Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

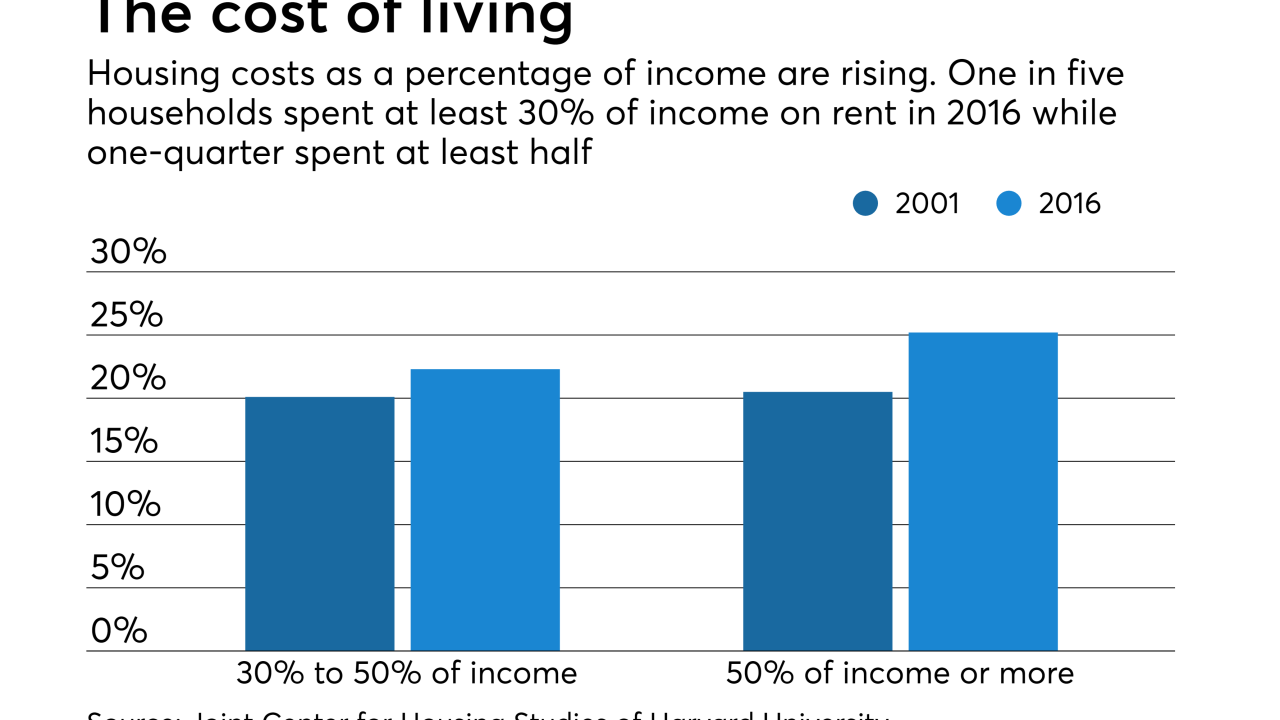

Advocates are seeking more federal funding for affordable housing. A federal investigation into the banks’ alleged manipulation of a popular tax-credit program can’t be helping their cause.

September 18 -

Speaking at an investor conference in New York, John Shrewsberry addressed a recent media report saying regulators had rejected Wells Fargo’s restitution plan for overcharged auto customers.

September 14 -

Four lenders, led by Sallie Mae, have long dominated the market for private student loans. But they could soon face new competition from Navient and Nelnet.

September 13 -

Delinquencies have held steady for a year, and observers are optimistic about upcoming third-quarter data. But the long-term question is whether solid underwriting can overcome higher vehicle prices and consumer debt burdens.

September 7 -

Agency’s first supervisory report under Mulvaney finds little change; the nonbank lender surpasses Citigroup and Bank of America in home loans.

September 7 -

Credit unions historically have focused on laws that directly pertain to them, but in a break with that tradition, NAFCU is calling on Congress to reintroduce efforts to break up big banks.

September 6 -

Investigators have sought more information from the bank in recent weeks about whether management pressured workers to improperly change documents in order to meet a regulatory deadline, according to a news report.

September 6 -

Just before the end of summer, several major banks have put new faces in key executive positions.

September 6 -

Wells Fargo said it thoroughly investigates all complaints of impropriety, after a report said the company is failing to treat some of its female employees fairly.

August 31 -

Women managers in the Well Fargo’s wealth management division say they are being passed up for promotions; TD Bank's U.S. retail division saw profit jump 27% in fiscal Q3.

August 31 -

Wells Fargo is investigating employees in its investment bank for alleged violations of its expense policy after they tried to get the company to pay for ineligible evening meals.

August 30 -

Digital banks dispute the notion that they can skimp on customer service because millennials are only shopping for low fees and high savings rates.

August 28 -

JPMorgan Chase, State Street, Wells Fargo, Citigroup and Bank of America decreased their holdings of tax-exempt bonds by nearly $16 billion in the first half of 2018, according to quarterly filings with the U.S. Securities and Exchange Commission.

August 27 -

Small and midsize banks are most at risk as commercial loan volume fails to ignite; the cutbacks are partly the result of lower origination volume.

August 27 -

Wells Fargo & Co. is cutting 638 mortgage employees as the nation’s largest home lender contends with a slowdown in the business.

August 24 -

Cheap funding and marketing muscle could give it an advantage over existing lenders, but this corner of the market may not be big enough to move the needle for the bank.

August 23 -

State Treasurer John Chiang says that Wells Fargo is keeping patterns of abuse hidden from view by resolving customer disputes through private arbitration.

August 23 -

Wells Fargo isn't making a political statement, it's following the rules. So goes the bank's response to backlash over terminating a pro-medical marijuana politician's banking relationship because of her advocacy and contributions from industry lobbyists.

August 23 -

The Troy, Mich., company is operating unfettered by regulatory orders for the first time in a decade, and its CEO says Flagstar now has the flexibility to pull the trigger faster on deals and accelerate its diversification beyond mortgages.

August 21 -

A Florida politician who has run a pro-medical marijuana campaign said Wells Fargo closed her account over her ties to the industry, adding that the incident was an example of the challenges legal cannabis businesses face from the U.S. financial system.

August 20