2018 bank reputation rankings: Who stood out, who stumbled

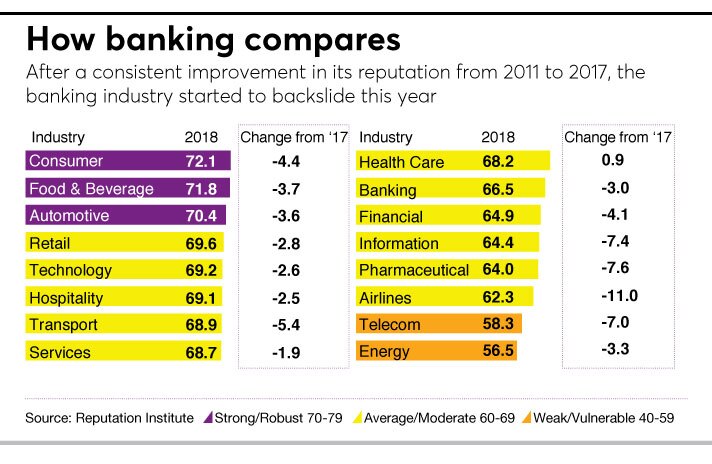

But perceptions of other industries — like airlines and telecommunications — fared much worse. So looking at how banking compares, it actually moved ahead of a few industries that had outshined it in the past.

There is a lot of insight to gain from analyzing the results of the annual American Banker/Reputation Institute Survey of Bank Reputations. Each spring, the institute surveys more than 10,000 U.S. adults to gauge their impressions of large and regional banks, which allows for a comparison with both other banks and other industries. All those who offer opinions about a particular bank — 40 banks were assessed this year — are first asked questions meant to ensure they are familiar with that bank.

Two years ago, the banking industry had the worst reputation among the 11 industries the Reputation Institute tracked at the time. Banking was even below the broader financial services industry back then. In this year's survey, banking ranked 10th out of 16 industries (see chart above), even though its overall reputation score of 66.5 out of 100 is lower than it was two years ago.

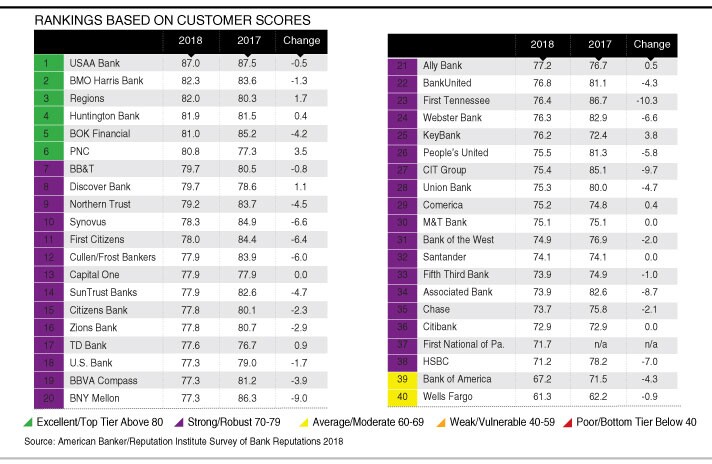

Scores between 60 and 69.9 are considered to be just "average." Scores of 70 to 79.9 reflect a "strong" reputation, and 80 or above is "excellent." At the opposite end of the spectrum, a score between 40 and 59.9 is "weak," while anything below 40 is "poor."

One reason the banking industry's score dropped by three points from last year's survey is that many consumers — both customers and noncustomers — don't believe that banks are acting in their best interests.

Only two banks rated in both the 2017 and 2018 surveys saw their customer scores improve meaningfully this year — PNC Bank and KeyBank. Ten others saw negligible improvements or no change at all. The rest declined, with some banks plunging nearly 10 points.

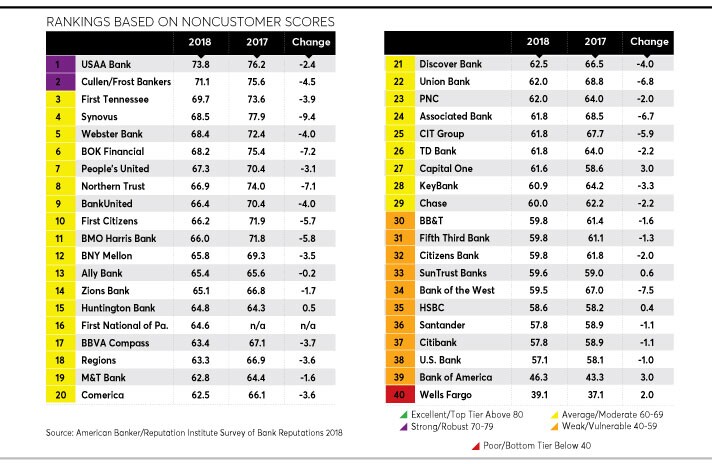

Among noncustomers, scores went up enough to be meaningful for again only two banks, in this case Capital One and Bank of America.

Though Bank of America remains next to last in that ranking, it's notable that any banks managed to get a lift in a year when corporate reputations in general, across many industries, took a beating.

Four other banks also showed improvement with noncustomers, but not enough to be considered statistically significant. And like Bank of America, three of those four — SunTrust Banks, HSBC and Wells Fargo — still had "weak" reputations, with scores below 60.

What follows are key takeaways from this year's survey — the highs, the lows, and the trends that drove the results.

USAA reigns

USAA shows that banks don’t necessarily need highly visible branch networks to effectively serve their customers and do well in their communities. A bank’s overall score is determined by seven “reputational drivers” tracked by the Reputation Institute — products and services, innovation, workplace culture, governance, citizenship, leadership and performance — and USAA ranked first in all seven among customers and five of the seven with noncustomers.

"Building and maintaining trust with our members over the long term is central to everything we do,” said Chad Borton, the bank's president (pictured above).

He added that USAA last year committed to spending over 50% of the money it invests in philanthropy to supporting the families of military personnel facing challenges related to deployments and other stresses inherent in military life.

Others that scored well across multiple categories were Synovus, of Columbus, Ga., and

Wells Fargo: Still a long way to go

A series of new revelations since that time about other customer abuses, such as wrongly forcing insurance on auto loan borrowers, have kept the scandal fresh and undermined trust for banks in general.

Among both customers and noncustomers, the embattled bank ranked dead last in

The customer score for Wells Fargo, meanwhile, fell to 61.9 in this year’s survey, from 62.2 last year. Only one other bank — again, Bank of America — scored below 70.

(Click

Consumers tend to like their own banks ...

Apart from USAA, the other "excellent" banks — those with scores above 80 — were BMO Harris, Regions Bank, Huntington Bank, BOK Financial and PNC Bank. (Regions had ranked

Regions,

The biggest mover, in a positive direction, was KeyBank, whose score climbed 3.8 points from last year, to 76.2. The increase is particularly significant because Key's score had fallen sharply in

Merger-related disruption also might explain why First Tennessee suffered the steepest decline of any bank among its customers. The Memphis-based bank, which dropped 10.3 points, spent much of 2017 integrating its acquisition of Capital Bank in Charlotte. The deal closed in late November.

… But don’t think much of others

Capital One tied with Bank of America for the biggest improvement in noncustomer scores, with both rising three points. Capital One climbed to 61.6, boosting it to an "average" reputation from a "weak" one. Bank of America's score, even with the increase, was a relatively dismal 46.3.

Four of the country’s five largest banks — Wells Fargo, Bank of America, Citibank and U.S. Bank — placed in the bottom four of the noncustomer ranking, all in "weak" territory with scores below 60. The fifth, JPMorgan Chase, placed 29th out of 40, with a score of 60, just barely making the cutoff for being "average" after its drop of 2.2 points from last year.

Trust in banks is eroding

Though customers might give good grades to the products their bank offers, many simply don’t believe that their banks have their backs, according to research done as part of the reputation survey.

Only 52% of bank customers surveyed said they trust their banks to do the right thing, down from 66% in last year’s survey. Only 47% of customers said that, in a situation where their bank is being cast unfavorably, they are willing to give it the benefit of the doubt, down from 61% in last year’s survey.

That loss of goodwill is a significant threat, because the less customers trust their bank, the less likely they are to recommend it to family and friends or to do additional business with it. Fewer than six in 10 customers said they would recommend their bank to others, down from nearly seven in 10 last year. The same drop occurred in customers' willingness to consider buying another product from their bank.

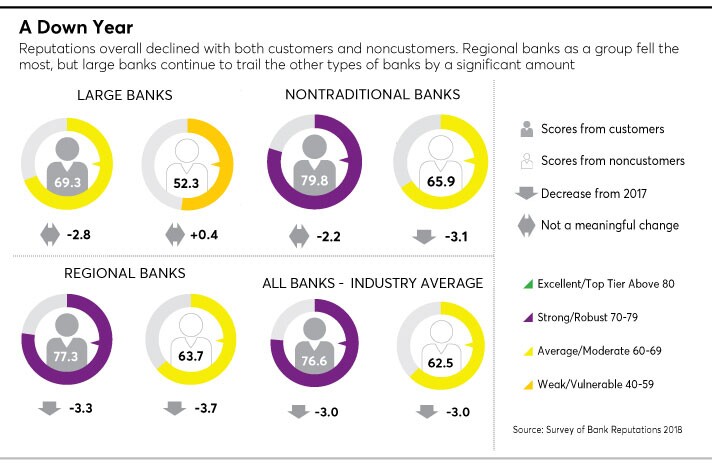

Regional banks as a group suffered more than their larger counterparts in terms of how much their reputation scores declined this year (as shown in the chart above). But big banks still lag significantly, with their "weak" noncustomer score being 11.4 points lower than the regionals' “average” one. The difference between the customer scores for the big banks and the regionals is 8 points.

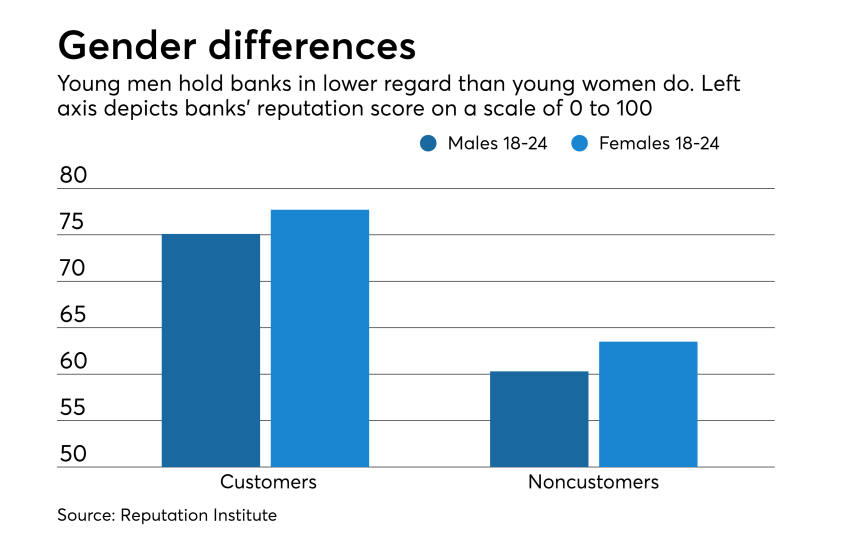

Young men can be tough customers

Analyzing the reputation scores by age group and gender shows that young men consistently rate bank products much lower than their female counterparts. The gap is 3.6 points between these "Generation Z" male and female customer segments.

Young male customers also rate their banks' governance much lower, with that gap between genders being 3 points. For this survey, governance is essentially a measure of how ethical people think a bank is, with the score being based on perceptions of transparency and fairness.

These two factors — products and governance — had a big impact on the overall reputation scores from men in this age group.

Banks received a reputation score of 75.1 from their young male customers, compared with a score of 77.1 from female customers between the ages of 18 and 24 and a score of 76.9 from all other demographic groups.

The gaps were even wider among noncustomers. From young men in the noncustomer group, banks received a score of 60.5, compared with a score of 63.5 from the young women and 62.6 from other groups.

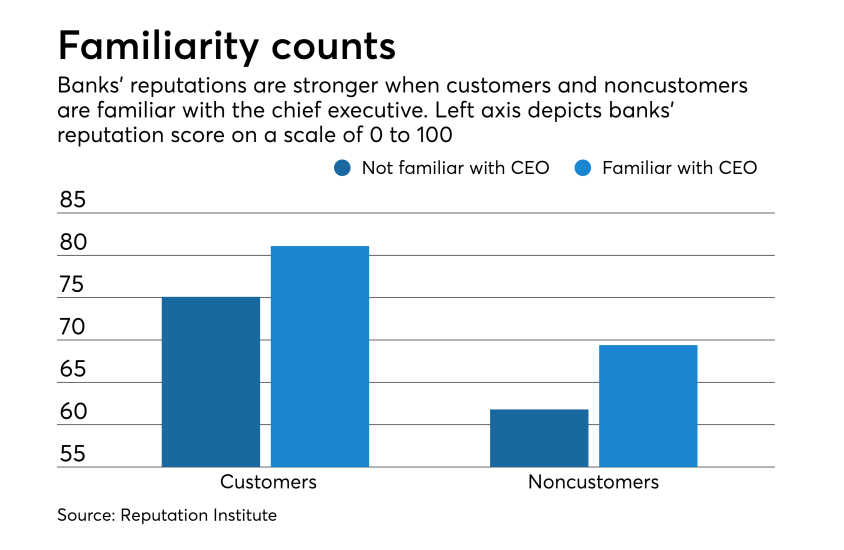

A CEO’s visibility matters

Though only 17% of customers are familiar with their bank’s CEO, the survey results show that when customers do know who the CEO is, the bank’s reputation score increases substantially.

The same holds true for noncustomers. Only 7% of them were familiar with the CEO of a bank they don't use. But these respondents gave the bank a much higher reputation score than those unfamiliar with the CEO.

Also worth noting: Banks with recognizable CEOs are viewed by both customers and noncustomers as

See the full results of the 2018 bank reputation survey