Not dead yet: Branches remain crucial to banks' growth plans

In recent weeks, two of the nation's three largest retail banks have announced plans to open as many as 900 branches over the next few years.

JPMorgan Chase said it intends to build as many as as 400 branches in Boston, Philadelphia and Washington, D.C., and other cities where it has no physical presence. Not to be outdone, Bank of America announced plans to add roughly 500 branches, also primarily in cities and states where it currently has no offices.

Many small banks, too, are expanding into adjacent markets by opening new branches.

If branch traffic is declining as consumers shift to mobile and online banking, why is there still an emphasis on building new branches?

Brian Moynihan, B of A’s chairman and CEO, says it's because many consumers and business owners still have reason to visit branches. Speaking at

The branch is also where many bank customers turn to for financial guidance. A

Many also prefer to open accounts in person, so the branch remains an effective channel for gathering collect low-cost, core deposits.

Of course, all the new offices banks are opening will not make up for the scores of ones they are closing. It is safe to say that

Wells Fargo alone closed 214 branches in 2017 and the San Francisco bank has said it

Still, Chief Financial Officer John Shrewsberry said in January that "branches play an important part in serving our customers and we will have as many branches as our customers want, for as long as they want them."

For that reason, banks will keep tinkering with their branch strategies. That means improving the experience inside each office and recalibrating the size of their networks. And it will mean banks keep building new ones.

JPMorgan Chase: Nationwide expansion

JPMorgan Chase recently outlined plans to

The decision to blanket new markets with branches is a bit of a departure from its recent strategy of building density in existing high-growth markets such as San Francisco, while cutting back in lower-growth markets.

“The head of our company is our retail branches,” Gordon Smith, the CEO of consumer and community banking, said recently. “We are a leader in 23 states but aren’t yet in major markets like Washington, D.C., Boston, Philadelphia and many others.”

Bank of America: Picking up the pace

The Charlotte, N.C., company had already taken a surgical-strike approach to opening branches, putting new offices in cities where it was not already located.

The new branches, in

On Monday, B of A

B of A didn’t provide complete details on where the branches will be located, although some will be opened in

U.S. Bancorp: Eyeing new markets

Tim Welsh, who joined Minneapolis-based U.S. Bank in July as head of retail banking, said it makes sense to expand to new cities by only

U.S. Bank’s retail operations are in the Midwest and West Coast, but it has been looking to build a stronger retail presence in other markets.

Capital One 360: 'Physical distribution matters'

The cafes have helped drive deposit growth at Capital One's digital-only bank, Capital One 360. Chairman and CEO Richard Fairbank said that the cafes are essential to the company’s strategy of building a nationwide retail presence.

“We believe very much that some physical distribution really matters,” Fairbank said on Feb. 13 at the Credit Suisse Financial Services Forum. “Now, there are some consumers for whom it doesn’t matter one bit. But this isn’t about just catering to one end of a continuum.”

Cherry-picking select markets is a more cost-effective approach than the old tactic of carpet-bombing a city with dozens of branches when entering a new market, Fairbank added.

“We’re not out to put a branch on every corner,” he said. “I think by the time that we got there after spending all of that money, we would find that that model was pretty obsolete.”

Texas Capital Bank: Reaching for consumers

During 2012, Texas Capital Bank helped finance a retail development in Trinity Groves, a gentrifying former industrial neighborhood in west Dallas. Six years later, the bank has opened what it says is the neighborhood’s only retail branch, according to the

Texas Capital, where consumer loans make up less than 1% of the loan book, will not start building branches by the dozen, said CEO Keith Cargill. But the new Dallas branch does represent a slight shift for Texas Capital, which has more than $25 billion in assets, but only operates 11 branches.

Eastern Bank: Thinking small

The $10.9 billion-asset Eastern Bank in Boston did just that in August when it opened an office in Revere, Mass., in a former

Not surprisingly, it’s Eastern Bank’s smallest branch. All teller transactions are handled by a video ATM. The branch is staffed and its personnel are suited to work in Revere, which has a sizable international community. The branch’s employees speak a combined six languages.

First International Bank: Covering its bases

Now that fracking has cooled off, First International has turned its attention to other sections of North Dakota. In December, the bank

“We have been serving customers in the Grand Forks area for years and are now able to further our commitment,” said Peter Stenehjem, the bank’s president.

Ridgewood Savings Bank: Opening where others are closing

Branch builders include Long Island’s Ridgewood Savings Bank, which unveiled its

Ridgewood’s chairman and CEO, Leonard Stekol, stressed that it was important for the bank to show its commitment to the Plainview community, even as rivals close branches.

“While banks within our marketplace continue to consolidate and change to a greater commercial bank model, Ridgewood remains focused on our commitment to offer the products and services that are important to both the residents and small businesses of the communities we serve,” Stekol said.

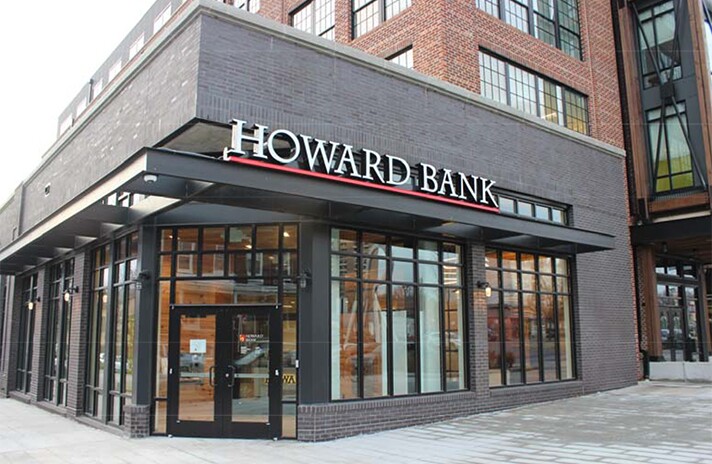

Howard Bank: Betting on Baltimore

Howard Bank in Ellicott City, Md., did just that in December when it opened an office in the Remington neighborhood of Baltimore. The bank was drawn to the community because of its “potential for growth,” said Chairman and CEO Mary Ann Scully. New homes, apartments, restaurants and small businesses continue to sprout up in the neighborhood near Johns Hopkins University.

“The market represents a diversity of age and income attracting teachers, entrepreneurs, artists and new businesses,” Scully said.