<a href="http://www.americanbanker.com/news/consumer-finance/inside-the-ugly-often-personal-fight-for-control-of-green-dot-1081007-1.html" target="_blank">Inside the Ugly, Often Personal Fight for Control of Green Dot</a>

Alan Kline, Senior Editor

Community Bank Deep Dives

Paul Davis, Community Banking Editor

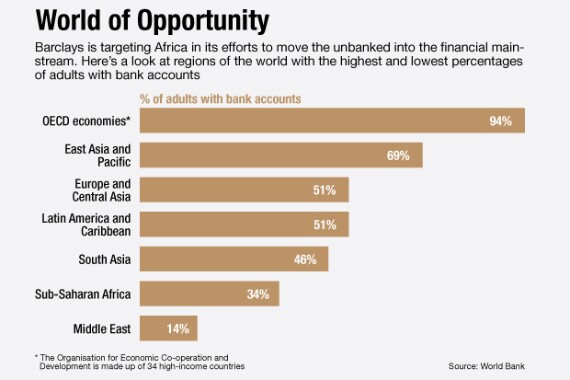

<a href="http://www.americanbanker.com/news/bank-technology/how-barclays-aims-to-bring-a-billion-unbanked-into-the-fold-1081591-1.html" target="_blank">How Barclays Aims to Bring a Billion Unbanked into the Fold</a>

Alan Kline, Senior Editor

<a href="http://www.americanbanker.com/news/national-regional/reputation-reboot-how-synovus-got-its-good-name-back-1081704-1.html" target="_blank">Reputation Reboot: How Synovus Got Its Good Name Back</a>

Alan Kline, Senior Editor

<a href="http://www.americanbanker.com/news/law-regulation/are-big-banks-necessary-1079790-1.html" target="_blank">Are Big Banks Necessary?</a>

Rob Blackwell, Washington Bureau Chief

"Also, check out the GIF that accompanies the story. It's like watching the Big Bang in slow-motion reverse."

Marc Hochstein, Editor in Chief

<a href="http://www.americanbanker.com/news/law-regulation/clinton-vs-trump-a-tough-choice-for-small-bankers-1080144-1.html" target="_blank">Clinton vs. Trump: A Tough Choice for Small Bankers</a>

Rob Blackwell, Washington Bureau Chief

<a href="http://www.americanbanker.com/news/law-regulation/how-wells-fargo-mishandled-a-reputational-crisis-1091541-1.html" target="_blank">How Wells Fargo Mishandled a Reputational Crisis</a>

Rob Blackwell, Washington Bureau Chief

<a href="http://www.americanbanker.com/news/bank-technology/when-will-fintech-regulation-grow-up-1091743-1.html" target="_blank">When Will Fintech Regulation Grow Up?</a>

Rob Blackwell, Washington Bureau Chief

Mergers and Acquisitions

Paul Davis, Community Banking Editor

<a href="http://www.americanbanker.com/news/bank-technology/mobiles-future-is-here-too-bad-so-many-banks-are-stuck-in-the-past-1090073-1.html" target="_blank"> Mobile's Future Is Here Too Bad So Many Banks Are Stuck in the Past</a>

Robert Barba, Technology Editor

<a href="http://www.americanbanker.com/news/bank-technology/startup-strategies-to-navigate-the-big-bank-labyrinth-1091739-1.html" target="_blank">Startup Strategies to Navigate the Big-Bank Labyrinth</a>

Robert Barba, Technology Editor

<a href="http://www.americanbanker.com/news/bank-technology/the-future-of-digital-identity-is-up-to-banks-1079943-1.html" target="_blank">The Future of Digital Identity Is Up to Banks</a>

Robert Barba, Technology Editor