-

The U.S. subsidiary of Japanese banking giant Mitsubishi UFJ Financial Group has entered into a consent order with the Office of the Comptroller of the Currency that requires it to improve its information security protocols, hire more IT staff and create a board-level committee to monitor its progress.

September 20 -

President Biden urged a group of chief executive officers to help improve cybersecurity across the nation’s critical infrastructure and economy, citing a lack of trained professionals to adequately protect the U.S.

September 17 -

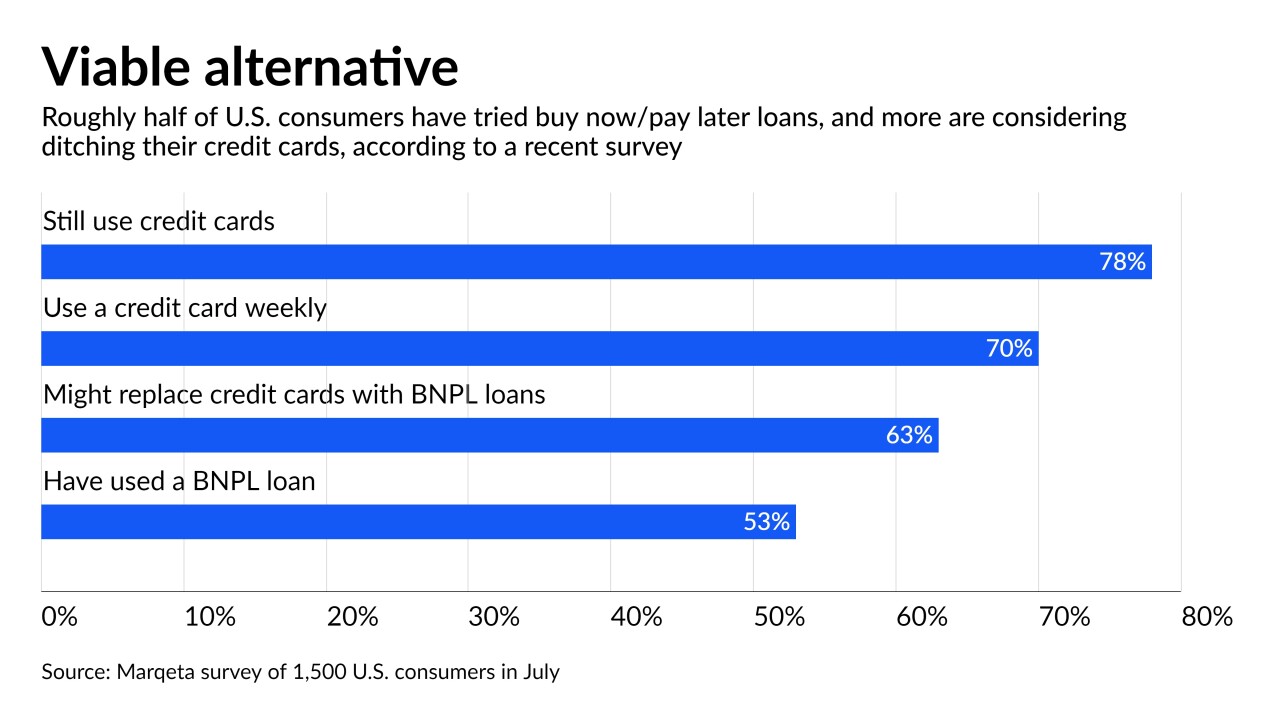

More than a third of installment borrowers are delinquent, according to new research. Fintechs and the banks that are following them into the market are willing to tolerate the credit risk — for now — because of BNPL’s rapid growth and the fee income from merchants.

September 17 -

Already in 2021, the nation's largest bank by assets has purchased more than 30 companies, including both fintechs and firms that are more removed from the financial industry. Here's a look at eight of those deals and the thinking behind them.

September 17 -

A long to-do list — from developing mortgage servicing requirements to revisiting payday lending rules — awaits Rohit Chopra, the administration’s choice to lead the consumer bureau. But it's still anyone's guess when the Senate will confirm him.

September 16 -

Email scams in which hackers siphon small amounts of money from thousands of accounts at once are on the rise. Here's what banks are doing about it.

September 16 -

Executives at JPMorgan Chase, Capital One and U.S. Bancorp all spoke this week about plans to take on upstarts that offer interest-free financing on consumer purchases. The increased competition figures to result in tighter margins across the category.

September 16 -

The Cincinnati bank, which last month closed its purchase of the health care lender Provide, has raised its estimate for the unit’s 2021 loan volume.

September 16 -

Buying the point-of-sale loan provider would give Goldman Sachs access to a network of millions of consumers and thousands of merchants that the bank would have difficulty building on its own, said Stephanie Cohen, its global co-head of consumer and wealth management.

September 15 -

Rodney Hood, a member of the National Credit Union Administration's board, detailed plans, such as the formation of an Office of Innovation and Access, to foster collaboration between credit unions and the tech community.

September 15