Buy now/pay later has become one of the hottest fintech categories for investors, though data suggests many consumers aren't using it regularly, are worried about taking on too much debt and in many cases don't even know the product exists.

Research from PayPal and BigCommerce, an e-commerce platform for merchants that offers BNPL through a

Citi Australia also contends there is a lack of uptake, particularly for nonbank BNPL offerings. Citi's internal research found that only one in five Australians had used BNPL from nonbanks. The bank is partnering with the retail site Kogan.com to support BNPL in Australia in competition with fintechs such as Afterpay. The services will launch later this year under a new brand, since

"I think the jury is still out as to whether BNPL will have a significant impact on other forms of merchant credit," said Amanda Rose McCreight, director of payments revenue at BigCommerce. Some consumers are loyal to particular payment options and as such may be difficult to attract to a new form of credit and payment, McCreight said.

PayPal and BigCommerce surveyed 3,000 consumers from the U.S., U.K. and Australia on a range of topics, including BNPL and preferences for online shopping. Regarding BNPL, 48% of Australian merchants, 20% of U.S. merchants and 11% of U.K. merchants offer installment payments.

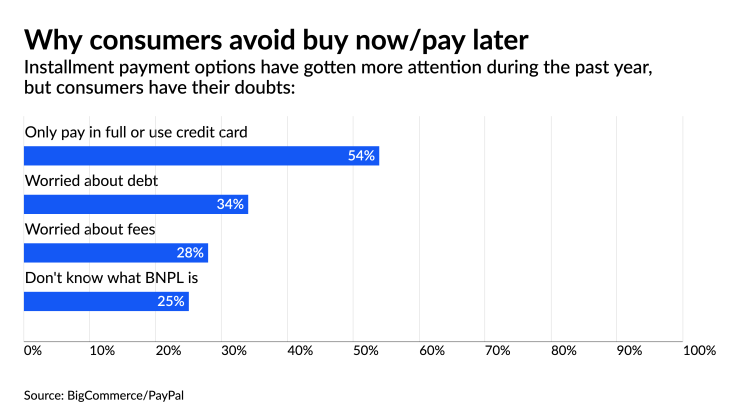

Consumer use is irregular. Across all three countries, 46% of consumers report having used BNPL at least once over the past three months, with just 10% reporting using it five or more times during the same period. In the U.S., nearly 61% of consumers have never used BNPL, mostly because they're worried about debt, fees or a lack of knowledge about the service — a third list debt concerns as their reason to not use BNPL, according to PayPal and BigCommerce's study.

Source of the doubt

There is a fair amount of skepticism in the market around BNPL, according to Brad Paterson, CEO of Splitit, a New York-based installment lender. BNPL lenders need to communicate how the product can be used safely and embrace governance for installment lending, he said.

"There are dramatic headlines of consumers getting financially pummeled because of missing payments or overextending because of BNPL purchases that have captured the attention of businesses, consumers and regulators," Paterson said.

That kind of attention can create misunderstanding about the product and steer people away, andy firms in the industry do earn a third or more of their revenue from "overstretched consumers" and late payment penalties, Paterson said. "The fact is to many, BNPL can sound too good to be true," said Paterson, who positions BNPL as a way for consumers to purchase the items they need, manage surprises and also obtain aspirational items by paying over time.

But the funding comes as the BNPL industry faces a challenging business model that threatens its profitability. The

In Australia, one of the earliest markets to embrace BNPL, 30% of the revenue of BNPL firms comes from "bad debt," or debt used for consumption rather than wealth creation, according to the

BNPL is not heavily regulated in most countries, though there is momentum to force BNPL lenders to face regulations similar to bank lending. BNPL firms should embrace regulation as a way to address consumer fears, according to Paterson.

"The industry needs to be more transparent and work with regulators to ensure we all have the consumers’ best interests at the forefront of all we do," Paterson said. "More education and more transparency coupled with continued innovation will help attract new believers and convert them into repeat customers."

The BNPL market has attracted

In an earlier interview,

Affirm earlier in 2021 launched a BNPL-linked debit card, while Klarna recently partnered with the fintech Liberas to power merchant credit based on future payment flows to counter similar products from Square and PayPal.

Splitit this week introduced Splitit InStore, which supports Apple Pay and Google Pay, to speed in-store installment lending. InStore was designed for sales associates at retailers, which are able to offer installment options for larger value purchases such as home furnishings, jewelry, luxury retail and sporting goods. Retailers at launch include La-Z-boy Furniture Galleries, Faberge, Gem Shopping Network and Aftershock PC in Australia.

Splitit has increased its focus on the service sector, including medical and legal bills. "Conversion rates and average spends with BNPL are higher, and the solution is increasingly becoming an organic piece of a consumers’ overall financial wellness journey," Paterson said. Splitit uses consumers' existing credit relationships to fund installment payments, which Paterson said allows consumers to avoid opening a new credit line. "Once our users understood Splitit, they consistently asked for more ways to use it, which is why we have also focused on the service sector," he said.

Despite the research showing tepid consumer uptake, BigCommerce is still bullish on BNPL, noting its research found 74% of BNPL users were prompted by a message early in their shopping experience, suggesting marketing and other messaging could boost usage. "While adoption of buy now/pay later has not been as pervasive as some other payment options, it’s showing strong growth, particularly with younger consumers who are growing in their spending power," McCreight said.

BNPL can contribute to consumers' financial health if used wisely, McCreight said. Additionally, 57% of U.K. consumers are more likely to make a purchase at a retailer that doesn't charge interest for point of sale financing, creating more upside for BNPL, according to BigCommerce.

"BNPL plans often don’t charge interest and are generally easier to get approved for than traditional credit cards, so there is potential for them to lower debt risk as long as shoppers don’t miss payments, which could affect credit scores," McCreight said. The overall trend is toward more merchant and consumer use, she said.

"Offering a BNPL option has revenue-related benefits like increasing conversion and average order value while decreasing cart abandonment," Paterson said. "What many haven’t yet realized is that not only does BNPL help shoppers spend smartly, but it’s a win for merchants, too, allowing retailers and consumers to align in their financial goals."

Need drives awareness

According to

Vrbo, an Experdia subsidiary that supports vacation home rentals, thinks of BNPL as a financing option that can help with an expected jump in travel volume that comes as more people schedule trips after the pandemic restrictions lift. The travel market is still

Vrbo in March partnered with

"We're seeing families stay longer, travel with more people and spend more in 2021," said Mike Sutter, senior vice president of product management at Vrbo. Renters "can use Affirm to find the perfect property and book it before someone else does."

At the online jeweler JamesAllen.com, BNPL is a

James Allen uses Splitit's BNPL offering, and says that option has increased average order value, though the company did not provide specific numbers. The jeweler has expanded marketing and other messaging to boost BNPL usage and raise awareness among consumers, according to Shannon Delany-Ron, James Allen's chief marketing officer.

"It allows consumers to purchase a more expensive engagement ring or piece of jewelry without having to worry about having the full funds available at the point of purchase," Delany-Ron said. As the use of BNPL increases, along with knowledge about the product, consumers' comfort with the debt risk will increase, Delany-Ron said.

"As consumers do the math, I think it's less about debt and more about cash flow," Delany-Ron said. BNPL, she added, provides flexibility without contributing to concerns that the consumer is increasing overall payout. "We believe it will become more popular over time."