Contactless transit fare systems are drawing lots of investment despite several

More than 55% of all payments in the London transit system are made via contactless instead of the legacy Oyster card, according to TfL figures for early April provided to PaymentsSource. And that’s just the tip of the iceberg, as the rapid uptake of contactless payments on London’s transit system and overall contactless usage show little signs of slowing.

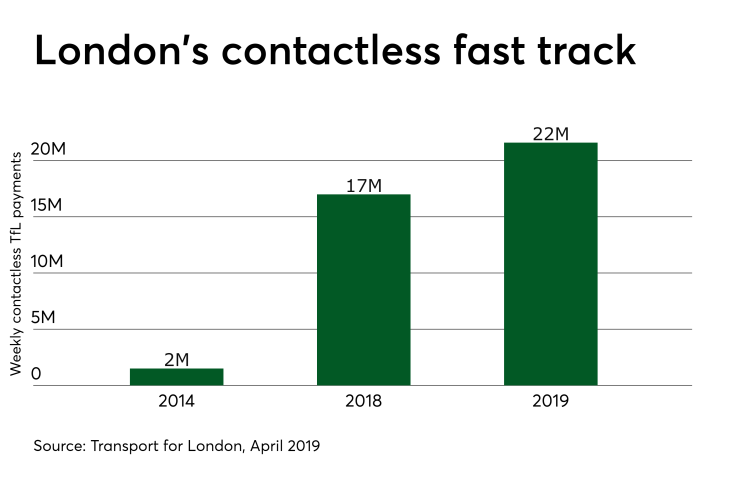

More than 21.6 million journeys per week are made on London public transit using contactless payments. More than 53,000 new contactless cards or new mobile contactless payments enter the TfL each day, and one in eight contactless journeys come via Apple Pay, Google Pay, Samsung Pay, or other mobile wallet apps.

While it didn’t provide specific data, TfL reports there is a link between contactless transit payments and contactless being adopted more generally by consumers in the U.K.

“We are also now working with other world cities to share our experience and knowledge to help them introduce a similar ticketing system in the coming years,” said Shashi Verma, chief technology officer at TfL, in an email.

Contactless fare payment was introduced in London in 2014, and within a year the TfL was named the fastest-growing

That growth coincides with broader contactless adoption in the U.K., where more than half of all in-store payments are now contactless, according to

London’s record — along with the expense of transit systems managing what amounts to their own currency, and general consumer preference for open-loop payment systems — provides

“Some of these fare collection systems are at the end of their life cycle, such as New York,” said Randy Vanderhoof, director of the U.S. Payments Forum, which consults with transit systems on ticketing modernization. “Do the systems continue to invest in and support the legacy systems with their own cards and readers and software, or do they make the investment in something that supports more mobile technology usage.”

Across the pond

The New York

Ticketing modernization projects like New York are attracting

The impact of Uber and other ride-sharing apps, which support a seamless payment that exists in concert with other transactions, also suggests a mobile experience can work for transit and other transactions.

“People want to be able to pay as the go using whatever ‘payment product’ they have with them,” Vanderhoof said. “That’s the vision of open loop.”

It's here where London's experience also provides a guide. A number of stations in high traffic/high shopping areas, or areas where the Underground connects with commuter rail — including Blackfriars, Shoreditch High Street, Canary Wharf and Clapham Common — are consistently seeing more than 60% of all pay-as-you-go journeys made using contactless, according to TfL. And close to half a million contactless payments are made from

“The New York [transit payment news] gives a tailwind push,” said Jason Thacker, an executive vice president and head of U.S. deposits and consumer payments for TD Bank. “We’ve always debated the benefits of contactless, which has been successful in Australia, Canada and Europe but not as much in the U.S. thus far.”

TD Bank’s debit card rollout includes more than 350,000 consumers who are New York MTA riders, Thacker said.

TD’s success will depend on matching upgrades of transit systems and EMV at merchants, which in the U.S. happened later than Europe, and also includes contactless capabilities. This will make it easier for the dual transit/merchant contactless migration that happened in London and other markets to take place in the U.S., according to Thacker.

“Time will tell if this time will be different, but we think there’s a real benefit,” Thacker said. “Everything is real time now, everything moves quicker. It’s crazy to say shaving 10 to 20 seconds by removing a [transit card] is a big deal, but when we talk to consumers that is what they rave about.”