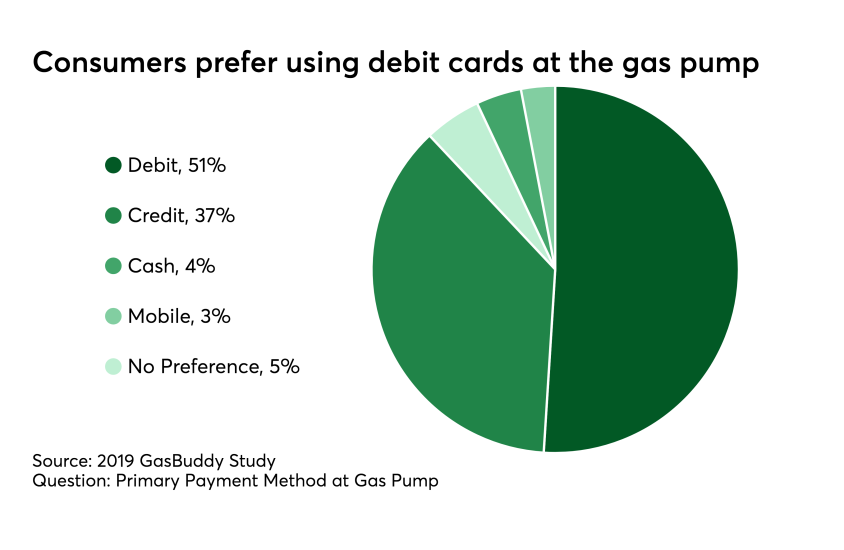

Debit cards often lack the rewards and spending power of credit cards, and thus do not figure prominently in TV ads or direct mail flyers. Yet despite these limitations debit cards are beloved by millennials and anyone else who wants to avoid credit card debit. They are the power behind Venmo transactions and are now the preferred method for paying at the gas pump.

When debit cards rose to popularity in the 1990s and 2000s, banks were able to profitably benefit from rising interchange rates, and at one point commonly offered rewards on them — especially when consumers opted to sign for their transactions instead of using a PIN.

Merchants balked, and the Durbin amendment was born, slashing interchange for covered banks with assets of $10 billion or more. The result was that debit marketing programs at big banks were wiped out, and now M&A activity for exempted banks (assets under $10 billion) is given pause should a bank exceed the asset threshold and become covered under the Federal Reserve’s Regulation II (Durbin amendment).