When American Express customers browse reward offers through their online accounts or their apps — from bonus points for booking a hotel stay to $40 back on luxury bedding — the offers they see are carefully curated for them. Behind the scenes, an engine that Amex built itself is constantly fine-tuning these recommendations by matching cardholders with relevant offers at optimal times, such as surfacing dining options when a customer lands in London.

The payments company, which is based in New York, built a personalization engine it calls Orchestra to shape marketing and servicing interactions for every customer in real time across the app, on the website and over email. It took two and a half years to conceive of and fully deploy Orchestra, but by September 2020, Orchestra had rolled out to every card member across the U.S.

Financial services firms have taken a renewed interest in personalization since the pandemic turned most banking virtual. But it can be a challenge for banks, which often have trouble consolidating data about their customers across numerous interaction points, said Stefano Fanfarillo, partner and director in personalization and digital marketing at Boston Consulting Group,

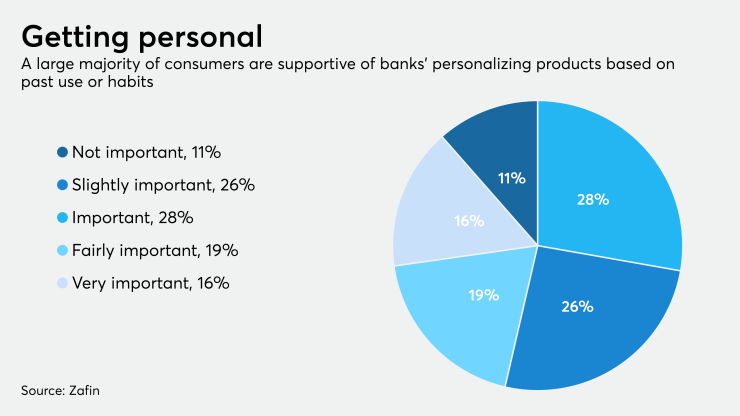

Still, research suggests that targeted offers are welcomed by bank customers. A September survey by Zafin, a cloud-based products and pricing solutions company for banks, found that 88% of respondents say it's important to them that their banks personalize products and services based on their needs and behaviors. Boston Consulting Group, or BCG, calculated that for every $100 billion of assets a bank has, it can increase revenues as much as $300 million by personalizing its customer interactions.

American Express, which competes with banks for high-spending or premium customers, has embraced personalization. Its new technology is a single, channel-agnostic platform that makes unified marketing decisions and weighs both relevance and timing when presenting offers to customers.

“American Express has been able to attract more wallet share onto its cards because people are loyal and see the benefits of the rewards program,” said Stephen Biggar, director of financial institutions research at Argus Research in New York. “Many banks are trying to emulate and enhance those programs and find a way to get more spend on their cards.”

The company, along with Discover Financial Services in Riverwoods, Ill., has an advantage that many banks do not: a closed-loop system that gives them direct relationships with their card members.

“They know the spending history, they service the account, they lend to you,” said Biggar of Amex and Discover. “From start to finish, they’ve got more information about the client than does the average bank or card-issuing institution.”

Determining which offers Amex should prioritize for cardholders is one major function of Orchestra. But the platform is also behind marketing messages that may highlight card benefits a customer is not aware of or not using, or recommend to customers the best way to redeem their points.

“Enhancing the brand is my first job,” said Anthony Mavromatis, the vice-president of global customer data science and platforms at American Express. “How do we show customers that we have their backs and meet their needs, but also delight them and add value to their everyday life through merchant offers and other products?”

The result of this outreach is a more engaged customer base. American Express reports a 5% to 25% increase in email open and click-through rates when card members receive content via Orchestra compared with those who receive content randomly.

Orchestra addresses questions like, “What did the customer just do? What can we learn from that? How can we anticipate what they might need?” said Mavromatis.

Orchestra is based on a real-time relevance prediction model that forecasts both reactively and proactively the relevance of a message to a customer in a certain moment, in accordance with their privacy choices and communications preferences. The engine also incorporates a number of “levers” to fine-tune the experience. For example, the minimum relevance lever would only allow Amex to show certain messages to a cardmember upon login to the Amex website if a minimum predicted probability to click is reached.

The platform was built in house but used open-source solutions such as Mockito to build tests, programming languages Java and Python, and a Spring Boot server for building applications.

One major part of Amex’s personalization strategy is to highlight relevant merchants, including both large and small businesses, that are relevant to each customer’s interests. But Mavromatis also emphasizes the importance of delivering these offers at the most opportune times.

“If we know a card member is scheduled to depart on a trip, we can suggest an Amex Centurion Lounge at the airport and recommend merchants such as hotels or restaurants at their destinations that they would find helpful,” said Mavromatis.

Of course, travel is off the table for many cardmembers right now. But Mavromatis says the pandemic has reinforced Orchestra's ability to adapt to changing customer needs.

"[We] let Orchestra figure out which offer is more relevant for which customer, let the system learn, and continue to evolve and deliver value," he said.