-

Banks need to ditch their "wait and see" approach to making real-time payments available to their customers says Vinay Prabhakar, Volante’s vice president of product marketing.

October 15 Volante Technologies

Volante Technologies -

Any entity questioning Libra runs up against the longstanding legal precedent set by private label gift and GPR, and myriad other prepaid account offerings, says payments consultant and researcher Richard Crone.

October 9 Crone Consulting LLC

Crone Consulting LLC -

The creator of the Zelle precursor clearXchange is heading a company building a blockchain-based international payment technology for banks.

September 12 -

As the competition mounts to increase adoption rates for person-to-person payment apps, PayPal's Venmo is adding a way for users to quickly move money from the app to their bank account.

August 12 -

A group of senators on the Banking Committee sent a letter to the central bank chairman grilling him on the agency's efforts to develop a real-time payments system.

July 22 -

In immediate, unrestricted availability of funds, the only true providers are those networks operated by banks or other financial institutions, writes Jack Baldwin, CEO of Baldwin Hackett & Meeks.

July 17 BHMI

BHMI -

Community bank executives, payments officials and others said Libra faces an uphill battle amid heavy competition and regulatory scrutiny.

June 20 -

Some of the biggest industry moves in May and early June were not executive promotions, but rather departures.

June 12 -

On-demand wage delivery has caught on in other industries. Banks have taken notice.

June 5 -

Albert Ko, who had been the chief transformation officer of Intuit, says he will work to improve Zelle's interface to make it more appealing to consumers.

May 30 -

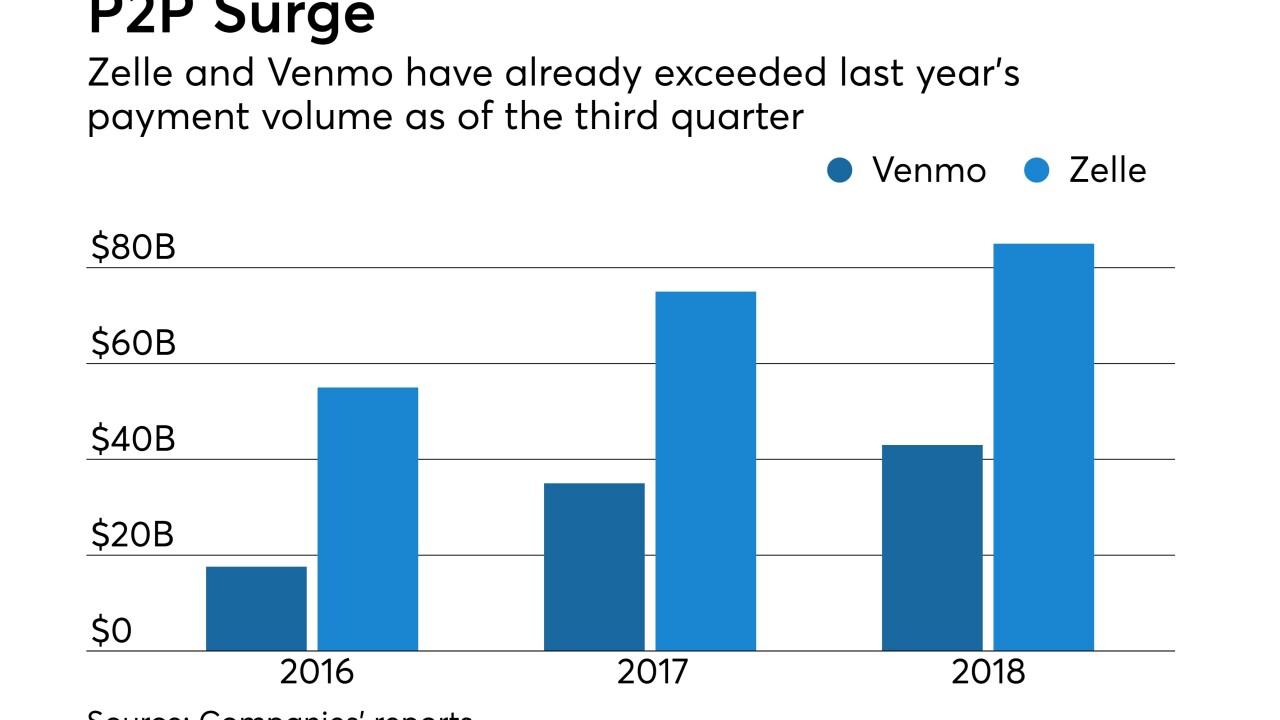

Venmo has more than 40 million active users, PayPal has revealed for the first time. This finally gives the market a sense of how popular Venmo is, and sheds a little light on how it compares to the bank-run Zelle service.

April 24 -

The largest U.S. banks got a head start in launching Zelle through their mobile apps about 18 months ago, working closely with Zelle’s owner Early Warning Services LLC. It’s taking longer for smaller institutions to get up and running, due to some technical complexity.

April 10 -

Banks of all sizes need to stick together to ward off threats from "unregulated" fintechs and other nonbanks, Bank of America Chairman and CEO Brian Moynihan said Tuesday.

April 2 -

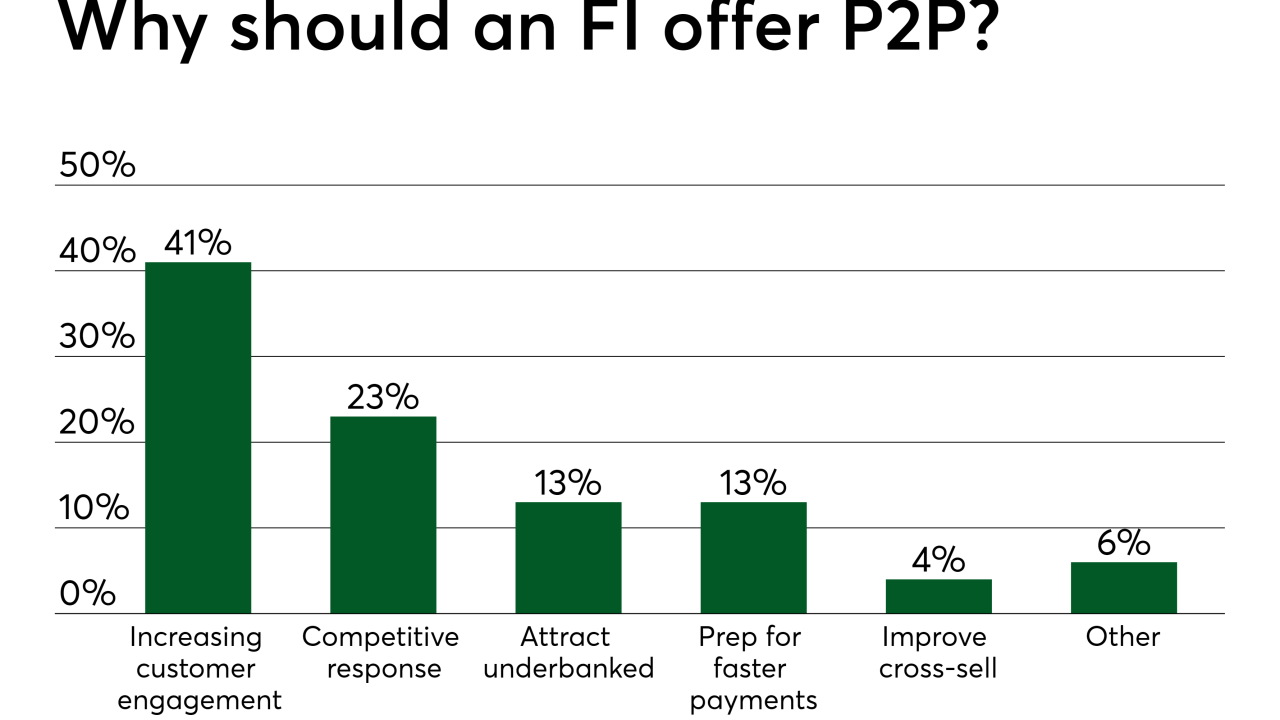

The market for P2P payments is finally taking off after years of false starts, but there are still many unanswered questions. The biggest one: How do banks get value out of offering this service free of charge?

March 22 -

The market for P2P payments is finally taking off after years of false starts, but there are still many unanswered questions. The biggest one: How do banks get value out of offering this service free of charge?

March 22 -

A man entered a SunTrust branch in Sebring, Fla., and shot and killed five women, four of whom were bank employees; 24 million mortgage documents exposed in data security lapse; the battle for deposits is like "a steel-cage" match; and more from this week's most-read stories.

January 25 -

Business pay has always lagged consumer innovation because of complexity. But new advancements in underlying business technology should change that, according to Rob Eberle, CEO of Bottomline Technologies.

December 28 Bottomline Technologies

Bottomline Technologies -

Proponents of real-time payments systems say banks must embrace them given consumer demand for more immediacy and transparency, even if criminals will try to exploit them.

November 28 -

A year after its launch, Zelle’s P2P payment volume has rapidly expanded through usage at the nation’s largest banks. But enabling smaller institutions to offer it to their customers is proving to be more challenging.

November 26 -

Zelle processed 116 million transactions during the third quarter as its payment volume jumped to $32 billion, while Venmo's volume increased 78% to nearly $17 billion.

October 23