-

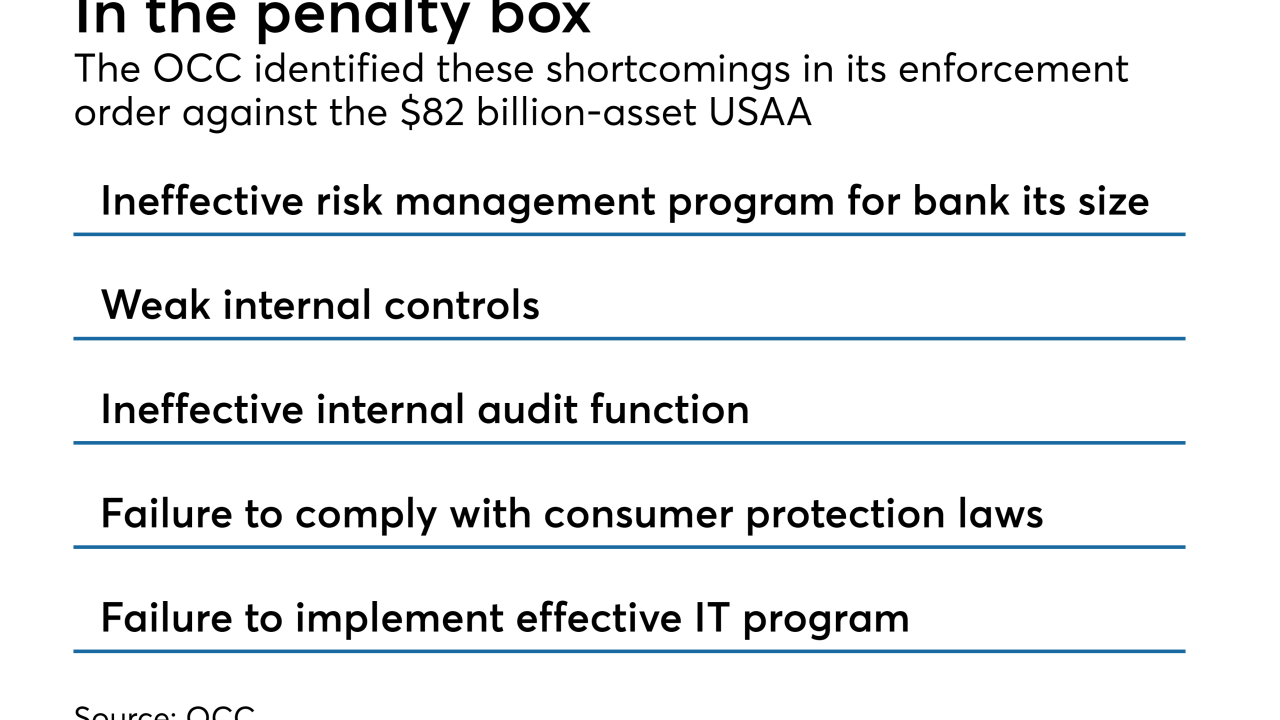

The enforcement action from the OCC comes on the heels of a CFPB consent order that said USAA reopened customers' accounts without consent and neglected stop-payment requests.

February 15 -

A MAPS Credit Union executive told the House Financial Services Committee her institution is proof credit unions and banks can safely serve the legal weed space.

February 13 -

The Federal Reserve’s top regulator, who assumed the chairmanship of the international board in November, said the FSB should explain the rationale behind its financial benchmarks while establishing new ones to combat emerging threats.

February 11 -

At least 14 suits have been filed this year alone accusing banks of operating websites that violate the Americans with Disabilities Act. Some banks prefer settlements to investments in technological overhauls, but experts say that strategy could be costlier in the long run.

February 10 -

The Feb. 13 hearing marks a turning point in long-running efforts in Washington to ease banks and credit unions' fears about serving the cannabis industry.

February 6 -

The Feb. 13 hearing marks a turning point in long-running efforts in Washington to ease bankers' fears about serving the cannabis industry.

February 6 -

Proposals that would have financial firms monitor or refuse to finance certain firearms purchases are misguided, putting the onus on unelected corporations.

February 4

-

The top Democrat on the Senate Banking Committee is warning that excessive optimism in the banking system could lead to another crisis.

January 31 -

In a lengthy report released Wednesday, the bank pledged to protect whistleblowers, handle customer complaints better and re-examine its lending practices.

January 30 -

The lawmakers want U.S. banking agencies to join their international peers in ensuring the financial system is resilient to climate-related risks.

January 28 -

Proposals that would have financial firms monitor or refuse to finance certain firearms purchases are misguided, putting the onus on unelected corporations.

January 25

-

It could be time for credit unions to rethink emergency plans after a second active shooter struck a bank branch in about four months, industry experts said.

January 25 -

Bank of England Governor Mark Carney said threats of jail for bankers are just a bluff and the real weapon to improve behavior is hitting pay packets.

January 24 -

The question of what banks are doing to aid government workers shows how the industry is still struggling to rebuild its image following the crisis.

January 24 -

Seventy-eight percent of global banks now use regulatory stress tests to assess concentrations and set limits internally, according to a Deloitte survey to be released Wednesday. That's up from 67% in 2012. Eighty-seven percent of respondents said they use capital stress tests for strategy and business planning, up from 68%.

January 23 -

Fragmented and manual AML processes pose a challenge to many institutions, contends Edmund Tribue, risk and regulatory practice leader for NTT.

January 15 NTT Data Consulting

NTT Data Consulting -

The revised recommendations are one of the last remaining pieces left to finish in the Basel III capital accords.

January 14 -

The post-Dodd-Frank era is one of rightsizing and tailoring rules, but a key bloc of the regulatory brain trust believes the U.S. still lacks mechanisms that could prove helpful in a crisis.

January 13 -

Bank portfolios are chock full of loans to industries — think agriculture, tourism, real estate and energy — that could be particularly hard hit by warming temperatures. Some large banks are engaging in "scenario analysis" to mitigate the risk.

January 2 -

Linda Levy, CEO of Lower East Side People's Federal Credit Union, has no regrets about suing President Trump when he appointed Mick Mulvaney to run the CFPB, despite some negative reactions from her credit union colleagues.

December 28