-

AI in a car can be fatal. What could go wrong with AI in a bank? A new council established by BofA and Harvard hopes to minimize unintended consequences that could jeopardize consumers' financial well-being or discriminate against them.

April 10 -

The self-regulatory body says working with data aggregators increases risk of cyber fraud, unauthorized transactions and identity theft. But aggregators say other links in the information chain are more vulnerable.

April 9 -

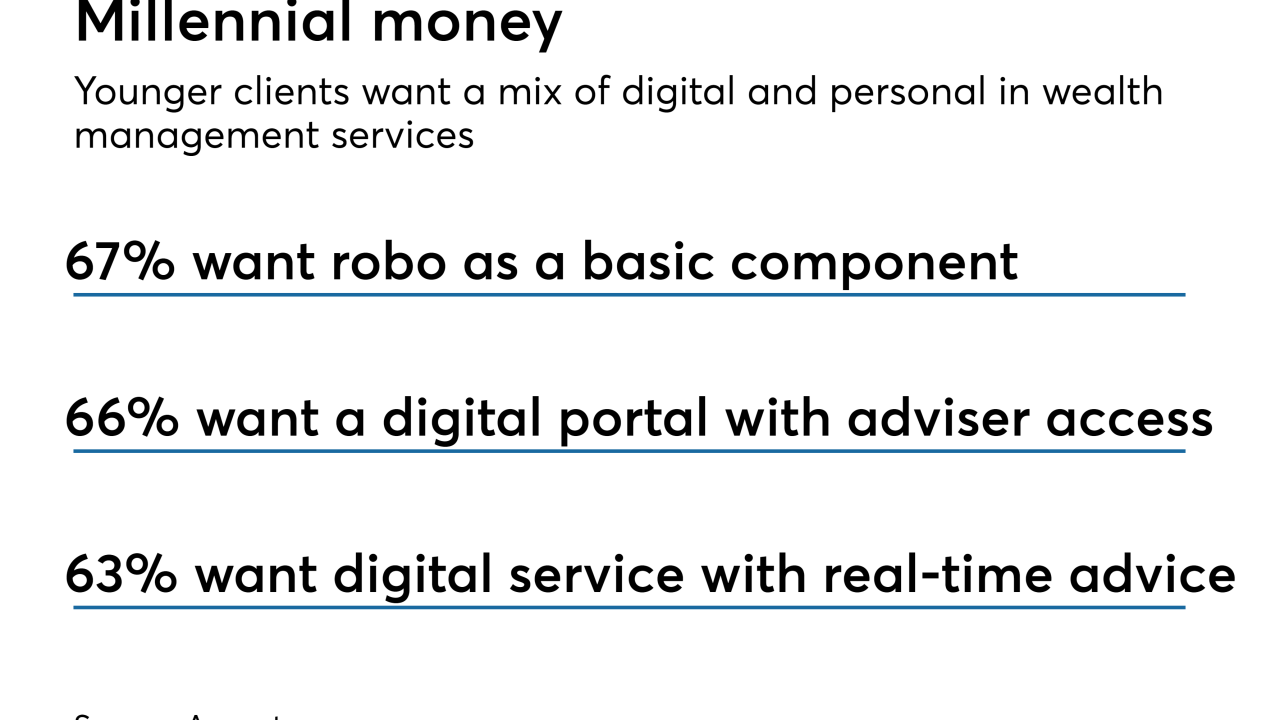

BMO Wealth Management aims to modernize its investment service and give advisers better equipment. Others offering automated advice solutions include UBS, Wells Fargo and JPMorgan.

April 6 -

Millennium Bank in Tennessee has quickened approval times on loan applications by using software that frees lenders from repetitive, manual tasks. The result: Loan balances have increased by more than 50% in less than two years.

April 5 -

Some speculate that the banks who do business with credit reporting agencies may be looking for alternatives after mounting concerns about their ability to keep information private. But breaking up is hard to do.

April 4 -

While the banking industry is divided on the use of conversational technology, the San Francisco company believes chatbots can make it easier for customers to discuss their finances.

April 3 -

The software firm MonetaGo and three Indian factoring exchanges have launched a blockchain that can identify invoices that have already been financed.

April 3 -

Some fear that the removal of such data from individual credit reports could lead lenders to believe a consumer is a better bet than they really are.

April 2 -

The funding round comes on the heels of what BitPay cited as a record year in 2017 in processing more than $1 billion in bitcoin payments.

April 2 -

Customers are sprinkling symbols into their texts, and it's a challenge for banks to fine-tune systems to support the use of the cartoon code in communications.

March 29