Want unlimited access to top ideas and insights?

Big data was supposed to unleash a lot of powerful insights for banks, but many financial institutions still haven’t found a way to harness their own data because the amount of available information is so vast.

But FIS saw that one rich stream of data easily accessible to banks—consumer payments—still remains largely untapped as a resource for big-data analysis, and it set out to develop a new product to utilize it.

The result is the Customer Experience Suite, a predictive data-analysis product FIS announced today that uses big data and machine learning to analyze customers’ payments and other bank activity, producing highly targeted marketing recommendations for each customer.

What’s different about FIS’ latest tool is the broad customer view it captures considering an individual’s spending patterns, said Rob Lee, chief product officer for banking and payments for Jacksonville, Fla.-based FIS.

“For the first time we’re able to deliver marketing recommendations for accounts, payment cards or loans, for example, that are based on actual behavioral data instead of the indirect approach many banks still use where they target customers by segment,” Lee said.

Predictive modeling for bank marketing has been around, but what's new is the increased focus on using data to more accurately predict individual customers' future needs, said Tiffani Montez, a senior analyst at Aite Group.

"Many banks have triggers in place to identify events that could require financial assistance (for home or car purchases, for example) but what most banks don't do today is use data to 'predict' that event will happen in the future and proactively offer a personalized message, offer or even guidance before the event occurs," Montez said.

FIS' new tool links to a bank's existing systems to aggregate all of its internal customer and payment information to create a profile for each customer called a “Key Lifestyle Indicator.” Each profile highlights a customer’s spending patterns, ranging from routine expenses for shopping to home and car maintenance and repair, travel and other investments, Lee said. It then points to the most relevant products for that customer.

While the tool recommends pricing and the best marketing channels for reaching each customer including online, mobile, direct mail or other media, banks can edit the offers by applying different parameters and scenarios based on products and pricing, Lee explained.

"The bank can now quickly pull together a whole lot of data to produce a unique profile for each customer, bundling the right offers together that make sense for each individual and communicating it through the most appropriate channel," he said.

In tests, consumers said they appreciated the way a more targeted the approach eliminates mismatched or redundant marketing offers, Lee noted.

“Consumers say one of the most frustrating things about dealing with their bank is continually getting offers that aren’t a good fit for them, on receiving the same offer over and over again when they visit the website or open their direct mail from the bank,” Lee said.

The tool can be adapted for banks of any size, according to Lee, which may enable some smaller institutions to leverage their own big data for the first time.

“Payments data is at the heart of this new service, because it cuts across all categories and departments of a bank and provides insight into how each person is actually consuming services and where gaps and other product needs exist,” Lee said.

But predictive modeling for marketing also could carry some risks to banks around consumers' sensitivity to privacy, said Aite's Montez. "There's a fine line between riding in like a hero and rolling out like a creep," she said, noting that some consumers might view banks' deeper insight into their potential life events and decisions as an invasion.

"Banks need to balance the insight they obtain from data for predictive analytics by making the right offer at the right time, in the right channel," Montez said. One way to ensure that is by overlaying other data sources to validate the integrity and conclusions gathered from payments and other data, she added.

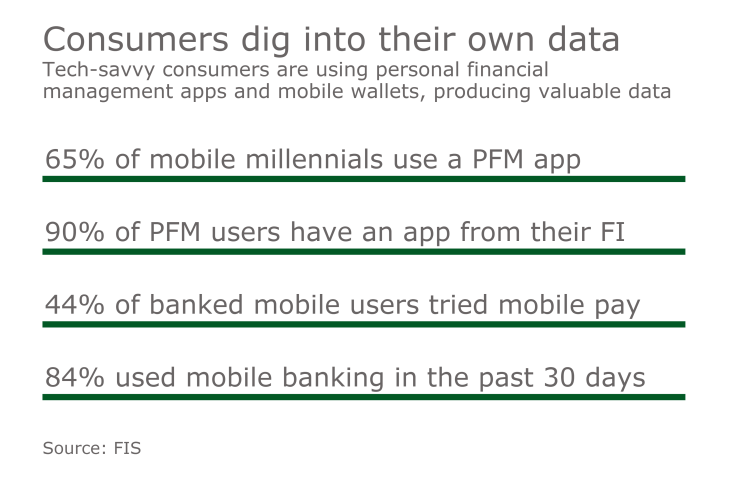

But even data isn't sitting still. One of the most interesting factors of harnessing payments data for predictive analytics, is that it’s a much richer channel than it was even five years ago.

“More and more transactions are moving from cash to electronic payments, giving banks greater visibility into how their customers are actually living, where they’re going and spending their money, versus withdrawing a chunk of cash that provided no clues about the customer’s lifestyle,” Lee said.