-

The widely held belief that application programming interfaces are the key to banking’s future rests on the many ways early adopters are experimenting with the technology. But security and privacy concerns are still leading many in the industry to hold back.

May 30 -

When Visa opened its tools to third-party developers two years ago, it was a strong pivot away from a longstanding of operating a closed, proprietary network. Its latest investments indicate this strategy is of growing importance on a global scale.

May 24 -

Success stories about teen-focused payment cards are relatively few, despite steady improvements in technology to give kids a measure of independence in their spending while parents hold the purse strings via shared apps.

May 23 -

The financial technology infrastructure firm has made its first move to provide services outside of the U.S.

May 22 -

While there are some potential challenges to address, the European-focused PSD2 is an opportunity for banks globally to bolster their service offering, while at the same time working with fintechs to respond effectively to changing customer demands, to drive both convenience and security in the fast-paced, online world, writes Frederik Mennes, senior manager for market and security strategy at the Security Competence Center at VASCO.

April 30 Vasco Data Security

Vasco Data Security -

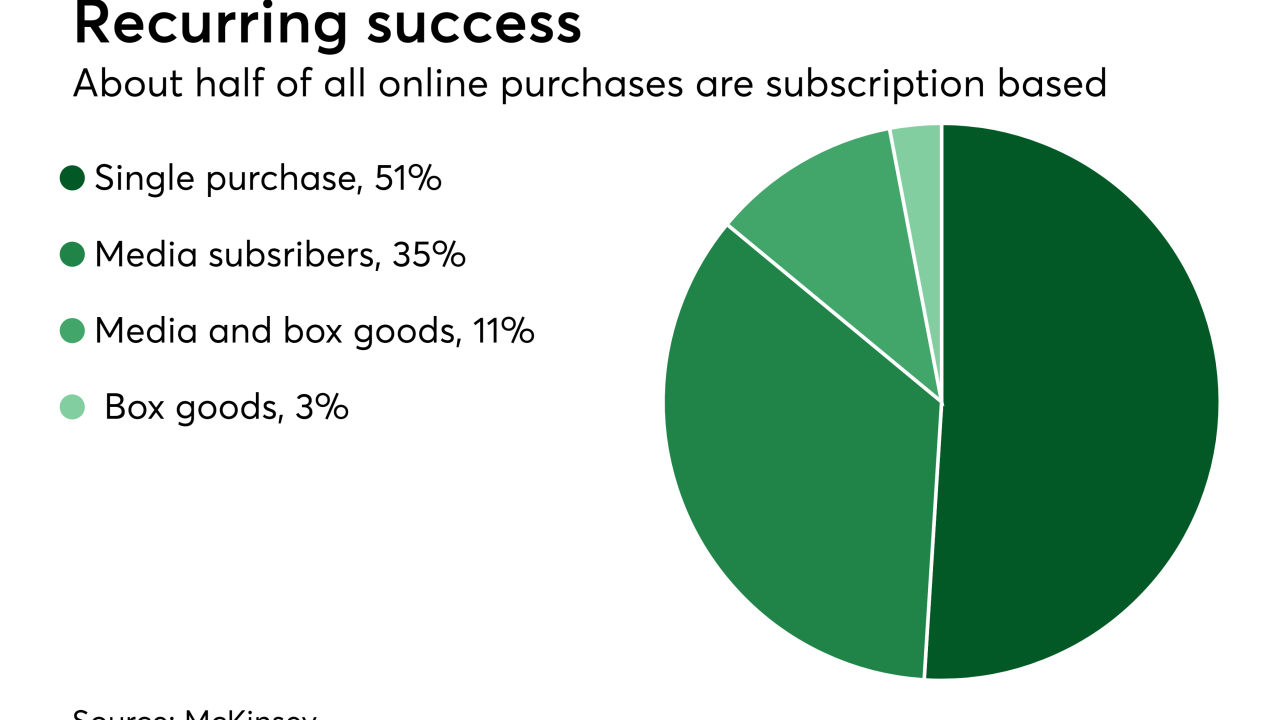

Zuora's stunning IPO was a victory for the entire subscription payments space, though new competitors and talk of a market bubble stalk the market.

April 18 -

The disparities, last-minute additions and disputes in a contractor's payment are giving the business gateway Qualpay a chance to use an invoice fixer as a differentiator in a market filled with payment companies that are morphing into general software sellers.

April 17 -

Apple and Ripple may have a potential idea to remove friction from mobile payments, but the implementation could make for a rough ride.

April 12 -

Processing firm Galileo has built an API to bridge the gap between cryptocurrencies and mainstream payments, an area where a handful of other providers are experimenting. Large banks and card networks continue to keep their distance.

April 11 -

The self-regulatory body says working with data aggregators increases risk of cyber fraud, unauthorized transactions and identity theft. But aggregators say other links in the information chain are more vulnerable.

April 9