Want unlimited access to top ideas and insights?

If you follow headlines about consumer trends in the U.S., you might be growing tired of hearing about

Experts have analyzed their shopping habits, their workplace performance, their social media preferences, and everything in between. But now that even the youngest millennials have reached adulthood, the focus is beginning to shift to the up and coming generation known as Gen Z.

Why bother looking at a segment of the population that is currently primarily made up of students, and children too young for school? Well, for starters, Gen Z already makes up a quarter of the U.S. population, and is set to account for

And many are living in multi-generational homes with Baby Boomer grandparents as well. But they have consumer power, nonetheless, and that power will only grow over time. Financial institutions, consumer analysts, and marketers alike, are wisely starting to pay attention now, so they aren’t caught off guard when Gen Z reaches their peak. So, who is Gen Z and how do they differ from other consumers today? Let’s take a high-level look.

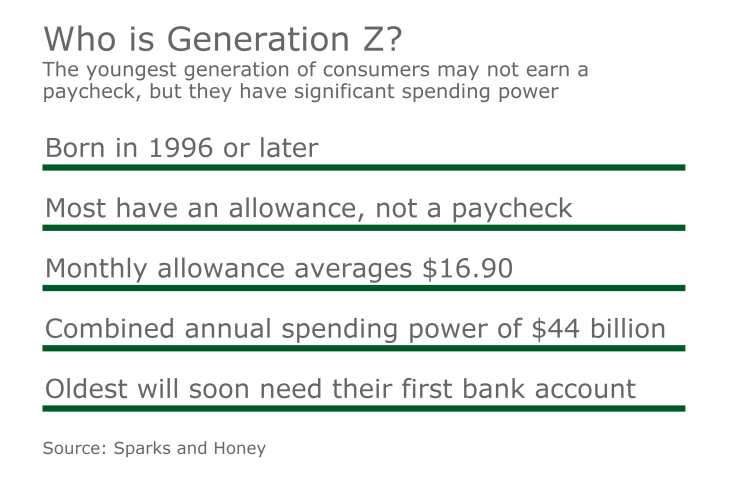

Gen Z is most commonly defined as people born between 1996 and today. While the majority aren’t earning paychecks just yet, they are receiving allowances and influencing purchases in their households. According to the marketing firm,

The oldest Gen Z members are 20-years old, and if they don’t already use banking products like savings accounts and debit cards, they will soon. With that in mind, it’s definitely not too early for financial institutions to begin marketing to them. The question then is how to capture the attention Gen Z?

Millennials have gotten attention for being digital natives, but the internet didn’t exist when more than half of Millennials were born. Gen Z is the first generation that can fully lay claim to being born into today’s technology. When the oldest members of Gen Z were born, cell phone usage and internet availability were still in their infancy. But a sizeable group of Gen Z members are younger than Facebook, which was founded in 2004. They have quite literally grown up alongside the technology boom of the 2000s.

Attention spans, or lack thereof, are among the chief concerns for marketers looking to capture the attention of Gen Z. A study by the National Center for Biotechnology Information has identified the attention span of Gen Z as being eight seconds. But analysts at Sparks and Honey prefers to think of it not as a lack of attention, but as a highly effective filter. Being more adept at navigating the digital world means sifting through information more quickly, and dismissing non-essential or unappealing information much more efficiently. Gen Z is hyper aware of when they’re being sold to, and aren’t accustomed to having to sit through commercials on television or the radio, thanks to Netflix, Spotify and other mainstream entertainment outlets.

Gen Z is also trending towards privacy, pragmatism, and social responsibility. They volunteer at a much higher rate than previous generations, and take fewer risks. Born into a recession, and having seen the fallout of their over-sharing millennial relatives in the era of bare-all selfies, Gen Z values caution and security more than their millennial counterparts. Evidence towards this trend can be seen in their preference for more private versions of social media like SnapChat and Whisper than the self-aggrandizing Facebook, a point made by a

The picture Gen Z is beginning to paint for themselves as consumers is going to bring even more challenges for marketers than Millennials do.

The trend toward shorter, “snackable” content, meaning information that is broken down into bite-sized chunks and distilled to its most simple core, is growing stronger. Forget about simplifying your message into less than 40 characters for Twitter. Get it down to five words and use a compelling image to reach this audience. Make your content accessible across multiple devices and formats. Make it customized and personal. And think less in terms of selling, and more in terms of making your brand broadly accessible. Without an element of empathy, and a clear and immediate benefit, your brand could be filtered into the margins in seconds.

If your brand has been slow to accommodate millennials, now is the time to make the changes, and go forward with the investments needed to bring your brand up to speed. After all, if you’re not yet able to capture millennials, you risk being trampled by Gen Z.