-

Establishing trust, especially when it comes to online payments, is critical. People need to feel secure and confident that their personal boundaries won’t be crossed or their information misused, writes Rik van't Hof, director of product management front-end for Ingenico e-commerce.

December 8 Ingenico

Ingenico -

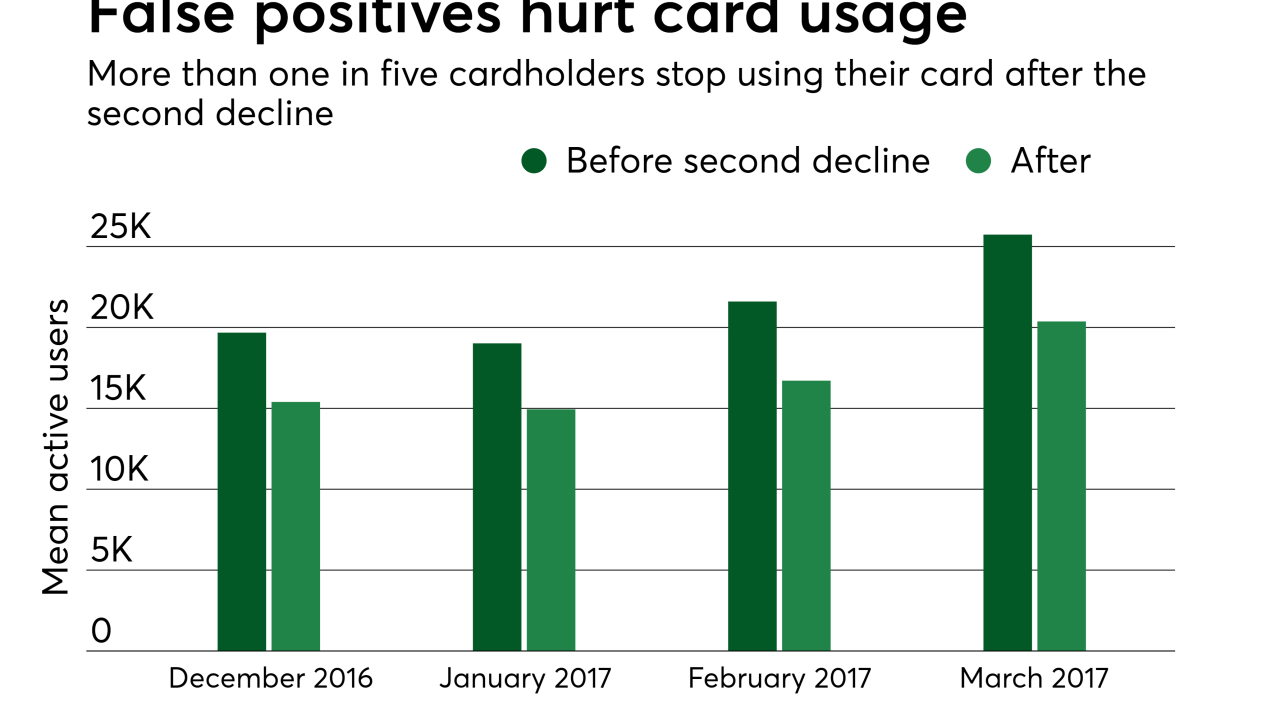

Card usage drops off fast after a false positive. In many cases, two false positives cause consumers to abandon a card permanently.

December 8 -

The company has been working to address an informal agreement with regulators tied to Bank Secrecy Act compliance.

December 7 -

Discover's shift starts in April 2018. Mastercard has also eliminated signatures for credit and debit card transactions.

December 7 -

Airlink's knowledge of the local market and relationships with banks, acquirers and large merchants in region will help the Paris-based Ingenico grow in Taiwan and strengthen its position in Northeast Asia.

December 7 -

The incentive marks a new direction for card-linked offers, which have become a staple for many banks that offer the deals through third-party services like Cardlytics.

December 7 -

The free pass becomes effective when a flight is expected to be delayed by two or more hours and the cardholder has registered flight details at least six hours prior to scheduled departure.

December 7 -

It's part of Visa's strategy of using the Olympics to showcase innovation, a move that in the upcoming Olympics will also include wearable payments.

December 7 -

Even the efficiencies of an upgrade may not be enough for the human touch that some higher-risk accounts require, leaving a "painful" process for merchants and acquirers.

December 7 -

Recent data breach events in September 2017 in the U.S., involving the stock value drop of Sonic as well as Equifax, are evidence of the negative impact of data breaches on the economic value of businesses. Clearly, they have become incidents of board-level importance, writes Justhy Deva Prasad, chief data partner at Claritysquare.

December 7 Claritysquare

Claritysquare