-

Owners of firms that employ only themselves would prefer to use loans or lines of credit, but more often than not they resort to credit cards, according to a new Fed report. Is this a missed opportunity for banks?

December 12 -

The credit union stalwart purchased Mirador, which is heavily dependent on bank relationships. The challenge now is keeping those clients in the fold.

December 12 -

CUNA Mutual, a service provider to credit unions, recently bought Mirador, which is heavily dependent on bank relationships. The challenge now is keeping those clients in the fold.

December 11 -

The legislation would ban legal clauses that force small-business borrowers to give up their right to court proceedings before obtaining a loan.

December 6 -

Attorney General Barbara Underwood’s office is looking into whether merchant cash-advance companies engaged in fraud or abused the state court system.

December 3 -

Faciam Holdings will pay nearly $68 million for Summit Bancshares.

November 29 -

Date, now a venture capitalist, worked with the lending software company's CEO, Dan O'Malley, at Capital One in the 2000s.

November 28 -

As the economy softens, traditional banks have an opportunity to win back market share from fintech competitors.

November 27 Oliver Wyman

Oliver Wyman -

Lenders fear the agency's rule could make most poultry producers ineligible for 7(a) loans.

November 19 -

The lender is working with the fintech Biz2Credit to offer both secured and unsecured digital loans.

November 19 -

Entrepreneurship among veterans has been declining over the past 20 years, according to a report by the SBA and the New York Fed.

November 12 -

What the Democrats' House takeover means for banks; Synchrony has a lot to lose in fight with Walmart; should industry fear Waters-led banking panel?; and more from this week's most-read stories.

November 9 -

Entrepreneurship among veterans has been declining over the past 20 years, according to a report by the SBA and the New York Fed.

November 9 -

Readers sound off on the 2018 midterm election results, OCC's Otting defending his agency's right to charter fintechs, and predictions the plastic credit card is nearly dead.

November 8 -

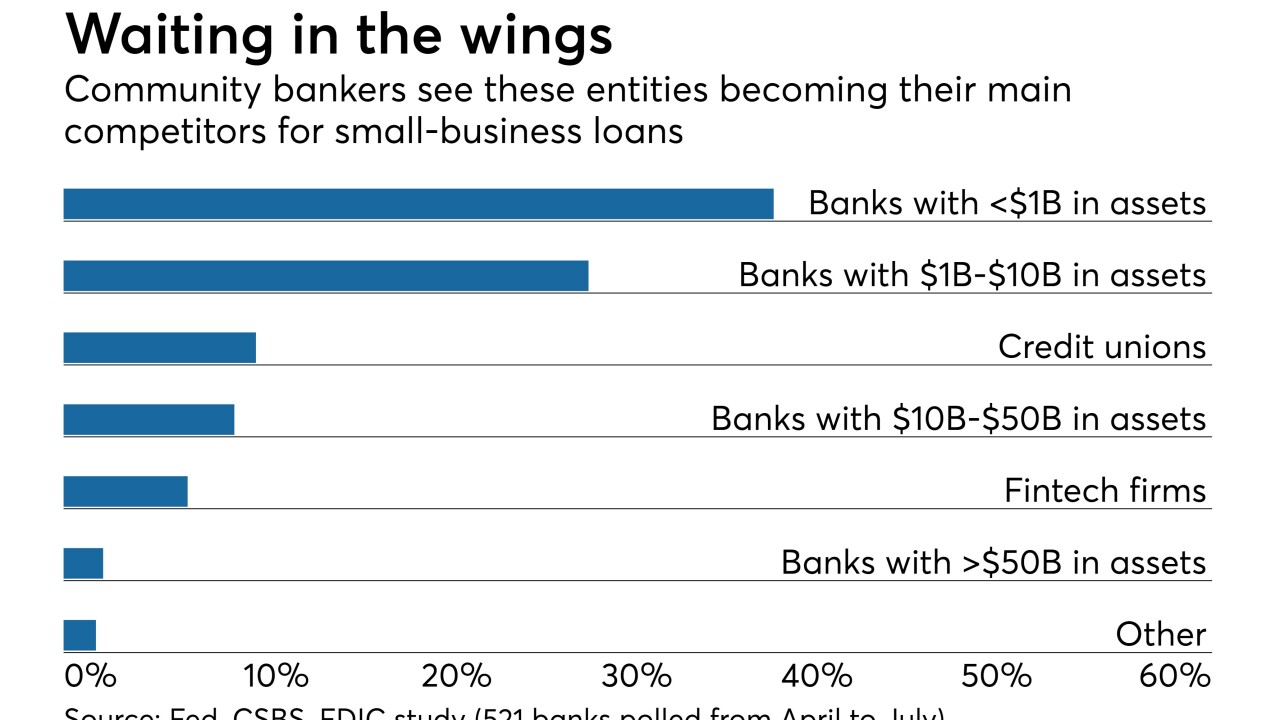

Big banks and fintechs are aggressively adding digital capabilities to process applications quickly, creating a sense of urgency for community banks.

November 6 -

The New York-based online lender plans to spend an additional $15 million next year, largely on bank partnerships and international expansion.

November 6 -

Azlo, Bento, Bank Novo and other neobanks argue they are better at helping small businesses, giving them extra attention, technology and advice.

October 31 -

Traditional financial institutions still have an advantage over challenger banks when it comes to building relationships with small merchants, despite scandals that have befallen megabanks.

October 30 -

The New York unit of Popular has contracted with Biz2Credit to automate commercial loan approvals and handle the underwriting for applications under $100,000.

October 30 -

Wells Fargo puts two top execs on leave as scandal's reach grows; regional banks freed from SIFI label lobbying regulators hard for more relief; FDIC to launch innovation office to help banks compete with fintechs; and more from this week's most-read stories.

October 26