-

In the conclusion of a three-part interview, Ryan Singer, a blockchain-tech entrepreneur, explains why bankers should care about Washington's resurgent efforts to insert back doors into security systems.

April 20 -

Despite the enormous hype and investment surrounding biometric technology, U.S. Bank's Elavon predicts that fingerprint, "selfie" and voice-based authentication will not render passwords obsolete anytime soon.

April 20 -

On any given day, there are countless articles circulating about the issues associated with EMV and how it will soon be replaced by the next big thing. However, EMV is here to stay, and, despite some who claim otherwise, thats a good thing.

April 20 Paragon Application Systems

Paragon Application Systems -

When EMV came to market in Europe in the 1990s, it entered a world with a much less robust communications infrastructure than what the U.S. has today. So, following the launch of EMV in the U.S., Visa decided it was time to break some old habits.

April 19 -

A closer look at a strangely named piece of malicious software shows it makes crafty use of drive-by downloads and Web injections to fool users into complicity with online banking fraud.

April 19 -

While beneficial for businesses and consumers, Nacha's new rule for same day transactions will require banks and other financial institutions to review thousands of additional transactions per day, leading to a significant increase in costs, not to mention an increased potential for fraud due to volume and rapidness of review.

April 19 BioCatch

BioCatch -

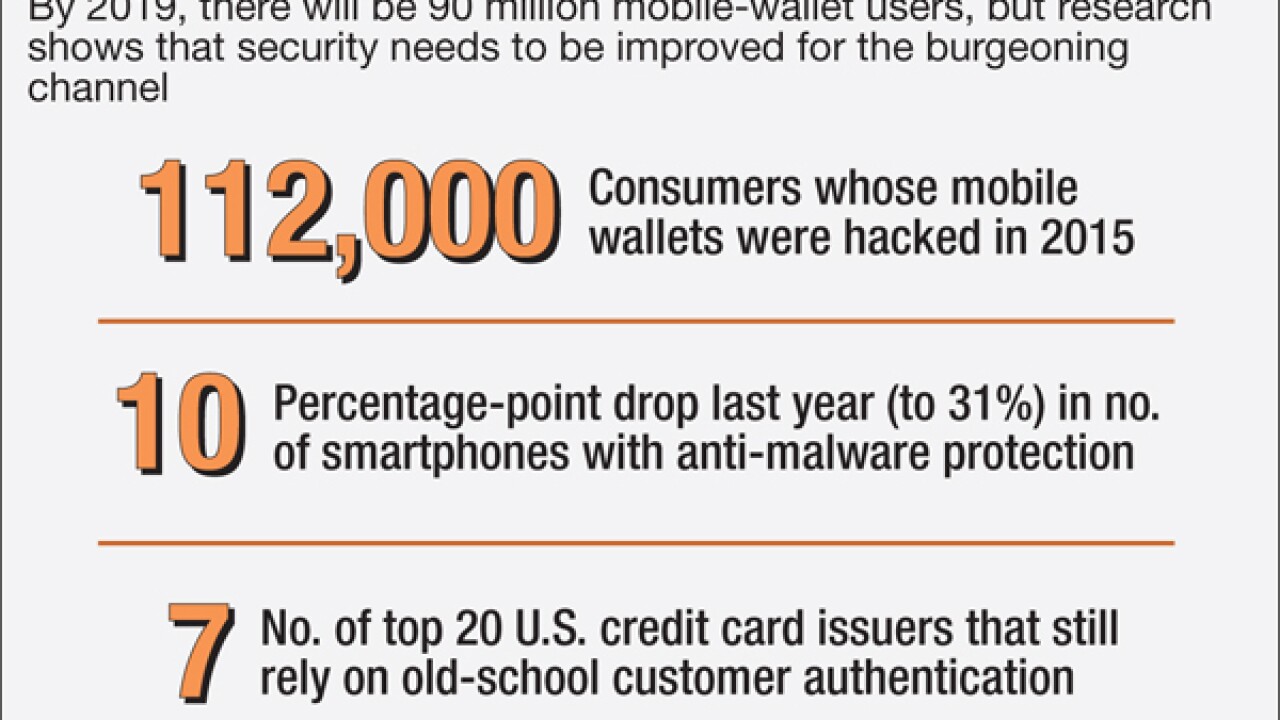

As mobile wallets become more popular they'll also become more popular targets for fraud. Banks ought to improve enrollment guidelines and other security tools in plotting their mobile-wallet strategy.

April 18 -

Cyberthieves using malicious software discovered by IBM Security have stolen $4 million from business customers of two dozen financial services providers this month, IBM said.

April 15 -

Experts from across the payments industry gathered in Los Angeles for SourceMedia's annual Card Forum and Expo. Here are some of the biggest ideas discussed at this year's event.

April 15 -

Biometric authentication is coming to numerous e-commerce merchants who may not realize that it will be a part of their checkout process, depending on the issuers involved.

April 15