-

Cobranded travel credit cards — including some of the most popular and profitable in the payment card industry — are looking at darker skies because of COVID-19.

March 16 -

The agency will be tasked with providing $50 billion in loans to small businesses harmed by the pandemic. It is unclear whether the SBA will need help from banks and CUs.

March 13 -

E-commerce firms and payment apps can reach new users and investors through crowdfunding, says Prime Trust's Bruce Dyer.

March 13 Prime Trust

Prime Trust -

No-interest loans and overdraft forgiveness are among the lifelines banks are offering to consumers and small businesses whose livelihoods are being upended by the economic fallout.

March 12 -

The agency will be tasked with providing $50 billion in loans to small businesses harmed by the pandemic. It is unclear whether the SBA will need bankers' help.

March 12 -

Firms such as Afterpay that offer financing to shoppers have been enjoying rapid growth. But their model is under scrutiny from regulators, being mimicked by credit card lenders and faces heightened risks in a downturn.

March 11 -

Financial institutions need to alert customers about emails or websites that pretend to offer important COVID-19 information but instead could end up stealing their account numbers or logins.

March 11 -

Payments software company SpotOn Transact has completed a $50 million funding round that included investments from 01 Advisors, a firm founded by former Twitter executives.

March 11 -

The Fed can take steps now to speed up existing networks.

March 10 Cato Institute

Cato Institute -

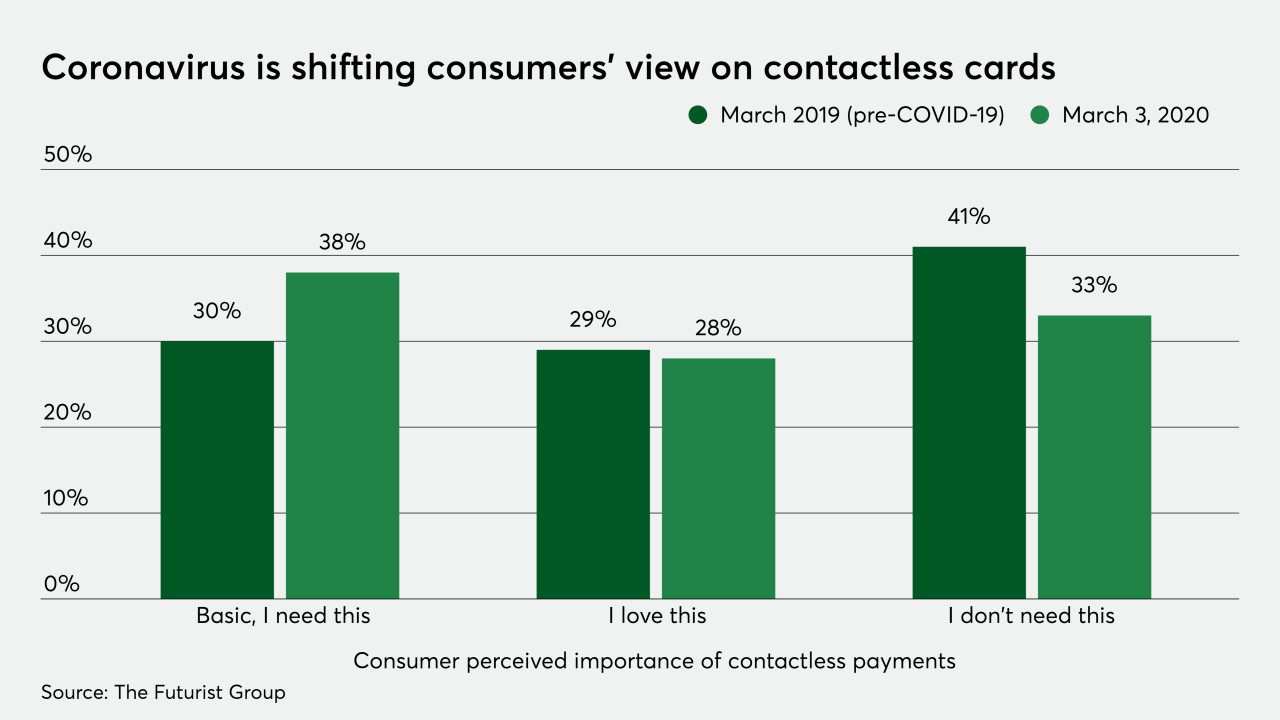

Contactless cards are a potential refuge for consumers who fear plastic and cash are carrying COVID-19.

March 10