Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

Scott Powell, who resolved numerous regulatory problems as the head of the Spanish bank's U.S. operations, will face similar challenges at scandal-plagued Wells. As the bank's chief operating officer, Powell will report to CEO Charlie Scharf, a former colleague at JPMorgan Chase.

December 2 -

USAA won $200M from Wells Fargo in patent fight — will others be on the hook?; three takeaways from regulators' approval of the BB&T-SunTrust merger; don't believe the doom and gloom on Fannie, Freddie; and more from this week's most-read stories.

November 27 -

One-time expenses at a handful of large banks marred an otherwise solid quarter, while higher charge-offs point to possible credit-quality concerns.

November 26 -

Profits dipped 7% from a year earlier but banks still earned nearly $60 billion, the agency said in its Quarterly Banking Profile.

November 26 -

The bank is testing the emerging technology with IBM in an effort to speed up risk analysis and derivatives pricing.

November 25 -

Rep. Katie Porter, D-Calif., wants details about refunding "hundreds of millions of dollars" in fees improperly charged on checking accounts. Wells has acknowledged the potential problem but hasn't estimated how much it owes.

November 22 -

Banks’ third-party technology providers may face increased scrutiny; Rep. Porter wants more data about "confusing" checking account fees.

November 22 -

New American Customer Satisfaction Index data shows consumers slightly favored banks, which are benefiting from investments in technology.

November 21 -

Avid Modjtabai, who runs Wells Fargo's payments and technology innovation unit, is leaving the firm as new Chief Executive Officer Charlie Scharf continues to shake up top management.

November 21 -

A lawsuit filed by a New Jersey branch employee who was fired in 2016 includes detailed allegations about the pressure that front-line workers faced to meet monthly sales targets. The case is scheduled to go to trial in February.

November 20 -

The remote deposit capture tech at the center of the dispute is used by 6,500 institutions. That may mean other institutions will have to pay licensing fees to USAA.

November 18 -

The FDIC and the Fed have yet to sign on to the plan; this year’s managing director class includes fewer overall, but a higher percentage are women.

November 15 -

Allen Parker, who led Wells Fargo during its six-month search for a new chief executive, will leave the bank next year.

November 14 -

Tech giant takes will work with Citi; the bank reportedly asked IT providers to return some of the money it paid them in 2018.

November 13 -

The two previously worked at BNY Mellon in similar roles, Scharf as CEO and Daley as head of public affairs; Michael Johnson’s demotion follows the bank’s massive data breach in July.

November 8 -

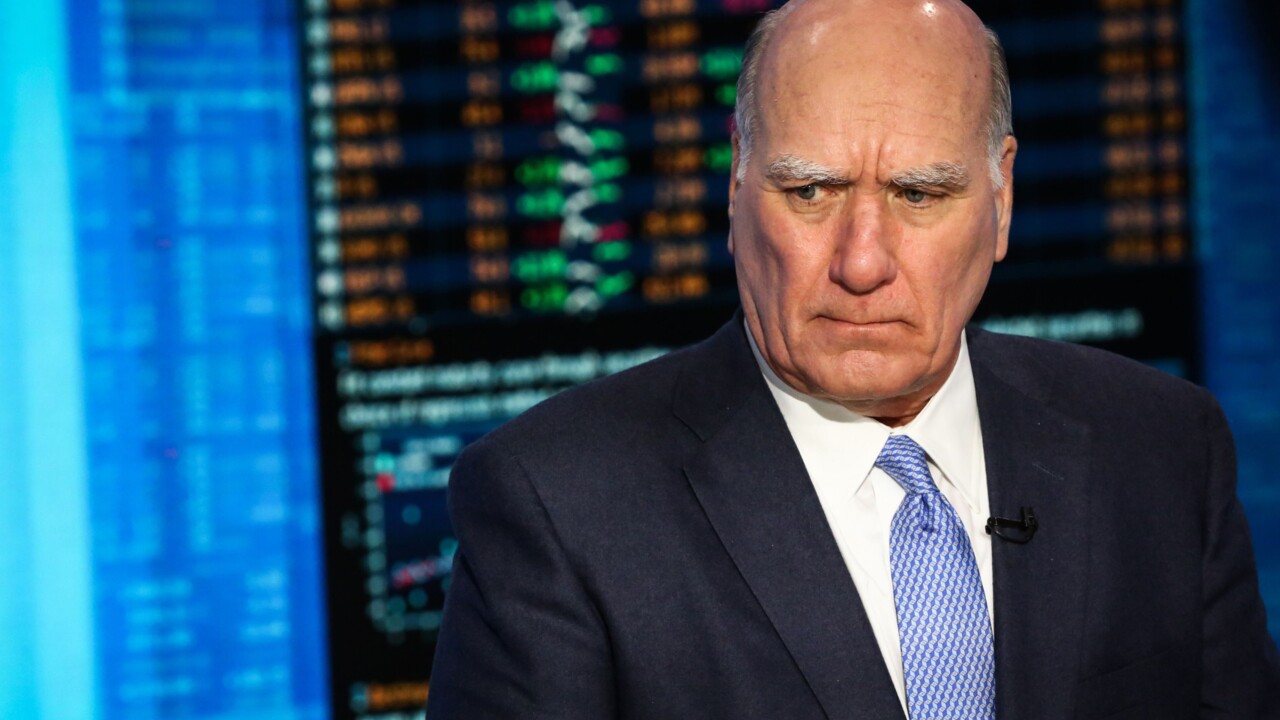

Chief Executive Officer Charlie Scharf plans to name Bill Daley, the former White House chief of staff, to a senior post to improve relations with authorities in Washington, according to people with knowledge of the plan.

November 7 -

Top officials at Bank of America and Wells Fargo said that commercial loan demand is weak, even as U.S. consumers show strength. Their comments echo recent findings by the Federal Reserve.

November 5 -

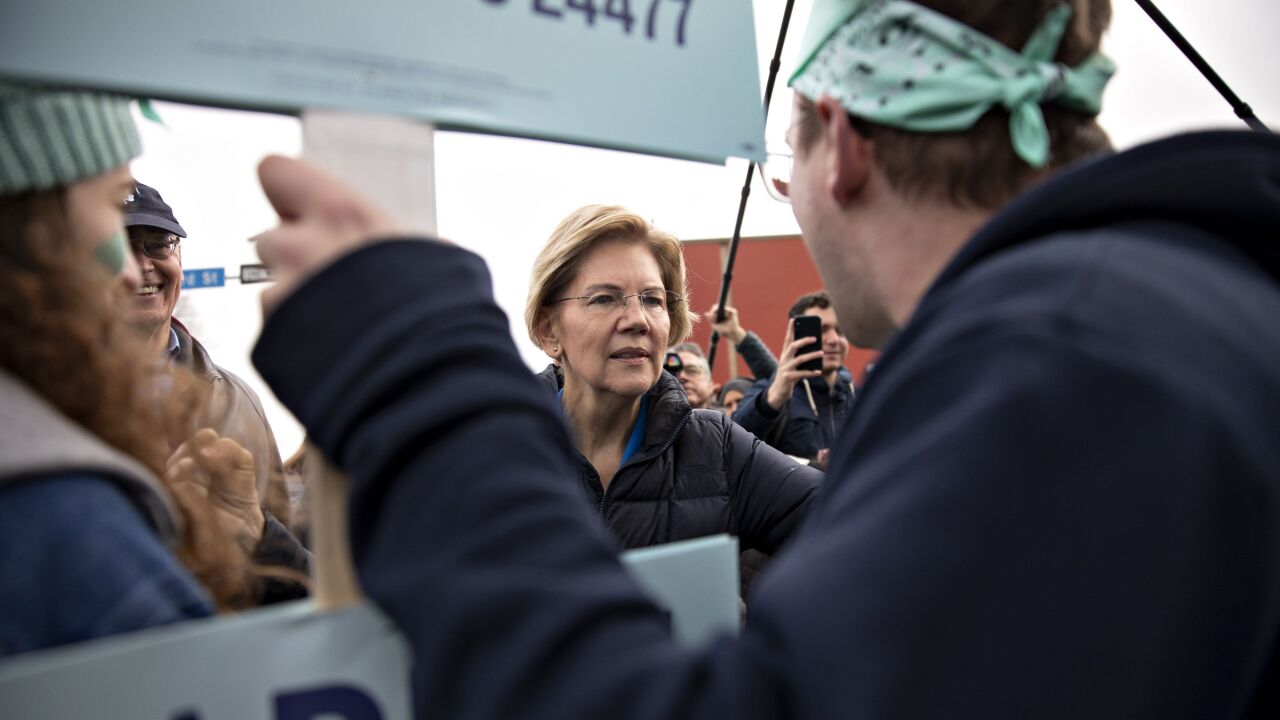

If elected president, Sen. Elizabeth Warren would charge large banks a fee to help pay for her Medicare-for-all plan.

November 4 -

CEO tells employees he wants them to be 'impatient' in fixing the bank’s woes; the new independent body would police banks’ compliance with AML regulations.

November 1 -

Rep. Ayanna Pressley, D-Mass., has proposed requiring annual testimony by the heads of the U.S. "global systemically important" banks.

October 31