Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

Two trends — competition from challenger banks and the emergence of real-time payments — threaten to eat away at the fees banks collect on overdrafts and bounced checks.

January 6 -

Several fintechs are testing apps that let customers gain more say over how third parties use their data — and hope to one day be able to give them the power to revoke access to it entirely.

January 1 -

The year saw anxiety over how banks would respond to record consumer debt, disruptive glitches at TD Bank and SunTrust, ongoing scandal at Wells Fargo, and much, much more.

December 30 -

The cost of Wells Fargo's scandals continues to rise as regulators from all 50 states forced the institution to pay hundreds of millions in penalties for the creation of fake accounts, improper enrollment in life insurance, force-placed auto insurance policies and other activities.

December 28 -

It was a year to remember for women executives at SunTrust and Amex’s new CEO, and one to forget for Wells Fargo and investors in bank stocks.

December 25 -

Treasury Secretary Steven Mnuchin called top executives from the six largest U.S. banks over the weekend, he said Sunday on Twitter, a move that followed heavy losses in the stock market last week and a partial federal government shutdown.

December 23 -

Regulators give OK, but find “shortcomings” that need to be addressed; Labor Department says the bank is laying off U.S. workers while hiring overseas.

December 21 -

Atlantic Equities’ John Heagerty cut his recommendation on JPMorgan Chase to neutral, saying the bank now “offers the least upside” to price targets among the major banks.

December 19 -

Rich Baich, Wells Fargo's security chief and newly appointed security advisor to the White House, shares attack types he’s worried about and top defenses.

December 18 -

Augmented devices and automation will push banking services beyond the current mobile phone delivery model into a virtual world — but how, exactly? Bank of America, Wells Fargo and others are trying to find out.

December 13 -

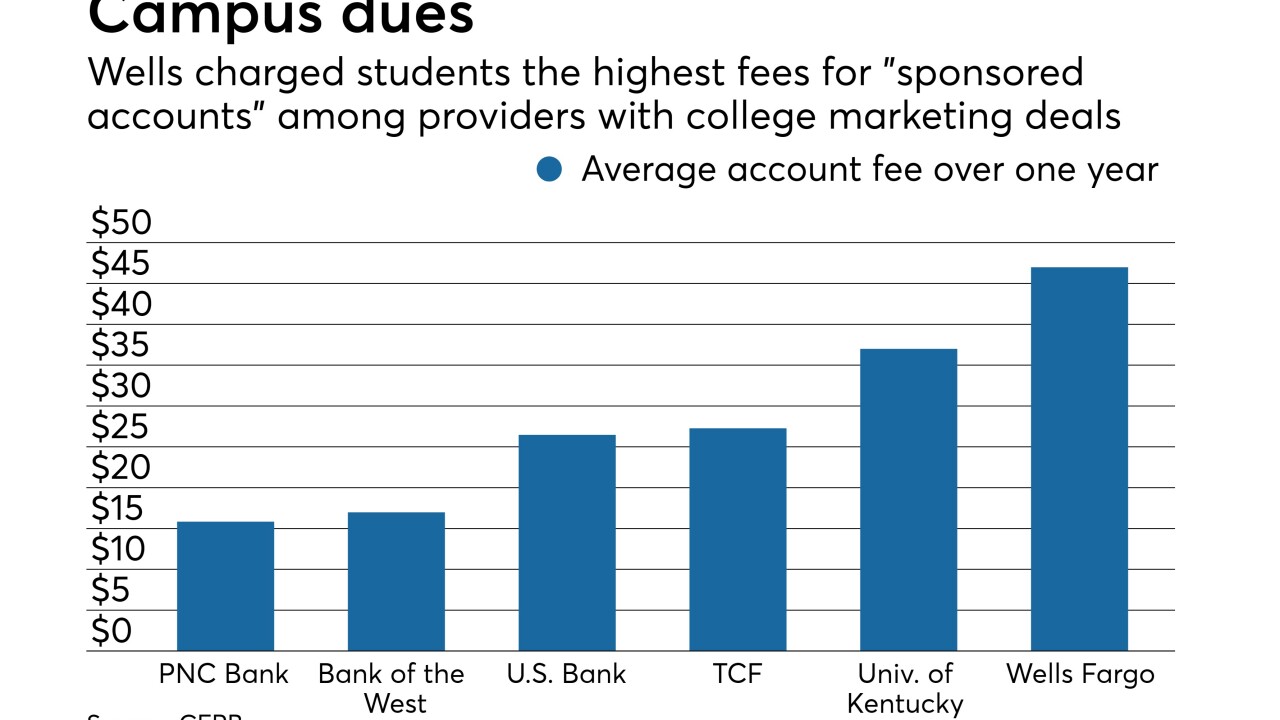

A CFPB report says the bank is the most expensive bank for college students; lenders would be banned from mailing high-interest loans disguised as checks.

December 12 -

The Federal Reserve Board chairman told Sen. Elizabeth Warren in a letter that the central bank is actively reviewing the bank's progress in following a February consent order.

December 10 -

Wells Fargo charges students nearly four times as much in fees as banks without college marketing agreements, according to an internal report by the Consumer Financial Protection Bureau.

December 10 -

Blockchain backers concede the hype is turning off bankers; Mulvaney's CFPB name change could cost industry millions of dollars; the one banking bill Congress might actually pass next term; and more from this week's most-read stories.

December 7 -

The move means the cap on asset growth may stay in place longer; the German bank reportedly processed 80% of the money laundered through Danske Bank.

December 7 -

An eight-month-old consent order appears to be forcing the San Francisco bank to grapple more deeply than it did previously with the many failures that led to its account-opening scandal.

December 6 -

This may be “the first wave” of managers being held accountable for the phony accounts scandal; high prices discouraging cross-border acquisitions.

December 6 -

Since banks are under constant attack by hackers, the startup XM Cyber is offering them a simulator that seeks to do its virtual worst in order to prevent a real breach.

December 5 -

Readers react to trends in public banking, weigh potential changes for brokered deposits, consider oversight of foreign banks and more.

November 21 -

The megabank’s continued compliance problems suggest that all of its board members, along with 100 of its most senior managers, should be replaced to make way for real change.

November 20