-

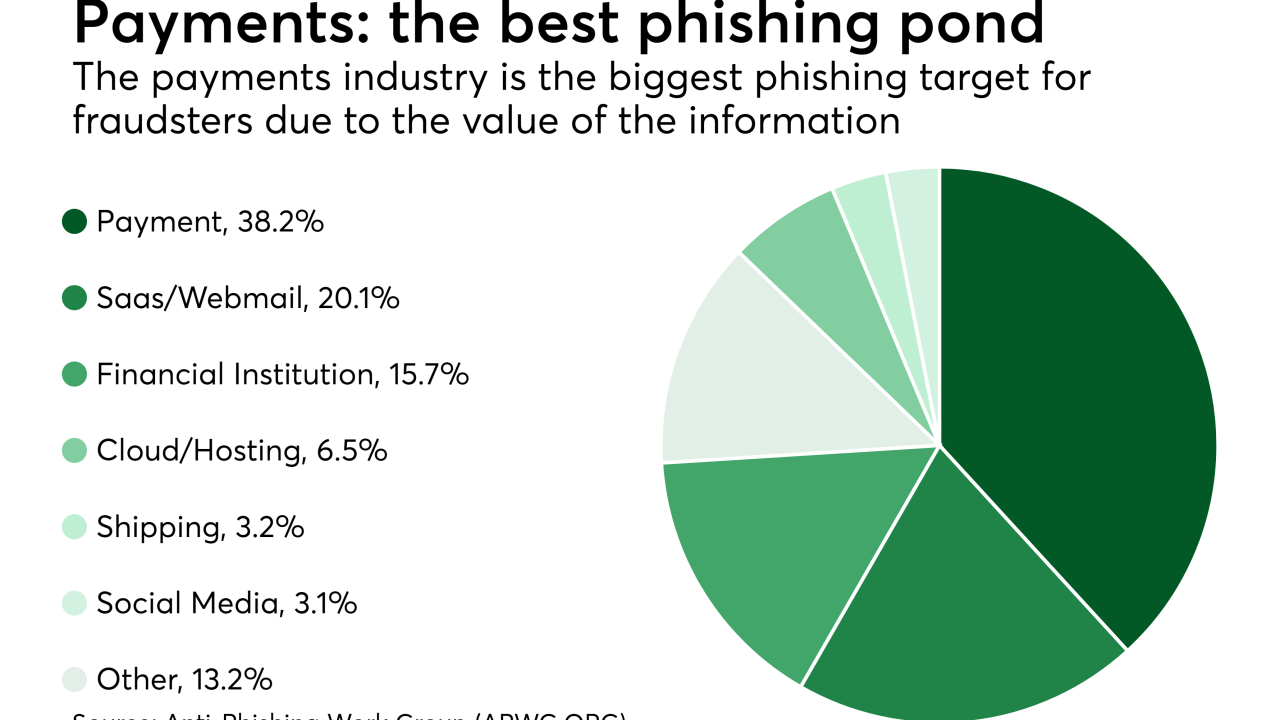

Today phishing scams have become so elaborate that they can take a variety of forms, including a phony job interview.

February 7 -

It’s past time for every organization handling sensitive data to lock down their security, and to stop relying personally identifiable information to verify users, writes Ryan Wilk, vice president of customer success for NuData Security.

February 7 NuData Security

NuData Security -

Swift is showing more swagger in its rivalry with Ripple thanks to progress it has made with a multifaceted payments-tracking technology called GPI.

February 7 -

Swift is showing more swagger in its rivalry with Ripple thanks to progress it has made with a multifaceted payments-tracking technology called GPI.

February 6 -

A year after buying the artificial intelligence fintech Layer 6, TD Bank is "rewiring how the organization has worked," Gregory Braca says.

February 5 -

Banks are a primary market to be pursued by Blue Hexagon, which received $31 million in venture capital.

February 5 -

Making micropayments feasible and viable for businesses will open up a whole new world of online commerce that was just not possible before, writes Sushil Prabhu, CEO of OpenCrowd.

February 5 OpenCrowd

OpenCrowd -

Facebook is inching closer to threatening traditional processors and financial institutions with its own digital currency by adding staff with expertise in the underlying technology.

February 4 -

Policymakers need to update banking regulations to minimize the risks posed by technology companies entering financial services, a well-known policy analyst says in a new paper.

February 4 -

Criminals are going to get smarter, but banks can implement a modern authentication solution to meet unique use cases and security requirements without sacrificing user convenience, writes Mike Byrnes, senior product manager at Entrust Datacard.

February 1 Entrust Datacard

Entrust Datacard