches from Wells Fargo, has hired Ryan Goldberg as a director of retail banking.

July 10 -

A first-in-the-nation ordinance, passed by the city council in the wake of the Wells Fargo scandal, would require banks that want the city’s business to reveal if they have sales quotas for employees. It remains to be seen, though, whether Mayor Eric Garcetti will sign the measure into law.

July 3 -

"Banks should be investing in innovation in this area or risk getting left behind," a fintech CEO warns.

July 3 -

Turnover of chief risk officers is on the rise as CEOs look to add executives whose experience goes far beyond assessing credit risk. Sometimes they are promoting from within, but often they are poaching talent from rival banks.

July 2 -

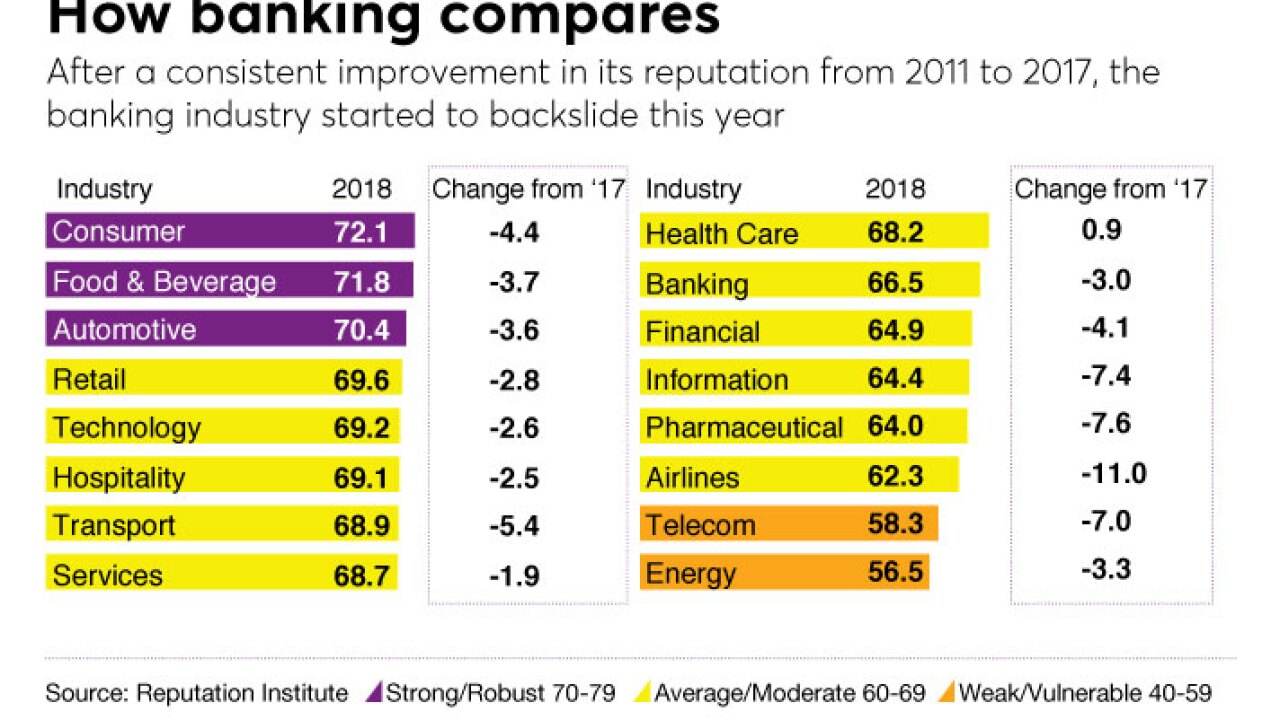

USAA reigns, Wells Fargo, well, doesn't. Here's a look at the highs and lows in this year's survey, as well as the trends that drove the results.

July 1 -

Commercial real estate is their bread and butter, but many banks are scaling back in this vital loan category. Here’s why.

June 29 -

The 13-term California Democrat is in line to chair the Financial Services Committee if her party wrests control of the House in the November election.

June 26 -

The rents are steep and they don't generate much revenue, but some banks believe that airport branches still have a role to play in their retail strategies — particularly as advice centers.

June 26 -

The company's brokerage unit agreed to pay $5.1 million to settle claims that employees persuaded clients to sell certain investments before maturity in order to collect higher fees.

June 25 -

Wells Fargo & Co. is finally going after the young and points-hungry by boosting rewards on one of its premium cards.

June 25 -

How the big banks fared in the Fed's latest round of stress testing; what's on new FDIC chair Jelena McWilliams' plate; why banks' biggest risk factor may be employees who don't speak up; and more from this week's most-read stories.

June 22 -

At a time when credit unions have seen a major increase in fee income from overdrafts, several big banks are following Silicon Valley's lead by offering new fee-free accounts.

June 22 -

SunTrust will operate a branch inside Hartsfield-Jackson's main domestic terminal and operate 16 ATMs throughout the airport. Wells said its revenue had been declining.

June 20 -

The bank’s weakened public reputation makes it a target for additional attacks.

June 20 -

JPMorgan Chase and Wells Fargo are following Silicon Valley's lead by offering new fee-free accounts. While there are risks involved, the cost of doing nothing would be significant, analysts said.

June 19 -

In an investor-backed power play, the robo tech firm wants banks to turn to it instead of traditional core software providers as they upgrade to digital-banking-friendly technology.

June 19 -

SigFig was among an early crop of digital advice firms that shifted their focus to serving wealth managers and banks. It has raised more than $100 million from a variety of investors.

June 19 -

Among the six biggest U.S. banks, Bank of America might deliver one of the steepest jumps in payouts. Wells Fargo is the wild card.

June 19